- China

- /

- Transportation

- /

- SZSE:001202

Undiscovered Gems And 2 More Small Caps Backed By Solid Fundamentals

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with major indices like the S&P 500 and Nasdaq Composite experiencing fluctuations amidst economic indicators such as declining PMI readings and revised GDP forecasts, investors are increasingly looking toward small-cap stocks for potential opportunities. In this environment, identifying stocks with solid fundamentals becomes crucial, as these attributes can provide resilience against broader market volatility and offer growth potential in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Bahnhof | NA | 8.70% | 14.93% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Guangdong Jushen Logistics (SZSE:001202)

Simply Wall St Value Rating: ★★★★★☆

Overview: Guangdong Jushen Logistics Co., Ltd. offers integrated supply chain logistics services and has a market cap of CN¥1.98 billion.

Operations: Guangdong Jushen Logistics generates revenue primarily from its logistics and warehousing segment, which accounts for CN¥973.25 million. The company's gross profit margin is a key financial metric to consider when evaluating its performance.

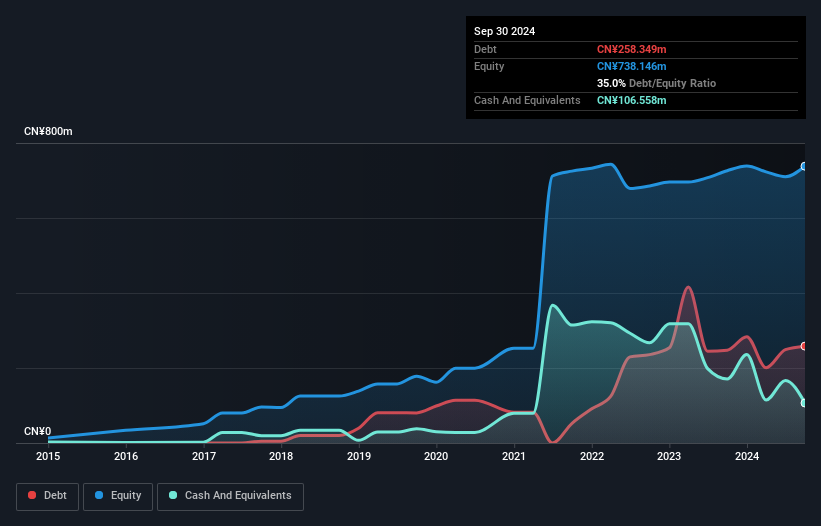

Guangdong Jushen Logistics seems to be on a steady path, with its debt to equity ratio improving from 45.1% to 35% over the last five years, indicating effective debt management. The company reported a notable earnings growth of 32.8% in the past year, outpacing the transportation industry average of 1.9%. Despite a slight dip in revenue from CNY 735.31 million to CNY 714.22 million for the nine months ending September 2024, net income rose significantly from CNY 49.75 million to CNY 67.65 million, showcasing operational efficiency and cost control measures that likely contributed positively to its bottom line performance.

- Click here and access our complete health analysis report to understand the dynamics of Guangdong Jushen Logistics.

Gain insights into Guangdong Jushen Logistics' past trends and performance with our Past report.

Automatic Bank Services (TASE:SHVA)

Simply Wall St Value Rating: ★★★★★★

Overview: Automatic Bank Services Limited operates payment systems for international debit cards in Israel and has a market cap of ₪1.04 billion.

Operations: Automatic Bank Services generates revenue primarily through its payment systems for international debit cards in Israel. The company's financial performance is reflected in its market capitalization of ₪1.04 billion, indicating the scale of its operations within the financial services sector.

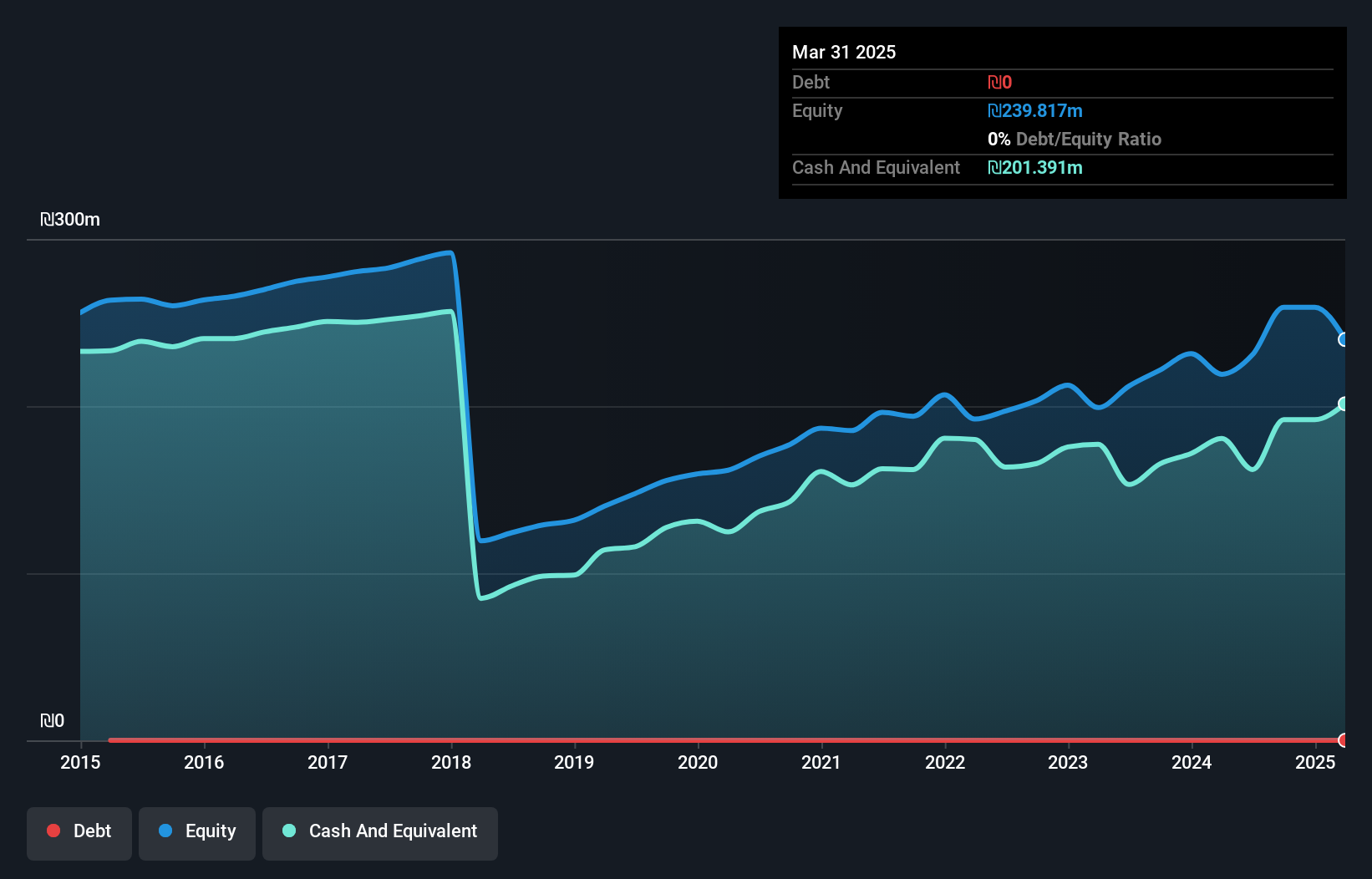

Automatic Bank Services, a nimble player in the financial sector, showcases robust performance with earnings growth of 30.2% over the past year, outpacing the industry average of -8.1%. Its recent financials reveal a net income of ILS 15.55 million for Q3 2024, up from ILS 8.69 million the previous year, alongside revenue climbing to ILS 39.42 million from ILS 35.94 million. The company operates debt-free and boasts high-quality non-cash earnings, reflecting strong operational efficiency and resilience in an evolving market landscape without concerns over interest payments due to its debt-free status.

- Navigate through the intricacies of Automatic Bank Services with our comprehensive health report here.

Assess Automatic Bank Services' past performance with our detailed historical performance reports.

Bonny Worldwide (TWSE:8467)

Simply Wall St Value Rating: ★★★★★★

Overview: Bonny Worldwide Limited, with a market cap of NT$15.40 billion, operates in the manufacture and sale of OEM and ODM carbon fiber rackets and related sporting goods through its subsidiaries.

Operations: The company generates revenue primarily from the research, development, design, manufacturing, and sales of carbon fiber products amounting to NT$2.31 billion.

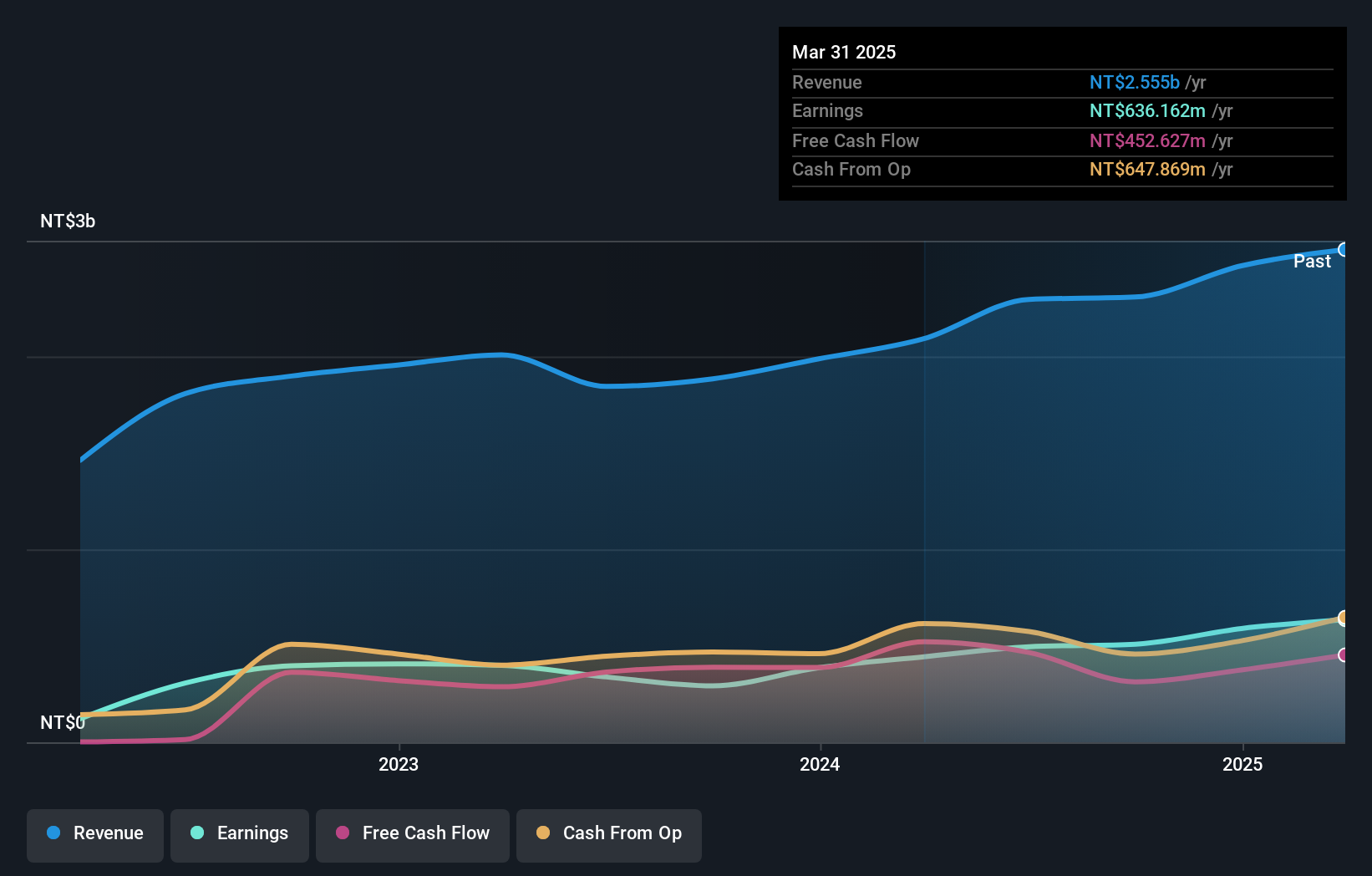

Bonny Worldwide, a promising player in the market, reported robust earnings growth of 74% over the past year, outpacing the Leisure industry's -15.6%. The company's debt-to-equity ratio improved from 44.7% to 37.8% over five years, indicating effective debt management. Despite recent share price volatility, Bonny maintains a strong financial position with more cash than total debt and positive free cash flow. Recent earnings showed net income rising to TWD 144.5 million for Q3 2024 from TWD 131 million last year, reflecting solid operational performance and high-quality earnings that bolster investor confidence in its future potential.

Taking Advantage

- Investigate our full lineup of 4672 Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001202

Jushen Logistics Group

Provides integrated supply chain logistics services.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives