FuSheng Precision Co., Ltd. (TWSE:6670) Doing What It Can To Lift Shares

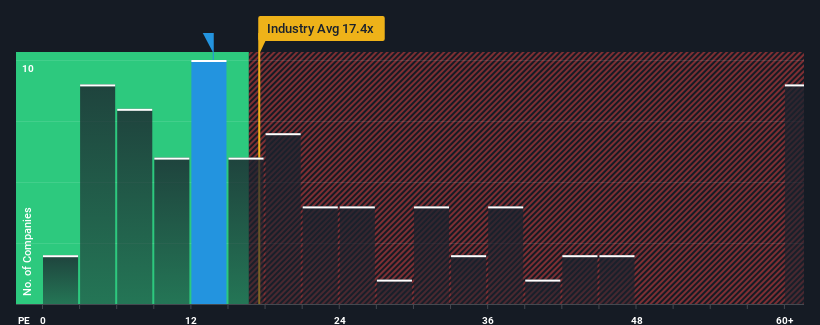

With a price-to-earnings (or "P/E") ratio of 13.7x FuSheng Precision Co., Ltd. (TWSE:6670) may be sending bullish signals at the moment, given that almost half of all companies in Taiwan have P/E ratios greater than 24x and even P/E's higher than 40x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings that are retreating more than the market's of late, FuSheng Precision has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

View our latest analysis for FuSheng Precision

How Is FuSheng Precision's Growth Trending?

FuSheng Precision's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 50% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 110% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 37% over the next year. With the market only predicted to deliver 26%, the company is positioned for a stronger earnings result.

With this information, we find it odd that FuSheng Precision is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On FuSheng Precision's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of FuSheng Precision's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You always need to take note of risks, for example - FuSheng Precision has 2 warning signs we think you should be aware of.

Of course, you might also be able to find a better stock than FuSheng Precision. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6670

FuSheng Precision

Engages in the golf and sports equipment businesses in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026