Asian Value Stocks: Zhejiang Leapmotor Technology And 2 Other Companies Estimated Below Fair Value

Reviewed by Simply Wall St

As global markets navigate economic uncertainty and inflation concerns, Asian stocks present intriguing opportunities for value investors. In this environment, identifying undervalued stocks like Zhejiang Leapmotor Technology and others can offer potential benefits as they are estimated to be trading below their fair value amidst market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Chison Medical Technologies (SHSE:688358) | CN¥31.35 | CN¥61.59 | 49.1% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥78.35 | CN¥153.42 | 48.9% |

| Japan Tobacco (TSE:2914) | ¥4048.00 | ¥8034.57 | 49.6% |

| Tongqinglou Catering (SHSE:605108) | CN¥20.93 | CN¥40.95 | 48.9% |

| Kokusai Electric (TSE:6525) | ¥2290.00 | ¥4502.45 | 49.1% |

| JSHLtd (TSE:150A) | ¥562.00 | ¥1099.88 | 48.9% |

| BalnibarbiLtd (TSE:3418) | ¥1110.00 | ¥2201.96 | 49.6% |

| T'Way Air (KOSE:A091810) | ₩2040.00 | ₩4007.16 | 49.1% |

| Contec.Co.Ltd (KOSDAQ:A451760) | ₩9980.00 | ₩19686.41 | 49.3% |

| SFA Semicon (KOSDAQ:A036540) | ₩2900.00 | ₩5699.32 | 49.1% |

Here we highlight a subset of our preferred stocks from the screener.

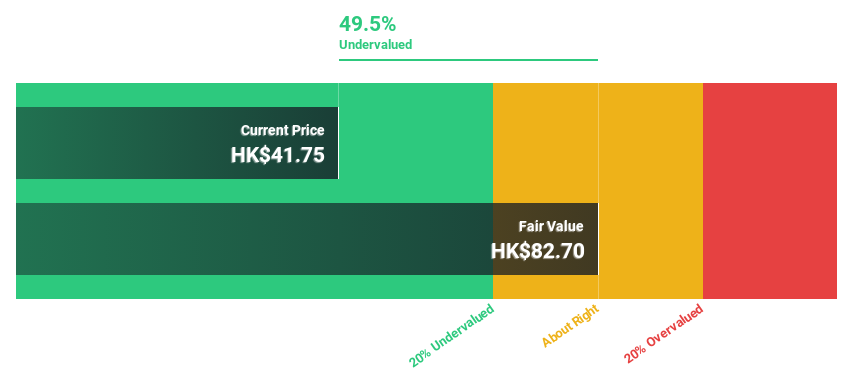

Zhejiang Leapmotor Technology (SEHK:9863)

Overview: Zhejiang Leapmotor Technology Co., Ltd. focuses on the research, development, production, and sale of new energy vehicles (EVs) in Mainland China and internationally, with a market cap of HK$74.13 billion.

Operations: The company's revenue is primarily derived from the production, research and development, and sales of new energy vehicles, amounting to CN¥32.16 billion.

Estimated Discount To Fair Value: 36.3%

Zhejiang Leapmotor Technology's recent financial performance shows a significant reduction in net loss from CNY 4.22 billion to CNY 2.82 billion, alongside impressive sales growth to CNY 32.16 billion. The company is trading at HK$55.45, notably below its estimated fair value of HK$86.98, suggesting undervaluation based on cash flows. With revenue forecasted to grow annually by 27.7%, surpassing the Hong Kong market average, and expected profitability within three years, it presents a compelling investment case despite current losses.

- In light of our recent growth report, it seems possible that Zhejiang Leapmotor Technology's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Zhejiang Leapmotor Technology.

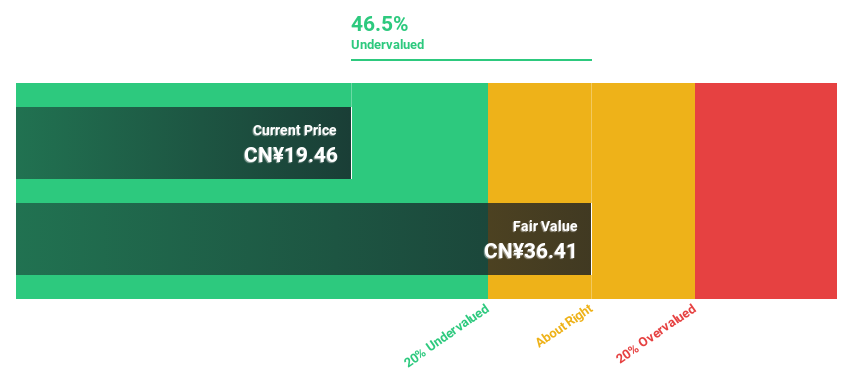

Chifeng Jilong Gold MiningLtd (SHSE:600988)

Overview: Chifeng Jilong Gold Mining Co., Ltd. is engaged in the mining of gold and non-ferrous metals, with a market capitalization of CN¥40.21 billion.

Operations: The company generates revenue from its operations primarily through Domestic Mining, which accounts for CN¥2.48 billion, and Overseas Mining, contributing CN¥6.24 billion.

Estimated Discount To Fair Value: 46.9%

Chifeng Jilong Gold Mining Ltd. is trading at CN¥22.29, significantly below its estimated fair value of CN¥42, highlighting potential undervaluation based on cash flows. The company reported robust financial performance with net income rising to CNY 1.76 billion and earnings per share doubling over the past year. Recent expansion efforts, including a new mining permit for its Xidengping Gold Mine, enhance its resource base and operational scale, supporting future growth prospects despite slower forecasted revenue growth compared to peers.

- Our earnings growth report unveils the potential for significant increases in Chifeng Jilong Gold MiningLtd's future results.

- Get an in-depth perspective on Chifeng Jilong Gold MiningLtd's balance sheet by reading our health report here.

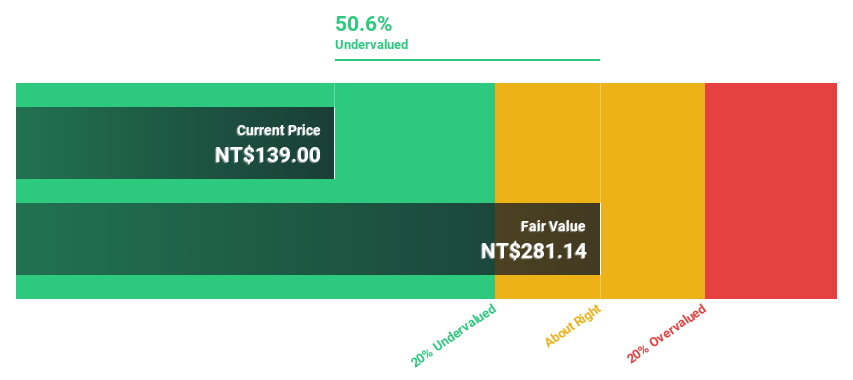

Alexander Marine (TWSE:8478)

Overview: Alexander Marine Co., Ltd. designs, manufactures, and sells yachts across Taiwan, Europe, Australia, and the United States with a market cap of NT$16.35 billion.

Operations: The company's revenue is primarily derived from its yacht manufacturing, processing, and trading business, which generated NT$4.94 billion.

Estimated Discount To Fair Value: 34.3%

Alexander Marine Co., Ltd. is trading at NT$174, significantly below its estimated fair value of NT$264.94, suggesting undervaluation based on cash flows. Despite a decline in net income to TWD 938.07 million for 2024 from TWD 2,081.43 million the previous year, revenue growth of 12.6% per year is expected to outpace the Taiwan market average of 10.1%. However, profit margins have decreased to 19%, and dividends are not well covered by free cash flows.

- Our comprehensive growth report raises the possibility that Alexander Marine is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Alexander Marine's balance sheet health report.

Key Takeaways

- Reveal the 271 hidden gems among our Undervalued Asian Stocks Based On Cash Flows screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Alexander Marine, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8478

Alexander Marine

Engages in the design, manufacture, and sale of yachts in Taiwan, Europe, Australia, and the United States.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives