- Taiwan

- /

- Consumer Durables

- /

- TWSE:5225

Three Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a landscape marked by accelerating U.S. inflation and rising stock indexes, investors are keenly observing how these dynamics might influence investment strategies. With major indices like the S&P 500 and Nasdaq Composite nearing record highs, dividend stocks present an attractive option for those seeking steady income amid market fluctuations. In such a climate, identifying robust dividend stocks can offer potential stability and regular income streams, making them a compelling consideration for investors looking to balance growth with income in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.24% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.05% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.95% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.04% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

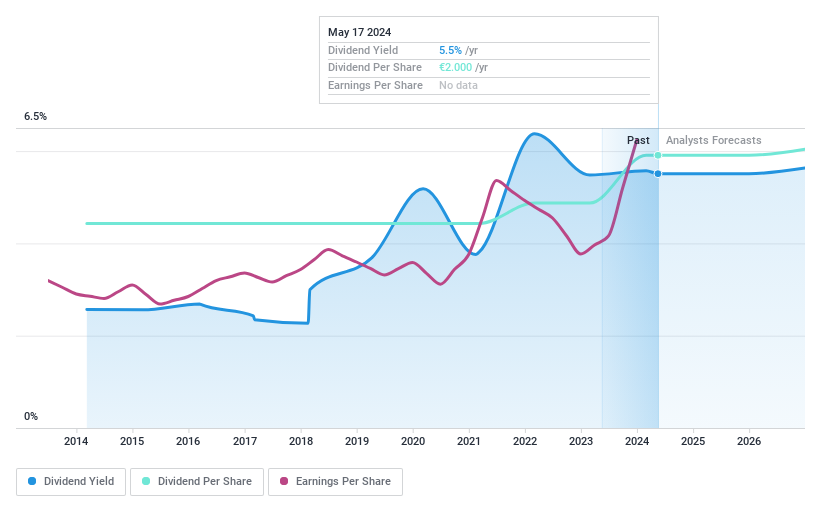

Vicat (ENXTPA:VCT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Vicat S.A. operates in the construction industry through its production and sale of cement, ready-mixed concrete, and aggregates, with a market cap of €2.01 billion.

Operations: Vicat S.A.'s revenue is primarily derived from its Cement segment at €2.52 billion and its Concrete & Aggregates segment at €1.55 billion.

Dividend Yield: 4.4%

Vicat offers a stable and reliable dividend, with payments increasing over the past decade. The company's dividends are well-covered by earnings (33.4% payout ratio) and cash flows (45.7% cash payout ratio), indicating sustainability. Despite trading at 56.3% below estimated fair value, its dividend yield of 4.43% is lower than the top quartile in France but remains attractive for income-focused investors due to its stability and growth history amidst a high debt level backdrop.

- Take a closer look at Vicat's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Vicat is trading behind its estimated value.

Chun Yuan Steel Industry (TWSE:2010)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chun Yuan Steel Industry Co., Ltd. is engaged in the production and sale of steel products across Taiwan and the rest of Asia, with a market capitalization of NT$12.24 billion.

Operations: Chun Yuan Steel Industry Co., Ltd.'s revenue segments include NT$9.23 billion from the First Business Segment, NT$8.96 billion from the Construction Division, NT$2.55 billion from the Second Business Unit, NT$1.95 billion from Shanghai Huateng Metal Processing Co., Ltd., NT$1.36 billion from QING DAO CHUN YUAN PRECISION MECHATRONIC CO., LTD., and NT$710.64 million from Shenzhen Hongyuan Metal Industry Co., Ltd.

Dividend Yield: 5.3%

Chun Yuan Steel Industry's dividend yield of 5.31% ranks in the top 25% of Taiwan's market, yet its dividends have been volatile and declining over the past decade. Despite this instability, dividends are covered by earnings (64% payout ratio) and cash flows (62.3% cash payout), suggesting sustainability for now. The company’s P/E ratio of 12.1x is attractive compared to the market average, but recent changes in corporate bylaws could impact future policies or strategies.

- Unlock comprehensive insights into our analysis of Chun Yuan Steel Industry stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Chun Yuan Steel Industry is priced higher than what may be justified by its financials.

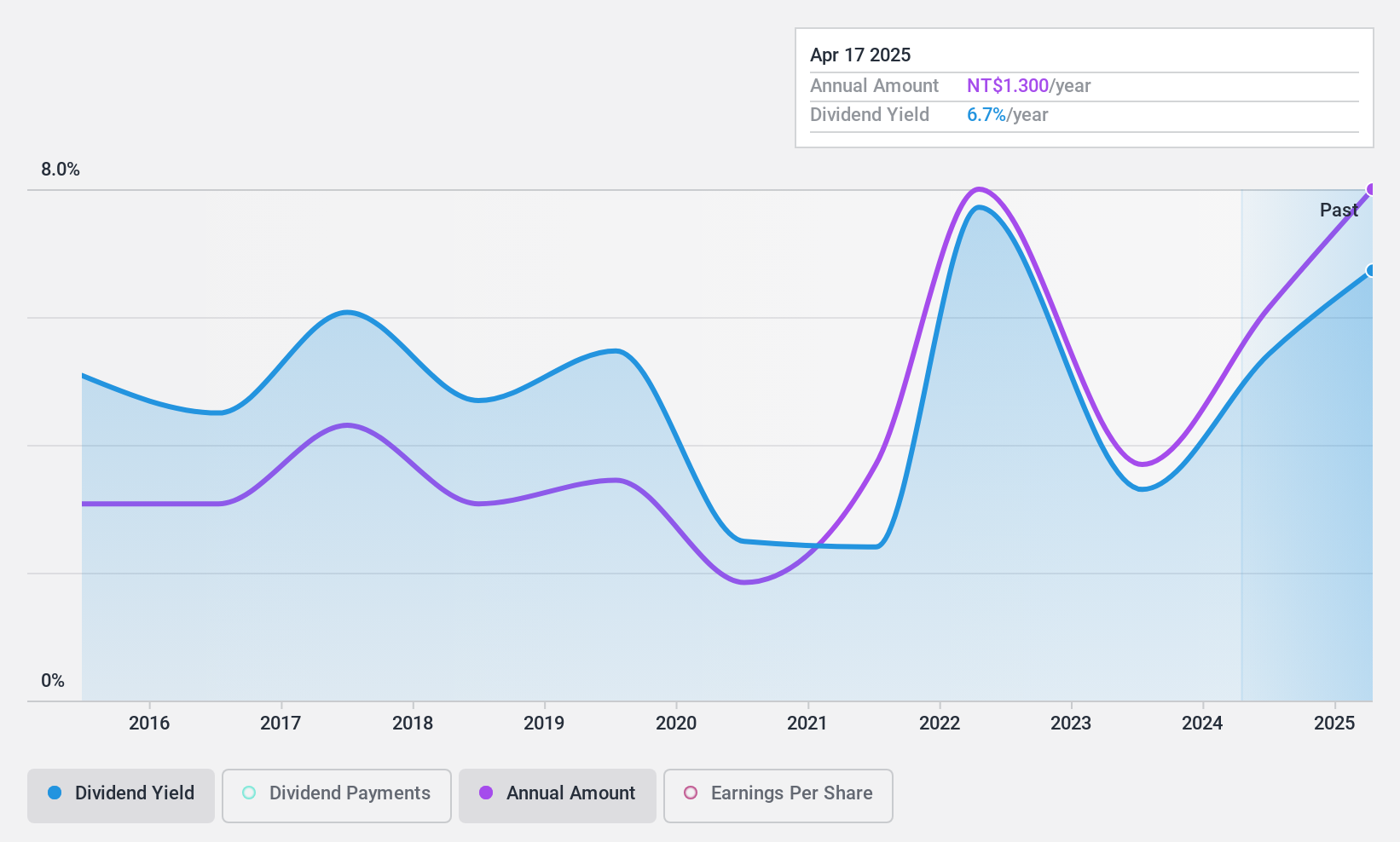

Eastech Holding (TWSE:5225)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Eastech Holding Limited, with a market cap of NT$10.68 billion, engages in the research, development, design, assembly, manufacturing, and sale of speakers, speaker systems, home electronic entertainment systems, and earphones across South Korea, Japan, Sweden, China, Denmark and internationally.

Operations: Eastech Holding Limited generates revenue primarily from its Audio / Video Products segment, which accounts for NT$12.15 billion.

Dividend Yield: 4.8%

Eastech Holding's dividend yield of 4.76% is among the top 25% in Taiwan, but its dividends have been volatile over the past decade. Despite this, a payout ratio of 53.5% and cash payout ratio of 47.2% indicate sustainability, supported by an 88% earnings growth last year. The company trades at a significant discount to its estimated fair value and plans to invest up to US$7 million in expanding operations in Vietnam, potentially enhancing future stability.

- Navigate through the intricacies of Eastech Holding with our comprehensive dividend report here.

- Our expertly prepared valuation report Eastech Holding implies its share price may be lower than expected.

Taking Advantage

- Delve into our full catalog of 1983 Top Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastech Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:5225

Eastech Holding

Researches, develops, designs, assembles, manufactures, and sells speakers, speaker systems, home electronic entertainment system, and earphones in South Korea, Japan, Sweden, China, Denmark, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives