What Thunder Tiger Corp.'s (TWSE:8033) 27% Share Price Gain Is Not Telling You

Thunder Tiger Corp. (TWSE:8033) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 19% is also fairly reasonable.

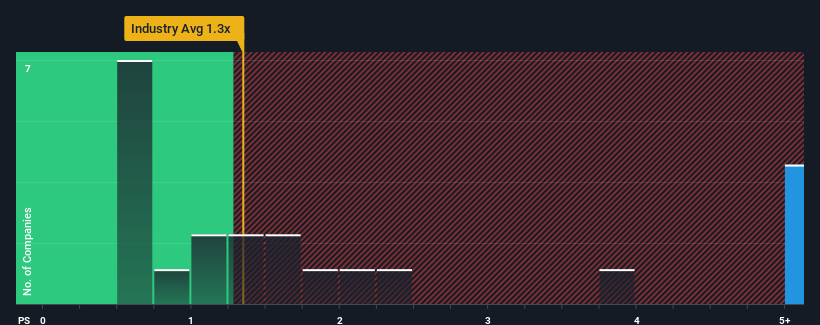

Following the firm bounce in price, when almost half of the companies in Taiwan's Leisure industry have price-to-sales ratios (or "P/S") below 1.3x, you may consider Thunder Tiger as a stock not worth researching with its 9.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Thunder Tiger

How Thunder Tiger Has Been Performing

For example, consider that Thunder Tiger's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Thunder Tiger's earnings, revenue and cash flow.How Is Thunder Tiger's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Thunder Tiger's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a frustrating 9.6% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 8.5% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 2.1% shows it's about the same on an annualised basis.

With this in mind, we find it intriguing that Thunder Tiger's P/S exceeds that of its industry peers. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On Thunder Tiger's P/S

Shares in Thunder Tiger have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Thunder Tiger revealed its three-year revenue trends aren't impacting its high P/S as much as we would have predicted, given they look similar to current industry expectations. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 2 warning signs for Thunder Tiger that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Thunder Tiger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:8033

Thunder Tiger

Manufactures and sells remote-controlled planes, helicopters, cars, boats, engine parts, and medical devices in Taiwan, the Americas, and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives