A Piece Of The Puzzle Missing From Taiwan Paiho Limited's (TWSE:9938) 25% Share Price Climb

Taiwan Paiho Limited (TWSE:9938) shareholders have had their patience rewarded with a 25% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 38% in the last year.

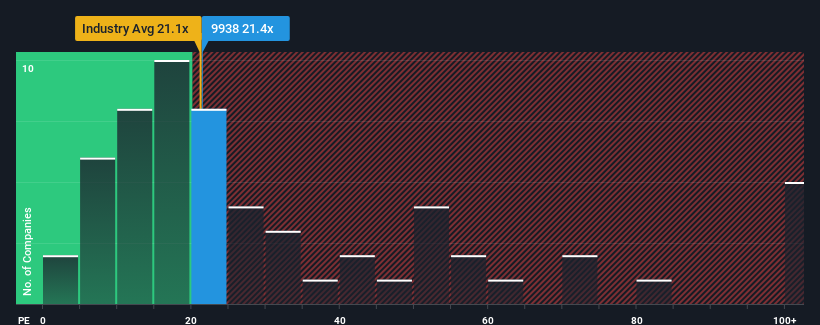

In spite of the firm bounce in price, it's still not a stretch to say that Taiwan Paiho's price-to-earnings (or "P/E") ratio of 21.4x right now seems quite "middle-of-the-road" compared to the market in Taiwan, where the median P/E ratio is around 22x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's superior to most other companies of late, Taiwan Paiho has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Taiwan Paiho

Is There Some Growth For Taiwan Paiho?

There's an inherent assumption that a company should be matching the market for P/E ratios like Taiwan Paiho's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 50%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 48% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 33% as estimated by the three analysts watching the company. With the market only predicted to deliver 25%, the company is positioned for a stronger earnings result.

In light of this, it's curious that Taiwan Paiho's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Taiwan Paiho's P/E

Its shares have lifted substantially and now Taiwan Paiho's P/E is also back up to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Taiwan Paiho currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 1 warning sign for Taiwan Paiho that we have uncovered.

If you're unsure about the strength of Taiwan Paiho's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Paiho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:9938

Taiwan Paiho

Manufactures and sells touch fasteners, digital woven fabrics, 4-way stretch fabrics, webbings, elastic, shoelaces, reflective materials, 2D/3D logo, material processing, molded hooks, and bamboo charcoal products in Taiwan and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives