There's Reason For Concern Over Fulgent Sun International (Holding) Co., Ltd.'s (TWSE:9802) Price

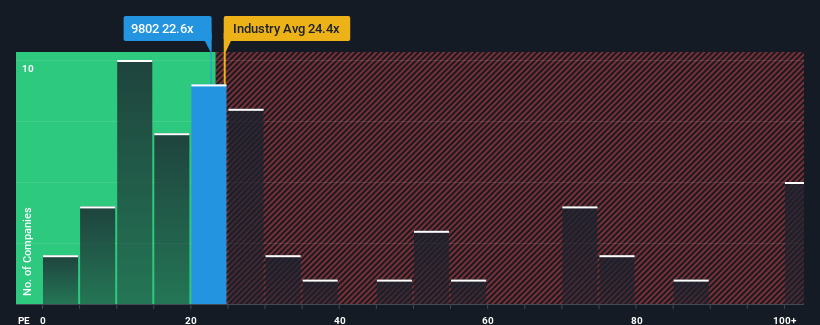

It's not a stretch to say that Fulgent Sun International (Holding) Co., Ltd.'s (TWSE:9802) price-to-earnings (or "P/E") ratio of 22.6x right now seems quite "middle-of-the-road" compared to the market in Taiwan, where the median P/E ratio is around 21x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

For example, consider that Fulgent Sun International (Holding)'s financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

View our latest analysis for Fulgent Sun International (Holding)

How Is Fulgent Sun International (Holding)'s Growth Trending?

In order to justify its P/E ratio, Fulgent Sun International (Holding) would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 58% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 15% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's an unpleasant look.

With this information, we find it concerning that Fulgent Sun International (Holding) is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Fulgent Sun International (Holding) currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 2 warning signs for Fulgent Sun International (Holding) that we have uncovered.

You might be able to find a better investment than Fulgent Sun International (Holding). If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:9802

Fulgent Sun International (Holding)

Produces and sells sports and leisure outdoor footwear in Taiwan.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives