There Are Reasons To Feel Uneasy About Giant Manufacturing's (TWSE:9921) Returns On Capital

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Having said that, from a first glance at Giant Manufacturing (TWSE:9921) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. To calculate this metric for Giant Manufacturing, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.11 = NT$5.5b ÷ (NT$89b - NT$41b) (Based on the trailing twelve months to September 2023).

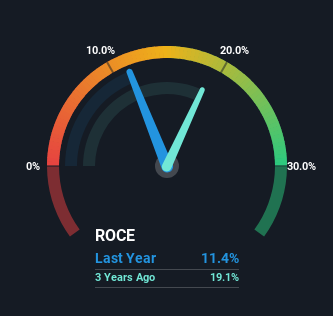

So, Giant Manufacturing has an ROCE of 11%. That's a relatively normal return on capital, and it's around the 13% generated by the Leisure industry.

View our latest analysis for Giant Manufacturing

Above you can see how the current ROCE for Giant Manufacturing compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Giant Manufacturing for free.

The Trend Of ROCE

Unfortunately, the trend isn't great with ROCE falling from 14% five years ago, while capital employed has grown 100%. However, some of the increase in capital employed could be attributed to the recent capital raising that's been completed prior to their latest reporting period, so keep that in mind when looking at the ROCE decrease. The funds raised likely haven't been put to work yet so it's worth watching what happens in the future with Giant Manufacturing's earnings and if they change as a result from the capital raise.

On a separate but related note, it's important to know that Giant Manufacturing has a current liabilities to total assets ratio of 46%, which we'd consider pretty high. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

In Conclusion...

Bringing it all together, while we're somewhat encouraged by Giant Manufacturing's reinvestment in its own business, we're aware that returns are shrinking. Although the market must be expecting these trends to improve because the stock has gained 41% over the last five years. However, unless these underlying trends turn more positive, we wouldn't get our hopes up too high.

One more thing to note, we've identified 2 warning signs with Giant Manufacturing and understanding them should be part of your investment process.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:9921

Giant Manufacturing

Engages in the manufacturing and sale of bicycles and electric bicycles in Taiwan, the United States, Europe, Asia, Taiwan, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.