- Taiwan

- /

- Construction

- /

- TWSE:6691

Undiscovered Gems Promising Stocks To Explore In November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties of the incoming Trump administration's policies, investors are witnessing a mixed performance across key indices, with small-cap stocks like those in the Russell 2000 facing particular challenges amid shifting economic indicators and market sentiment. In this dynamic environment, identifying promising stocks often involves looking beyond immediate market fluctuations to uncover companies with strong fundamentals and potential for growth despite broader volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tait Marketing & Distribution | NA | 7.36% | 18.40% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Savior Lifetec | NA | -7.74% | -0.77% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Vivo Energy Mauritius | NA | 13.58% | 14.34% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Nanto Bank (TSE:8367)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Nanto Bank, Ltd., along with its subsidiaries, operates in banking, securities, leasing, and credit guarantee sectors in Japan with a market capitalization of ¥97.55 billion.

Operations: Nanto Bank generates revenue primarily through its banking, securities, leasing, and credit guarantee services. The company focuses on diversifying its income streams across these sectors to optimize financial performance.

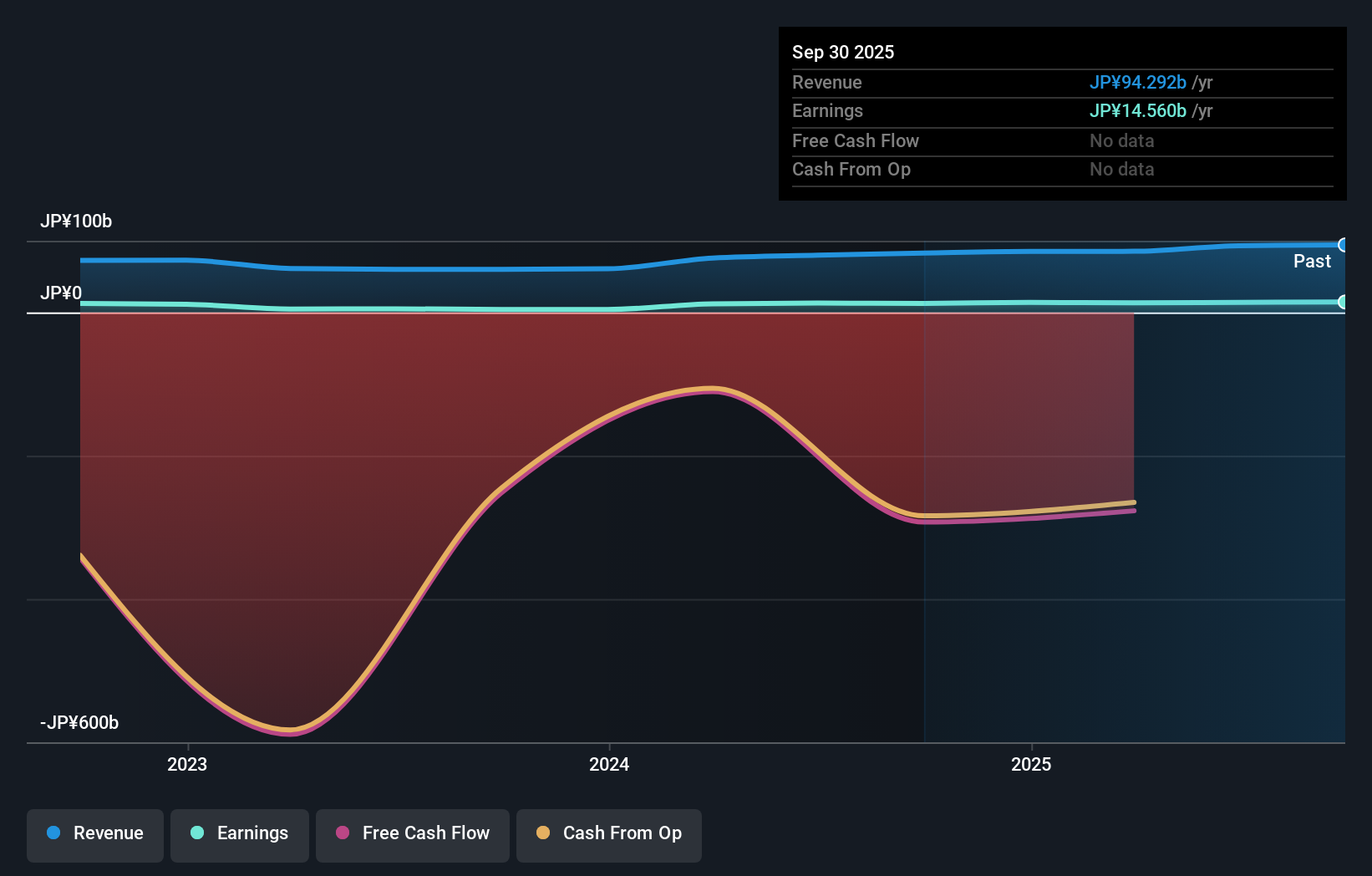

Nanto Bank, with total assets of ¥6,819.7 billion and equity of ¥299.7 billion, showcases impressive earnings growth at 201.9%, outpacing the industry average of 22%. The bank's deposits stand at ¥5,887.8 billion against loans totaling ¥4,306.7 billion, though it has an insufficient allowance for bad loans at 1.4% and a low allowance coverage of 36%. Despite trading at a significant discount to its estimated fair value by 48.5%, Nanto Bank's reliance on low-risk funding sources is noteworthy; however, its free cash flow remains negative as per recent data points provided up to September 2023.

- Click to explore a detailed breakdown of our findings in Nanto Bank's health report.

Gain insights into Nanto Bank's past trends and performance with our Past report.

Yankey Engineering (TWSE:6691)

Simply Wall St Value Rating: ★★★★★★

Overview: Yankey Engineering Co., Ltd. provides engineering services in Taiwan, China, and Thailand with a market cap of NT$31.77 billion.

Operations: Yankey Engineering generates revenue from its engineering services across Taiwan, China, and Thailand. The company has a market capitalization of NT$31.77 billion.

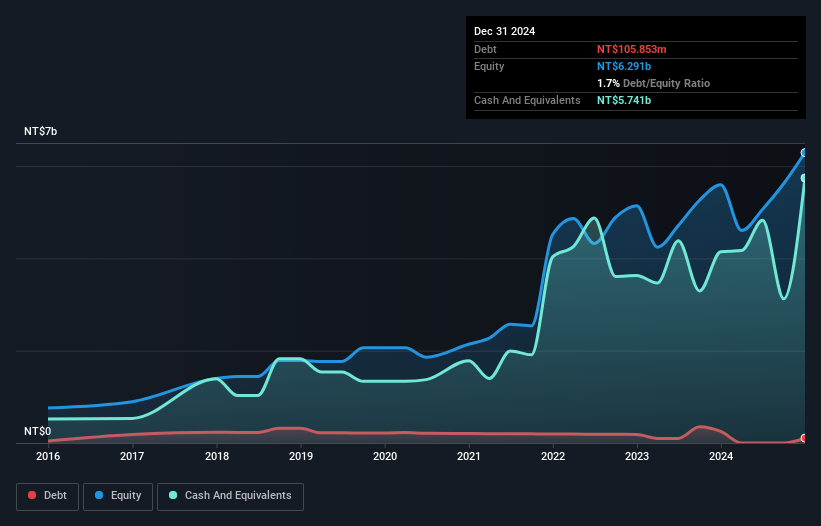

Yankey Engineering, operating in the construction sector, faced a challenging year with negative earnings growth of 4.6%, contrasting the industry average of 7.3%. Despite this, its financial health appears robust, as it is debt-free and reported high-quality earnings. The company seems undervalued, trading at 37.4% below estimated fair value. Recent results show mixed performance; third-quarter sales dropped to TWD 3.77 billion from TWD 4.19 billion last year, yet net income rose to TWD 549 million from TWD 503 million a year ago, indicating potential resilience amidst fluctuating market conditions.

- Click here and access our complete health analysis report to understand the dynamics of Yankey Engineering.

Explore historical data to track Yankey Engineering's performance over time in our Past section.

Taiwan Paiho (TWSE:9938)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Taiwan Paiho Limited is a company that produces and distributes a variety of textile and fastening products, including touch fasteners, digital woven fabrics, and shoelaces, serving both domestic and international markets with a market cap of NT$23.24 billion.

Operations: Taiwan Paiho Limited generates revenue from the sale of textile and fastening products, such as touch fasteners and digital woven fabrics, across both domestic and international markets. The company's market capitalization stands at NT$23.24 billion.

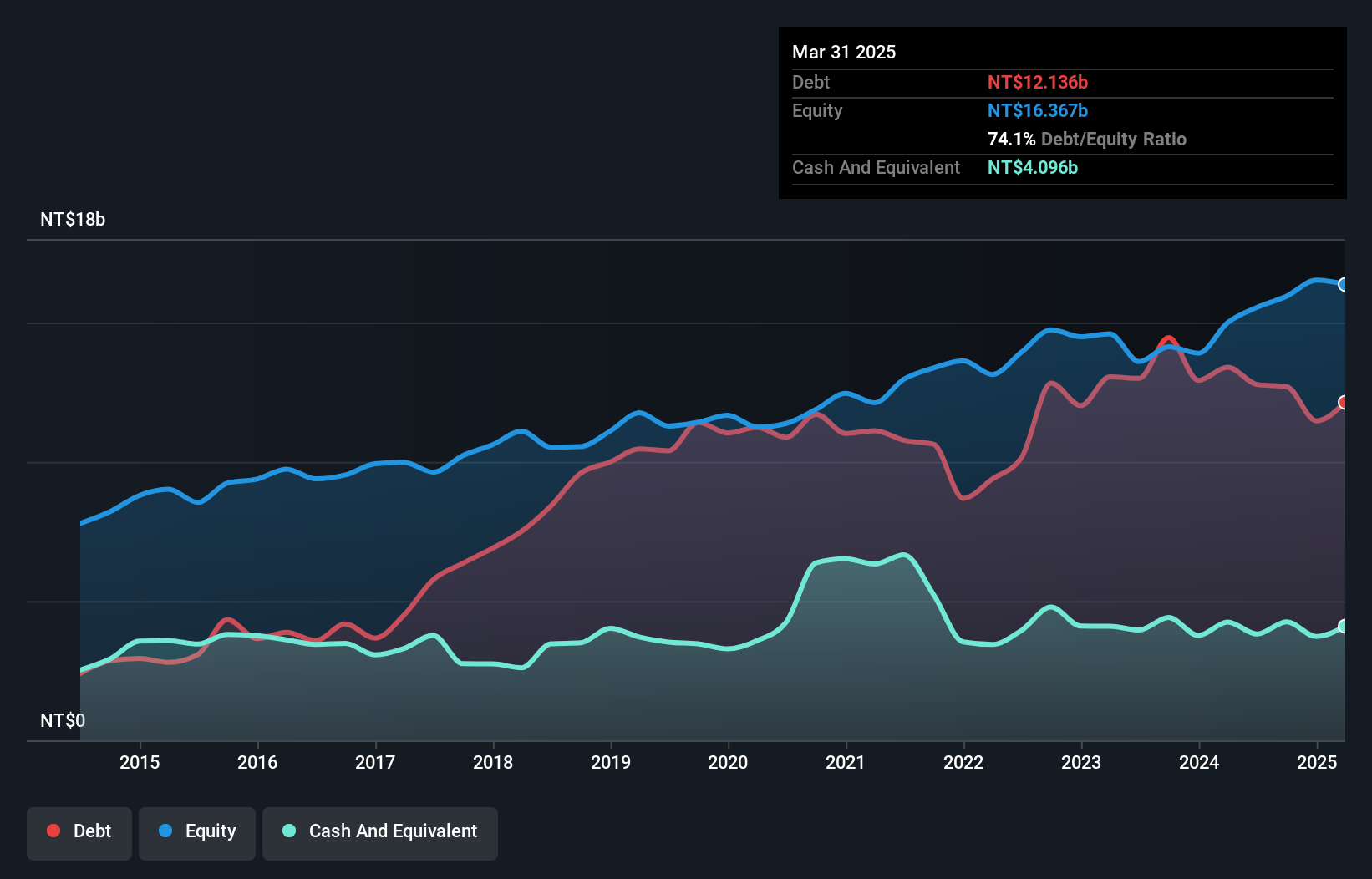

Taiwan Paiho, a company on the rise, has shown impressive financial performance recently. Over the past year, earnings have surged by 124.6%, significantly outpacing the luxury industry’s growth of 13.4%. The firm reported third-quarter sales of TWD 4.32 billion and net income of TWD 456 million, both up from last year’s figures. Despite a high net debt to equity ratio at 52.9%, interest payments are well covered with EBIT at 4.5 times coverage, indicating strong operational efficiency. With earnings projected to grow annually by 18.66% and a price-to-earnings ratio below market average at 18.6x, Taiwan Paiho seems positioned for continued success in its sector.

- Delve into the full analysis health report here for a deeper understanding of Taiwan Paiho.

Understand Taiwan Paiho's track record by examining our Past report.

Seize The Opportunity

- Click through to start exploring the rest of the 4646 Undiscovered Gems With Strong Fundamentals now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Yankey Engineering, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6691

Yankey Engineering

Offers engineering services in Taiwan, China, and Thailand.

Flawless balance sheet with solid track record.