- Taiwan

- /

- Capital Markets

- /

- TWSE:2889

Optimism for IBF Financial Holdings (TWSE:2889) has grown this past week, despite five-year decline in earnings

The main point of investing for the long term is to make money. Better yet, you'd like to see the share price move up more than the market average. But IBF Financial Holdings Co., Ltd. (TWSE:2889) has fallen short of that second goal, with a share price rise of 60% over five years, which is below the market return. On a brighter note, more newer shareholders are probably rather content with the 38% share price gain over twelve months.

The past week has proven to be lucrative for IBF Financial Holdings investors, so let's see if fundamentals drove the company's five-year performance.

See our latest analysis for IBF Financial Holdings

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

IBF Financial Holdings' earnings per share are down 6.0% per year, despite strong share price performance over five years.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

There's no sign of growing dividends, which might have explained the resilient share price. The revenue decline of 1.8% wouldn't have helped. But a closer look at the history of earnings and revenue might give clues as to why the share price is up.

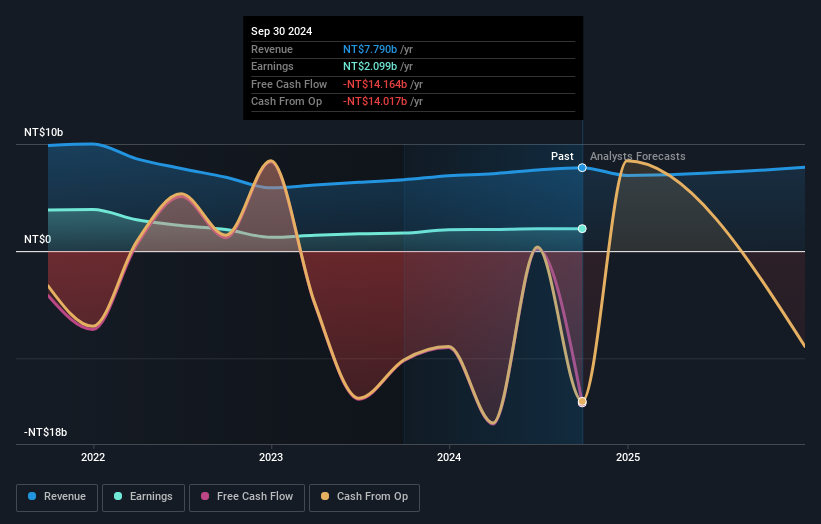

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that IBF Financial Holdings has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on IBF Financial Holdings

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for IBF Financial Holdings the TSR over the last 5 years was 93%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that IBF Financial Holdings has rewarded shareholders with a total shareholder return of 44% in the last twelve months. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 14% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand IBF Financial Holdings better, we need to consider many other factors. Take risks, for example - IBF Financial Holdings has 3 warning signs we think you should be aware of.

But note: IBF Financial Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2889

IBF Financial Holdings

Through its subsidiaries, provides various financial products and services for individual and corporate clients primarily in Taiwan.

Proven track record second-rate dividend payer.