- China

- /

- Metals and Mining

- /

- SZSE:000795

Undiscovered Gems To Explore In January 2025

Reviewed by Simply Wall St

As global markets experience a rebound driven by cooling inflation and strong earnings, the spotlight has shifted to small-cap stocks, with indices like the S&P MidCap 400 and Russell 2000 showing notable gains. In this environment of optimism and potential rate cuts, investors are keenly searching for undiscovered gems that offer resilience and growth potential amid evolving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi | 0.18% | 50.86% | 65.05% | ★★★★★☆ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.47% | 61.65% | 67.97% | ★★★★★☆ |

| Kerevitas Gida Sanayi ve Ticaret | 48.40% | 45.75% | 37.51% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Innuovo Technology (SZSE:000795)

Simply Wall St Value Rating: ★★★★★☆

Overview: Innuovo Technology Co., Ltd. operates in the research, development, production, and sale of rare earth permanent magnet materials both in China and internationally, with a market cap of CN¥13.47 billion.

Operations: Innuovo Technology generates revenue primarily from the sale of rare earth permanent magnet materials. The company's cost structure includes expenses related to research, development, and production processes. Notably, its net profit margin has shown variability across reporting periods.

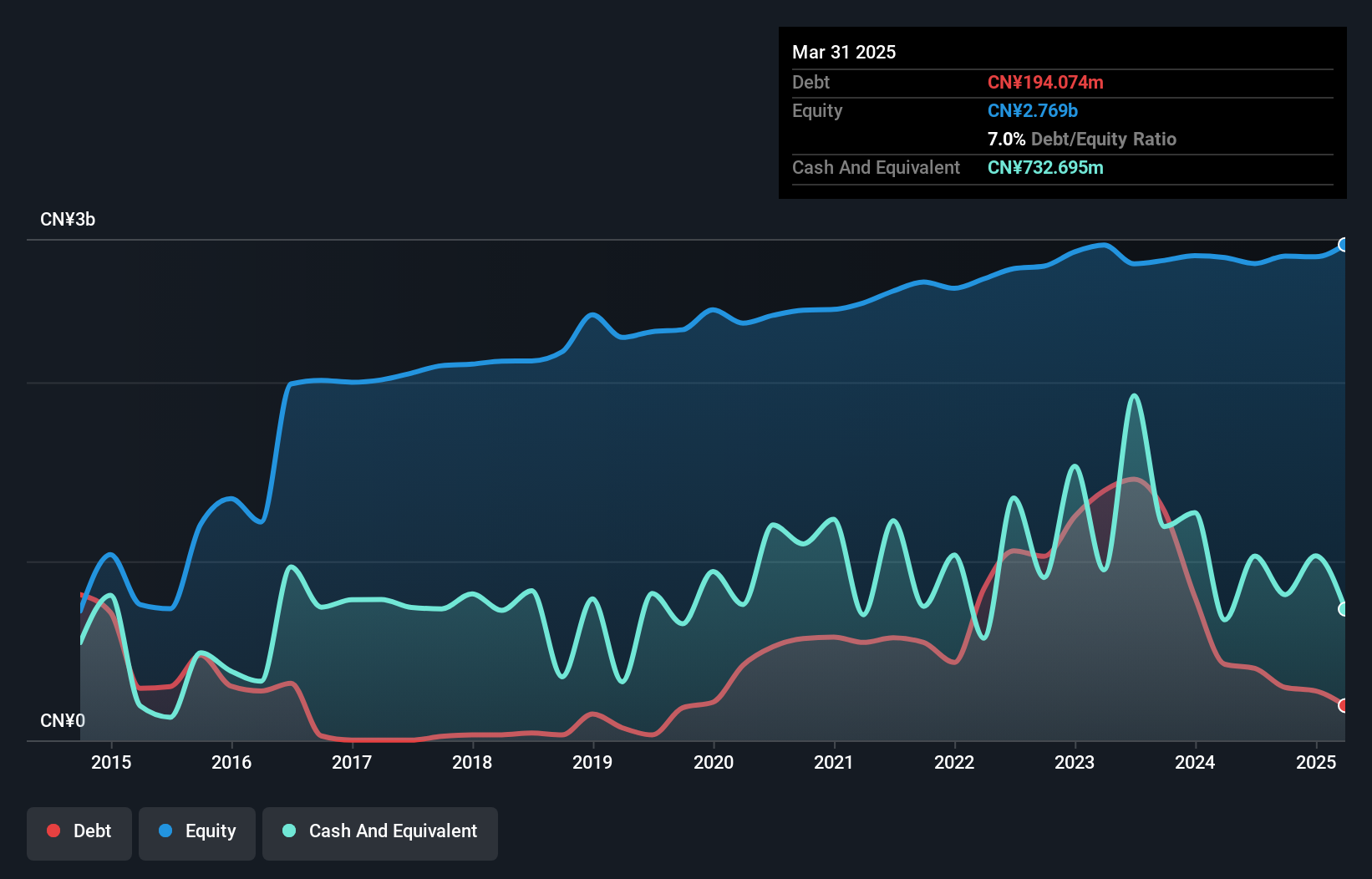

Innuovo Technology, a small cap entity in the tech sector, has shown impressive financial performance recently. The company's earnings surged by 62.5% over the past year, outpacing the Metals and Mining industry which saw a -2.3% change. Trading at 66.7% below its estimated fair value suggests potential undervaluation. Despite high volatility in share price over the last three months, Innuovo remains profitable with positive free cash flow of CNY 442 million as of September 2024. Earnings for nine months ending September 2024 reached CNY 206 million compared to CNY 82 million a year prior, showcasing significant growth momentum.

- Unlock comprehensive insights into our analysis of Innuovo Technology stock in this health report.

Explore historical data to track Innuovo Technology's performance over time in our Past section.

Shenzhen Farben Information TechnologyLtd (SZSE:300925)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Farben Information Technology Co., Ltd. operates in the technology sector, focusing on providing information technology services and solutions, with a market cap of CN¥10.39 billion.

Operations: Farben's primary revenue streams are derived from its information technology services and solutions. The company has a market capitalization of CN¥10.39 billion, reflecting its position in the technology sector.

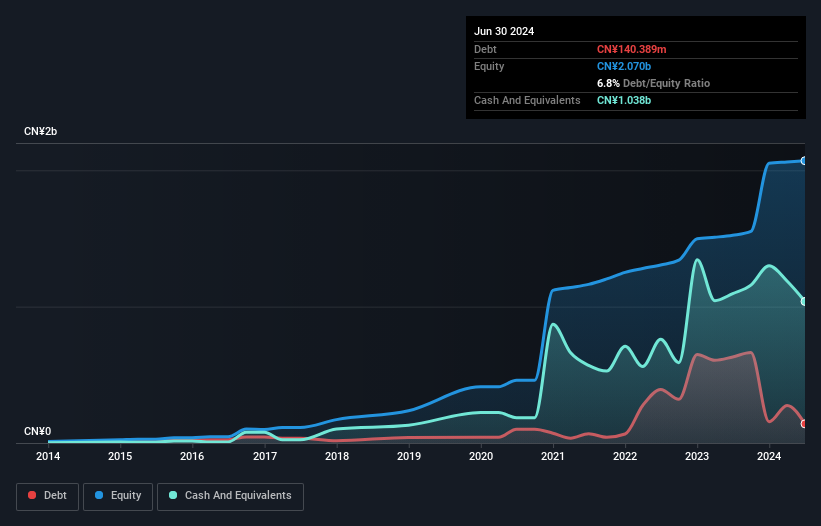

Shenzhen Farben, a nimble player in the IT sector, has been making waves with its robust earnings growth of 28.2% over the past year, outpacing the industry's -8.1%. The company's net income for the first nine months of 2024 reached CNY 109.92 million, up from CNY 84.45 million last year, reflecting its high-quality earnings and profitability. With a debt-to-equity ratio reduced to 7.7% from 11.2% over five years and more cash than total debt, Shenzhen Farben seems well-positioned financially despite recent share price volatility in the last three months.

Fulgent Sun International (Holding) (TWSE:9802)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fulgent Sun International (Holding) Co., Ltd. and its subsidiaries are engaged in the production and sale of sports and leisure outdoor footwear in Taiwan, with a market capitalization of NT$24.74 billion.

Operations: Fulgent Sun generates revenue primarily from the production and sale of sports and leisure outdoor footwear. The company has a market capitalization of NT$24.74 billion, reflecting its scale in the industry.

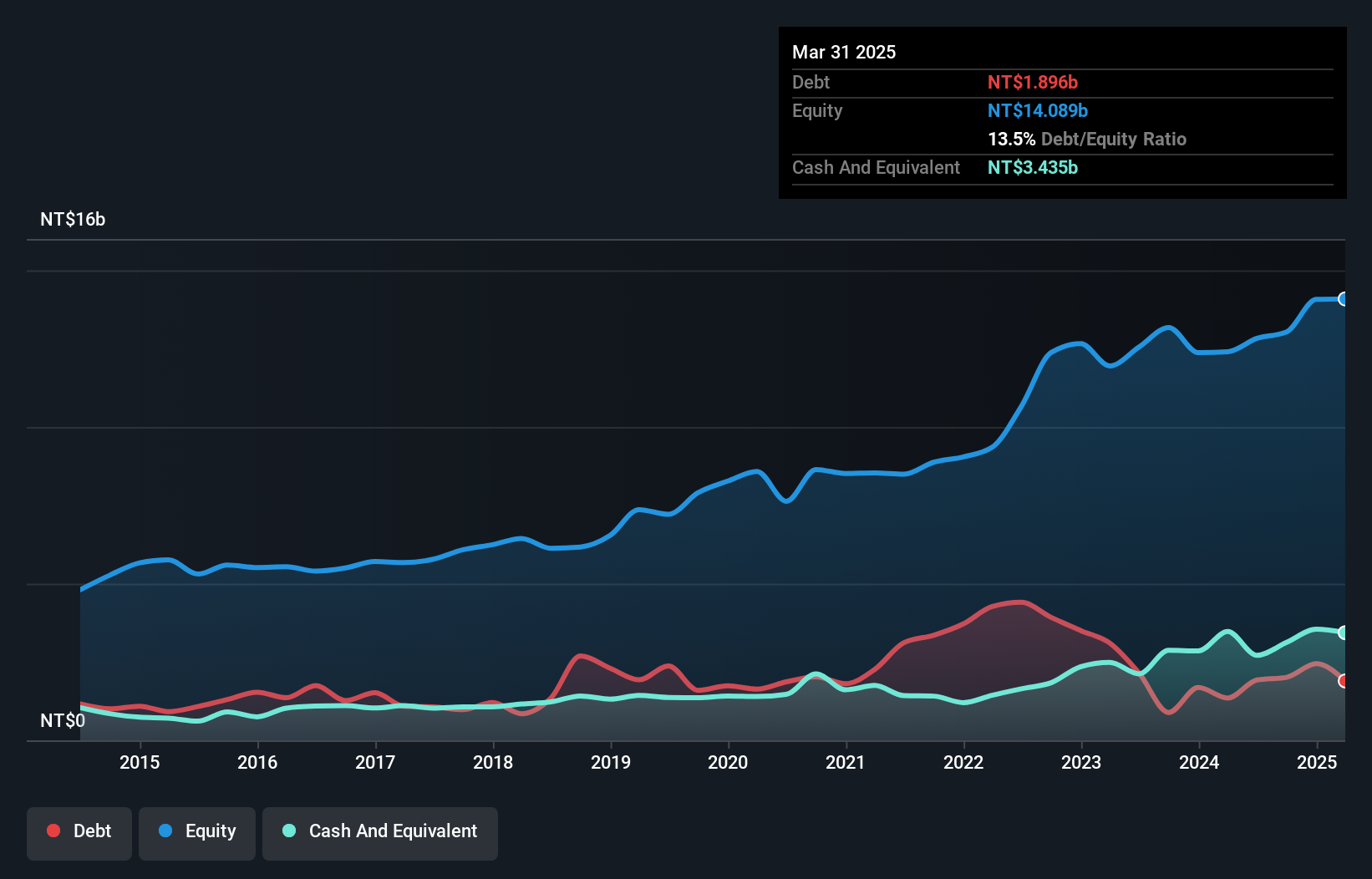

Fulgent Sun, a promising player in the footwear industry, shows mixed signals for investors. Despite a dip in earnings growth at -8.1% against the luxury sector's 13.9% average, it remains free cash flow positive and profitable with high-quality past earnings. The company’s debt-to-equity ratio has slightly increased from 21% to 22.2% over five years, yet its price-to-earnings ratio of 18x suggests good value compared to Taiwan's market average of 20.3x. Recent financials indicate a drop in net income from TWD 338 million to TWD 102 million year-over-year for Q3, highlighting potential challenges ahead despite revenue forecasts showing promise with an expected annual growth of roughly 21%.

Where To Now?

- Explore the 4644 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000795

Innuovo Technology

Engages in the research and development, production, and sale of rare earth permanent magnet materials in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives