Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, La Kaffa International Co., Ltd. (GTSM:2732) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for La Kaffa International

How Much Debt Does La Kaffa International Carry?

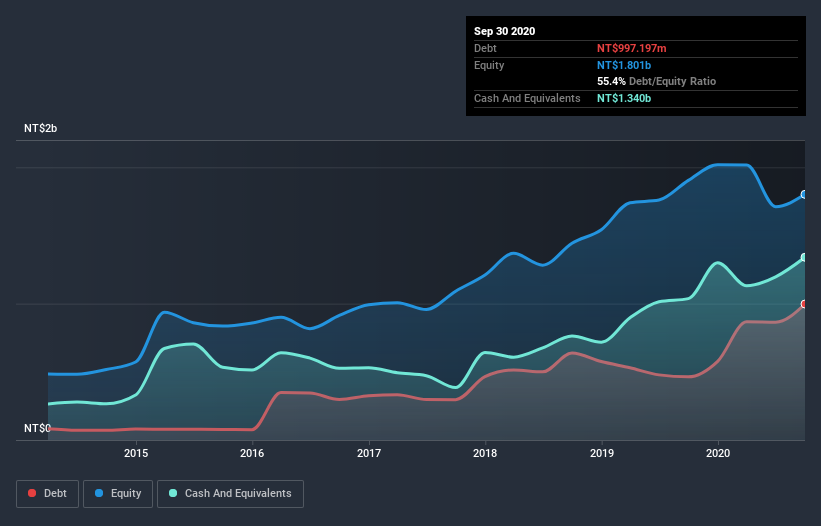

You can click the graphic below for the historical numbers, but it shows that as of September 2020 La Kaffa International had NT$997.2m of debt, an increase on NT$463.2m, over one year. But it also has NT$1.34b in cash to offset that, meaning it has NT$342.8m net cash.

How Healthy Is La Kaffa International's Balance Sheet?

We can see from the most recent balance sheet that La Kaffa International had liabilities of NT$2.01b falling due within a year, and liabilities of NT$519.1m due beyond that. Offsetting this, it had NT$1.34b in cash and NT$352.0m in receivables that were due within 12 months. So its liabilities total NT$836.0m more than the combination of its cash and short-term receivables.

Since publicly traded La Kaffa International shares are worth a total of NT$5.62b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. While it does have liabilities worth noting, La Kaffa International also has more cash than debt, so we're pretty confident it can manage its debt safely.

It is just as well that La Kaffa International's load is not too heavy, because its EBIT was down 56% over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. When analysing debt levels, the balance sheet is the obvious place to start. But it is La Kaffa International's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While La Kaffa International has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, La Kaffa International actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

Although La Kaffa International's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of NT$342.8m. And it impressed us with free cash flow of NT$622m, being 129% of its EBIT. So we don't have any problem with La Kaffa International's use of debt. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 4 warning signs for La Kaffa International that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade La Kaffa International, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade La Kaffa International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:2732

La Kaffa International

Operates franchise of chain restaurants in Taiwan and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives