- Taiwan

- /

- Diversified Financial

- /

- TWSE:5871

Chailease Holding (TWSE:5871) Set to Outperform with Strategic Product Launches and Dividend Potential

Reviewed by Simply Wall St

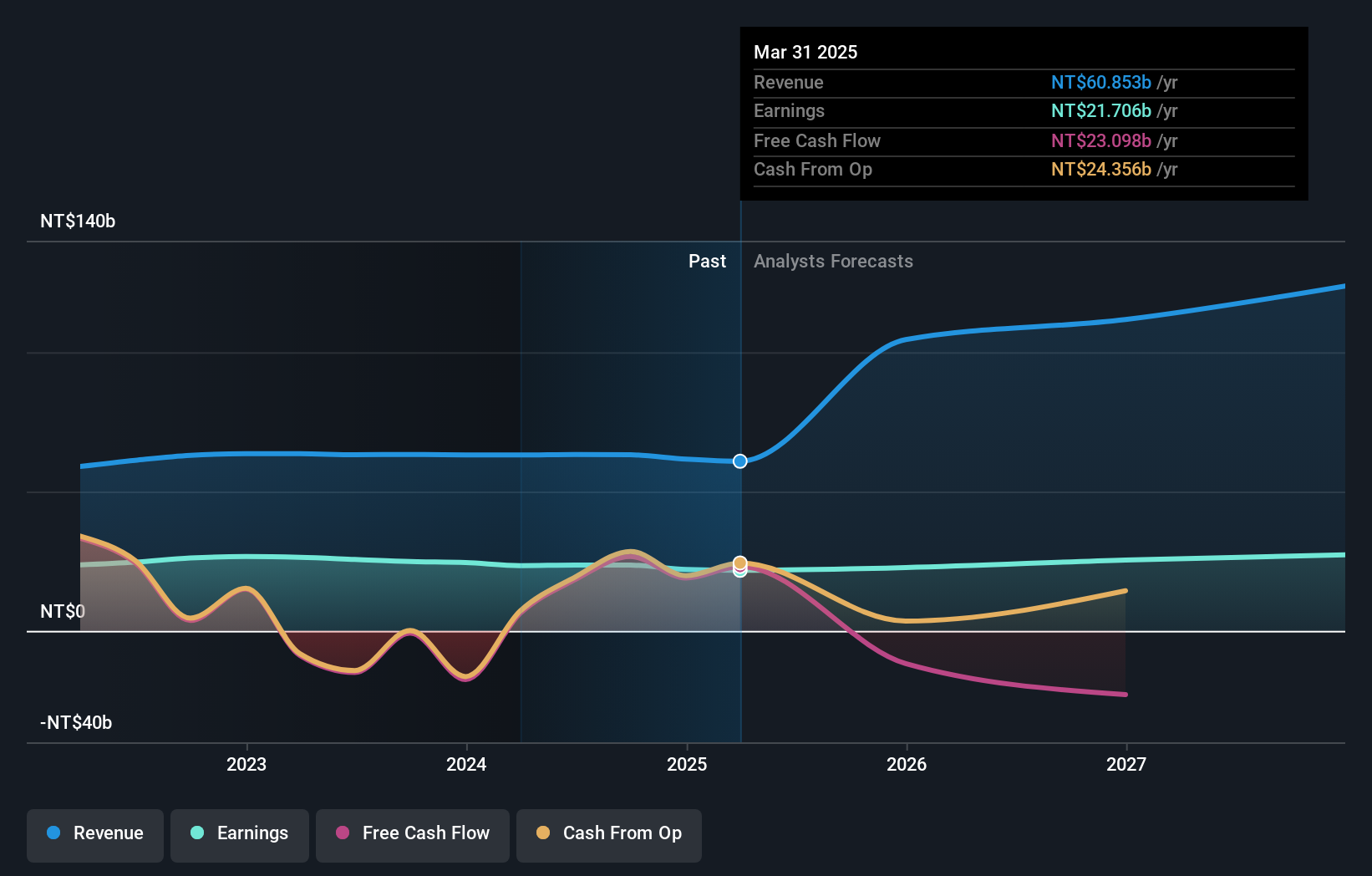

Chailease Holding (TWSE:5871) is poised for significant growth with a projected annual revenue increase of 23.7%, surpassing the market average. The company faces challenges such as a 7.8% decline in earnings growth and a high net debt to equity ratio, yet it remains a compelling investment opportunity, trading at a notable discount to its estimated fair value. Upcoming events, including presentations at major financial forums and a non-deal roadshow, are expected to provide further insights into its strategic direction and financial performance.

Get an in-depth perspective on Chailease Holding's performance by reading our analysis here.

Key Assets Propelling Chailease Holding Forward

With a projected revenue growth of 23.7% annually, Chailease Holding is set to outpace the TW market's 12.3% growth. This growth is supported by strategic product launches and an expanded customer base, as highlighted by CEO Lian Jialin. The company's commitment to product innovation, as noted by Chief Product Officer Gurpreet Sahi, further solidifies its competitive edge. Chailease's stable dividend policy, with a low payout ratio of 44.4%, underscores its financial health. The management's average tenure of 13.8 years provides the stability needed to navigate complex market dynamics. Notably, the company is trading at NT$148, significantly below its estimated fair value of NT$305.36, indicating potential undervaluation and investment opportunities.

To dive deeper into how Chailease Holding's valuation metrics are shaping its market position, check out our detailed analysis of Chailease Holding's Valuation.Critical Issues Affecting the Performance of Chailease Holding and Areas for Growth

Chailease faces challenges with a 7.8% negative earnings growth over the past year, complicating industry comparisons. The company's ROE at 15% falls short of the 20% benchmark, and a decrease in net profit margin from 40.6% to 37.3% further highlights profitability concerns. Additionally, a high net debt to equity ratio of 378.4% suggests financial risk. Rising operational costs, acknowledged by Jialin, necessitate tighter cost controls to safeguard margins.

To gain deeper insights into Chailease Holding's historical performance, explore our detailed analysis of past performance.Growth Avenues Awaiting Chailease Holding

Trading at a 51.5% discount to its estimated fair value, Chailease presents a compelling investment opportunity. The anticipated earnings growth of 13.6% per year could enhance shareholder value and attract new investors. Furthermore, improving the current dividend yield of 4.31% compared to the top 25% of TW market payers could strengthen its market position.

Learn about Chailease Holding's dividend strategy and how it impacts shareholder returns and financial stability.Key Risks and Challenges That Could Impact Chailease Holding's Success

Economic headwinds and regulatory hurdles pose significant threats, as noted by Jialin and Sahi. The company's debt coverage by operating cash flow remains a concern, threatening financial stability. Additionally, shareholder dilution, with an 11% increase in shares outstanding, may impact share value. Proactive strategies are essential to mitigate these risks and sustain growth.

Explore the current health of Chailease Holding and how it reflects on its financial stability and growth potential.Conclusion

Chailease Holding's projected annual revenue growth of 23.7% positions it to significantly outperform the TW market's 12.3% growth rate, driven by strategic product launches and a broadened customer base. The company faces challenges such as a 7.8% decline in earnings growth and a high net debt to equity ratio of 378.4%, yet its commitment to innovation and a stable management team with an average tenure of 13.8 years provide a solid foundation for navigating these hurdles. Trading at NT$148, well below its estimated fair value of NT$305.36, the company presents a strong investment opportunity, with potential for shareholder value enhancement through anticipated earnings growth and improved dividend yield. However, addressing financial risks, such as rising operational costs and shareholder dilution, is crucial for sustaining growth and ensuring long-term financial stability.

Where To Now?

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TWSE:5871

Chailease Holding

An investment holding company, provides leasing and financial services in Taiwan, China, ASEAN countries, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives