As global markets continue to navigate a landscape marked by rising inflation and cautious monetary policies, U.S. stock indexes are climbing toward record highs, with growth stocks outpacing value shares. Despite small-cap stocks lagging behind larger indices like the S&P 500, opportunities abound for discerning investors seeking undiscovered gems that can thrive amid economic uncertainties and potential tariff negotiations. In this context, a good stock often combines strong fundamentals with resilience to broader market volatility, making it well-positioned to capitalize on current conditions while offering long-term growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| Wema Bank | 45.02% | 36.14% | 60.04% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Malam - Team | 102.85% | 10.82% | -10.47% | ★★★★☆☆ |

| Britam Holdings | 8.55% | -2.40% | 35.94% | ★★★★☆☆ |

| Sanstar | 9.90% | 23.18% | 36.19% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

J.S. Corrugating Machinery (SZSE:000821)

Simply Wall St Value Rating: ★★★★☆☆

Overview: J.S. Corrugating Machinery Co., Ltd. specializes in the R&D, design, production, and sale of non-standard smart equipment for the photovoltaics and corrugated packaging industries both in China and internationally, with a market cap of CN¥8.17 billion.

Operations: The company generates revenue through the sale of non-standard smart equipment primarily for the photovoltaics and corrugated packaging industries. It focuses on both domestic and international markets.

J.S. Corrugating Machinery exhibits promising characteristics for those exploring niche investments. With a debt to equity ratio climbing from 23.8% to 31.8% over five years, the financial leverage is notable but manageable given its cash surplus over total debt. Its price-to-earnings ratio of 18.4x positions it attractively against the broader CN market at 37.9x, indicating potential undervaluation relative to peers and industry standards. Earnings growth at 18% last year outpaced the machinery industry's -0.06%, suggesting robust operational performance and high-quality earnings that could fuel future expansion with forecasts pointing towards a substantial annual growth rate of 38%.

- Unlock comprehensive insights into our analysis of J.S. Corrugating Machinery stock in this health report.

Learn about J.S. Corrugating Machinery's historical performance.

Universal Microwave Technology (TPEX:3491)

Simply Wall St Value Rating: ★★★★★☆

Overview: Universal Microwave Technology, Inc. operates in the microwave and millimeter wave wireless communication industry across Taiwan, China, Asia, Europe, the United States, and Oceania with a market capitalization of NT$26.90 billion.

Operations: With a market capitalization of NT$26.90 billion, the company's revenue streams include Radio Frequency Products (NT$1.06 billion), Microwave/Millimeter Wave Products (NT$1.26 billion), and Communications Network Engineering Services (NT$214.58 million).

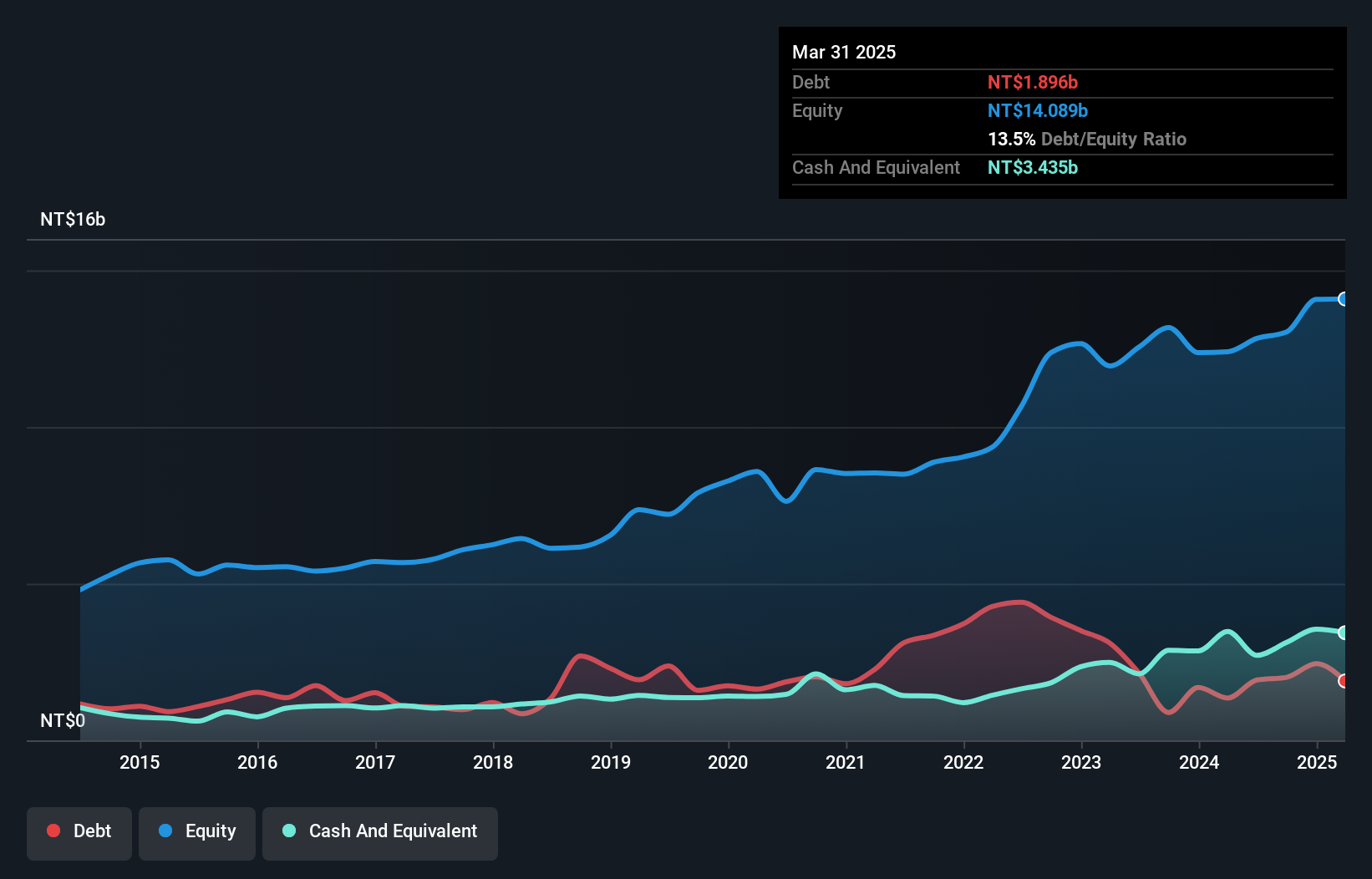

Universal Microwave Technology has been making waves with its impressive earnings growth of 108.7% over the past year, outpacing the electronic industry average of 7.8%. Despite a debt-to-equity ratio increase from 10.6 to 35.9 over five years, it maintains more cash than total debt, suggesting financial soundness. The company's free cash flow remains positive, reflecting operational efficiency and profitability without liquidity concerns. Although its share price has shown high volatility recently, forecasts indicate a promising annual earnings growth rate of 46%, positioning it as an intriguing prospect in the electronics sector for potential investors seeking dynamic opportunities.

Fulgent Sun International (Holding) (TWSE:9802)

Simply Wall St Value Rating: ★★★★★☆

Overview: Fulgent Sun International (Holding) Co., Ltd. and its subsidiaries are engaged in the production and sale of sports and leisure outdoor footwear in Taiwan, with a market capitalization of NT$27.85 billion.

Operations: The company generates its revenue primarily from the production and sales of sports and leisure outdoor footwear, accounting for NT$14.61 billion.

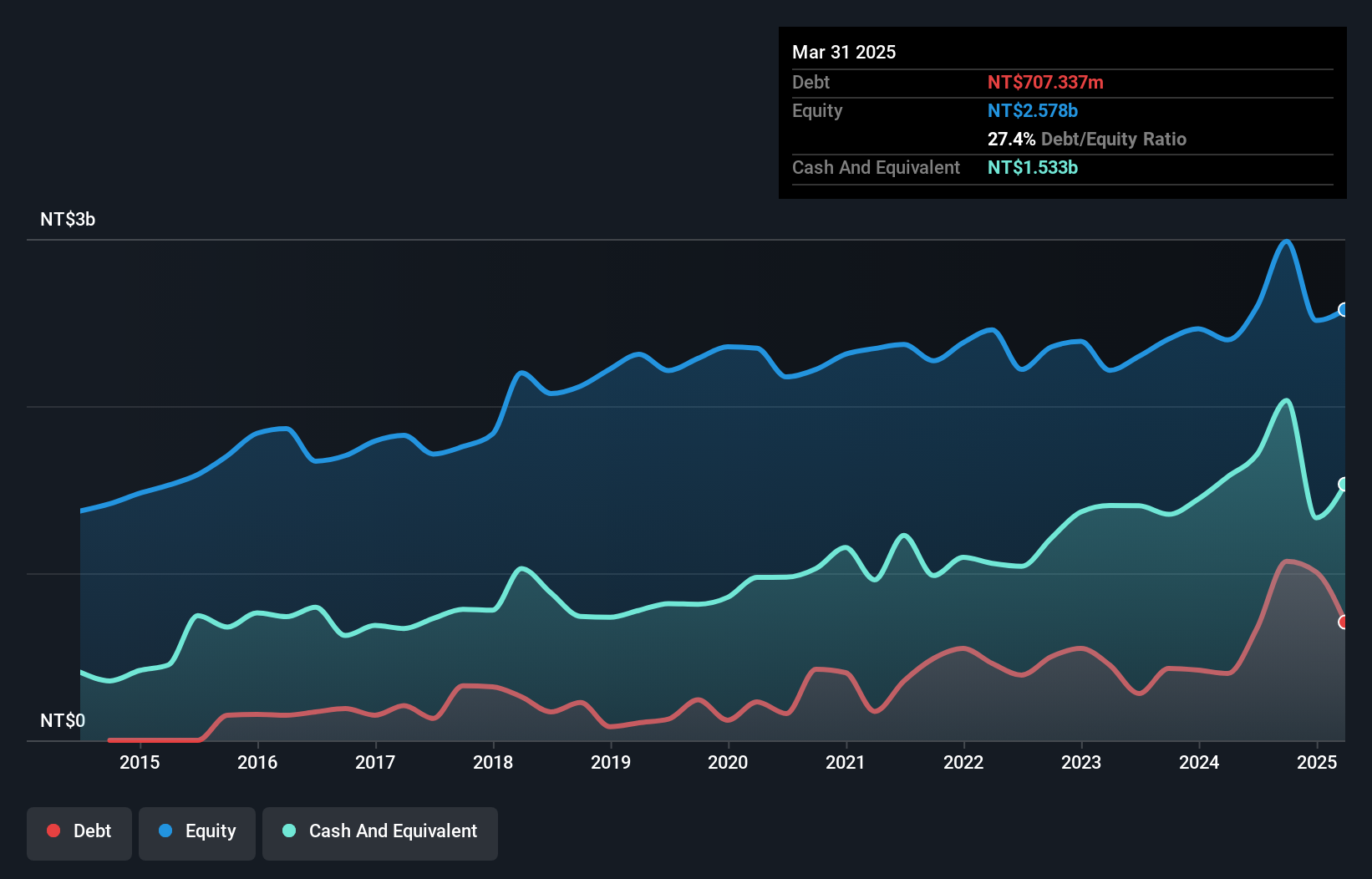

Fulgent Sun International, a smaller player in the luxury sector, offers an intriguing mix of financial stability and growth potential. The company boasts a Price-To-Earnings ratio of 22.2x, slightly under the industry average of 23.5x, suggesting reasonable valuation. Despite experiencing negative earnings growth at -8.1% over the past year, revenue is projected to grow by 22% annually. Notably, it holds more cash than its total debt and maintains positive free cash flow, highlighting sound financial health. Recent approval for a TWD 380 million dividend indicates confidence in future prospects despite recent share price volatility.

Where To Now?

- Click here to access our complete index of 4746 Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:9802

Fulgent Sun International (Holding)

Produces and sells sports and leisure outdoor footwear in Taiwan, rest of Asia, America, Europe, Africa, and Australia.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives