- Taiwan

- /

- Hospitality

- /

- TWSE:2707

Statutory Profit Doesn't Reflect How Good Formosa International Hotels' (TWSE:2707) Earnings Are

When companies post strong earnings, the stock generally performs well, just like Formosa International Hotels Corporation's (TWSE:2707) stock has recently. Our analysis found some more factors that we think are good for shareholders.

View our latest analysis for Formosa International Hotels

Examining Cashflow Against Formosa International Hotels' Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

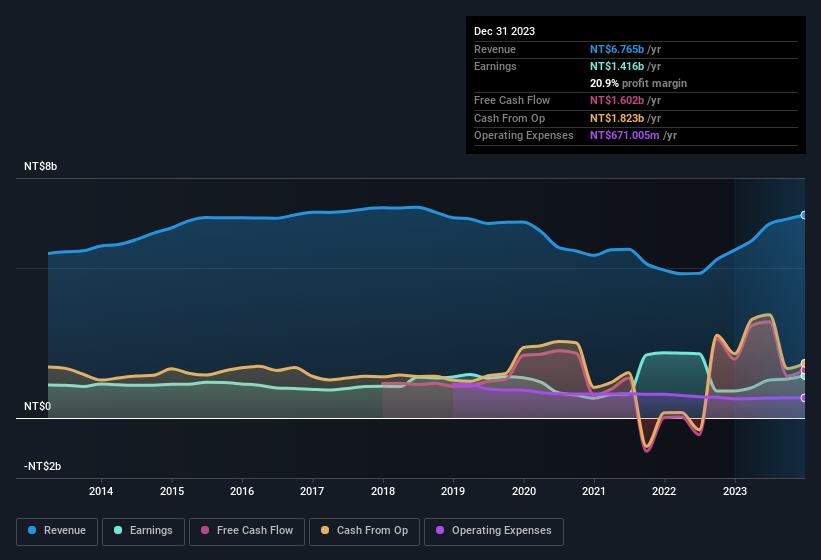

For the year to December 2023, Formosa International Hotels had an accrual ratio of -0.12. That implies it has good cash conversion, and implies that its free cash flow solidly exceeded its profit last year. To wit, it produced free cash flow of NT$1.6b during the period, dwarfing its reported profit of NT$1.42b. Formosa International Hotels did see its free cash flow drop year on year, which is less than ideal, like a Simpson's episode without Groundskeeper Willie.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Formosa International Hotels' Profit Performance

Formosa International Hotels' accrual ratio is solid, and indicates strong free cash flow, as we discussed, above. Based on this observation, we consider it likely that Formosa International Hotels' statutory profit actually understates its earnings potential! Better yet, its EPS are growing strongly, which is nice to see. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So while earnings quality is important, it's equally important to consider the risks facing Formosa International Hotels at this point in time. Case in point: We've spotted 1 warning sign for Formosa International Hotels you should be aware of.

This note has only looked at a single factor that sheds light on the nature of Formosa International Hotels' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2707

Formosa International Hotels

Engages in the operation of tourist hotels in Taiwan and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives