Do These 3 Checks Before Buying KMC (Kuei Meng) International Inc. (TWSE:5306) For Its Upcoming Dividend

KMC (Kuei Meng) International Inc. (TWSE:5306) stock is about to trade ex-dividend in four days. The ex-dividend date is commonly two business days before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is important as the process of settlement involves at least two full business days. So if you miss that date, you would not show up on the company's books on the record date. Therefore, if you purchase KMC (Kuei Meng) International's shares on or after the 18th of March, you won't be eligible to receive the dividend, when it is paid on the 16th of April.

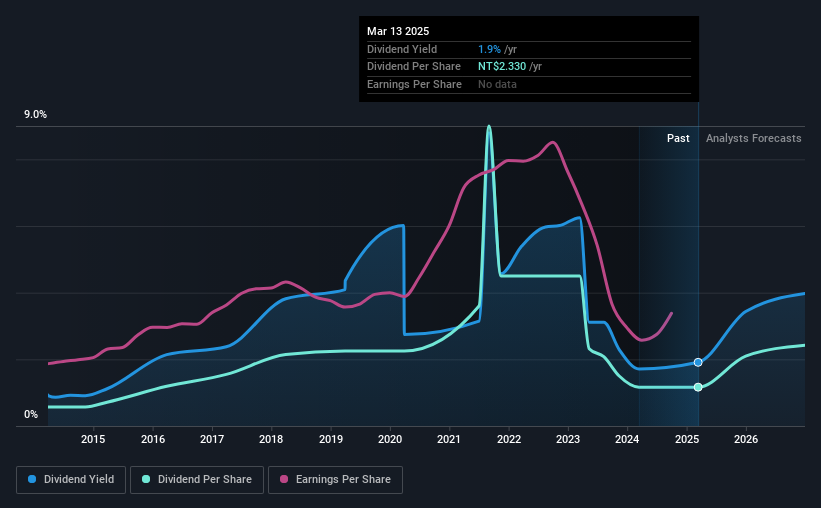

The company's next dividend payment will be NT$1.525165 per share. Last year, in total, the company distributed NT$2.33 to shareholders. Last year's total dividend payments show that KMC (Kuei Meng) International has a trailing yield of 1.9% on the current share price of NT$122.00. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for KMC (Kuei Meng) International

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. KMC (Kuei Meng) International paid out 60% of its earnings to investors last year, a normal payout level for most businesses. A useful secondary check can be to evaluate whether KMC (Kuei Meng) International generated enough free cash flow to afford its dividend. Thankfully its dividend payments took up just 41% of the free cash flow it generated, which is a comfortable payout ratio.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. So we're not too excited that KMC (Kuei Meng) International's earnings are down 2.1% a year over the past five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Since the start of our data, 10 years ago, KMC (Kuei Meng) International has lifted its dividend by approximately 7.4% a year on average. Growing the dividend payout ratio while earnings are declining can deliver nice returns for a while, but it's always worth checking for when the company can't increase the payout ratio any more - because then the music stops.

To Sum It Up

Has KMC (Kuei Meng) International got what it takes to maintain its dividend payments? We're not enthused by the declining earnings per share, although at least the company's payout ratio is within a reasonable range, meaning it may not be at imminent risk of a dividend cut. While it does have some good things going for it, we're a bit ambivalent and it would take more to convince us of KMC (Kuei Meng) International's dividend merits.

So if you want to do more digging on KMC (Kuei Meng) International, you'll find it worthwhile knowing the risks that this stock faces. Our analysis shows 1 warning sign for KMC (Kuei Meng) International and you should be aware of it before buying any shares.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

If you're looking to trade KMC (Kuei Meng) International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KMC (Kuei Meng) International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:5306

KMC (Kuei Meng) International

Manufactures and sells various types of chains, motorcycle components, and vehicle components in Asia, Europe, and the United States.

Flawless balance sheet with proven track record and pays a dividend.