- Taiwan

- /

- Consumer Finance

- /

- TWSE:6592

Investor Optimism Abounds Hotai Finance Co., Ltd. (TWSE:6592) But Growth Is Lacking

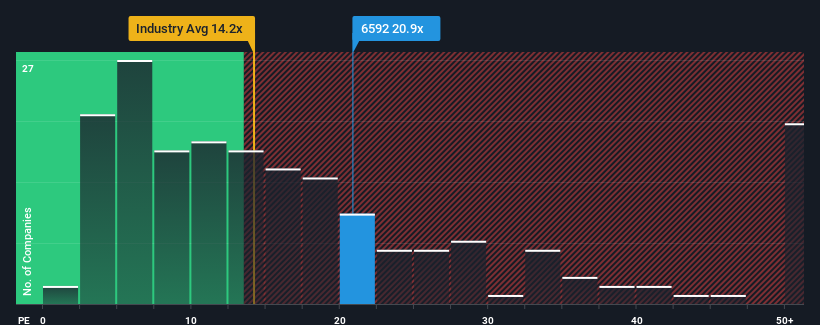

It's not a stretch to say that Hotai Finance Co., Ltd.'s (TWSE:6592) price-to-earnings (or "P/E") ratio of 20.9x right now seems quite "middle-of-the-road" compared to the market in Taiwan, where the median P/E ratio is around 22x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Hotai Finance hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Hotai Finance

How Is Hotai Finance's Growth Trending?

Hotai Finance's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered a frustrating 2.3% decrease to the company's bottom line. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings growth is heading into negative territory, declining 3.9% over the next year. Meanwhile, the broader market is forecast to expand by 24%, which paints a poor picture.

With this information, we find it concerning that Hotai Finance is trading at a fairly similar P/E to the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh on the share price eventually.

The Bottom Line On Hotai Finance's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Hotai Finance's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Hotai Finance (1 is a bit unpleasant) you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Hotai Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6592

Hotai Finance

Provides vehicle installment sales, and leasing of vehicles and equipment services in Taiwan and China.

Mediocre balance sheet with questionable track record.