Bonny Worldwide Limited (TWSE:8467) Stocks Shoot Up 34% But Its P/E Still Looks Reasonable

The Bonny Worldwide Limited (TWSE:8467) share price has done very well over the last month, posting an excellent gain of 34%. The annual gain comes to 280% following the latest surge, making investors sit up and take notice.

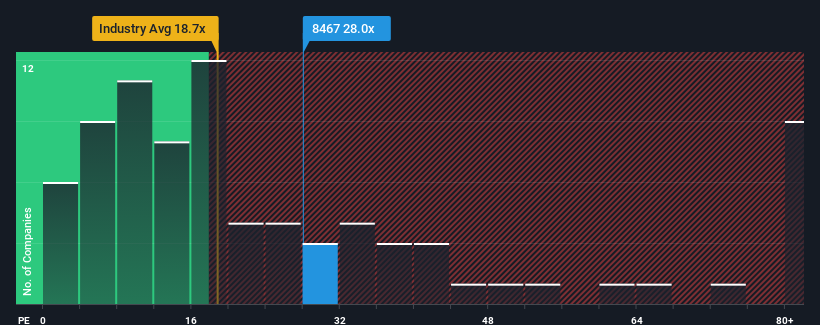

Since its price has surged higher, Bonny Worldwide's price-to-earnings (or "P/E") ratio of 28x might make it look like a sell right now compared to the market in Taiwan, where around half of the companies have P/E ratios below 23x and even P/E's below 16x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Bonny Worldwide has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Bonny Worldwide

Is There Enough Growth For Bonny Worldwide?

Bonny Worldwide's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Retrospectively, the last year delivered a decent 8.7% gain to the company's bottom line. This was backed up an excellent period prior to see EPS up by 1,850% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 24% shows it's noticeably more attractive on an annualised basis.

In light of this, it's understandable that Bonny Worldwide's P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Final Word

Bonny Worldwide's P/E is getting right up there since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Bonny Worldwide revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Bonny Worldwide.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

If you're looking to trade Bonny Worldwide, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bonny Worldwide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8467

Bonny Worldwide

Engages in the manufacture and sale of OEM and ODM carbon fiber rackets and related sporting goods.

Flawless balance sheet with solid track record.