As global markets react to the recent U.S. election results, with major indices reaching record highs on hopes of growth and tax reforms, investors are increasingly looking at dividend stocks as a way to capitalize on potential economic expansion while managing risk. In this environment of shifting policies and market optimism, a good dividend stock typically offers reliable income through consistent payouts and has the potential for capital appreciation, making it an attractive option for those seeking stability amid market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Globeride (TSE:7990) | 4.06% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.35% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.32% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.46% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.32% | ★★★★★☆ |

| Premier Financial (NasdaqGS:PFC) | 4.32% | ★★★★★☆ |

Click here to see the full list of 1936 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

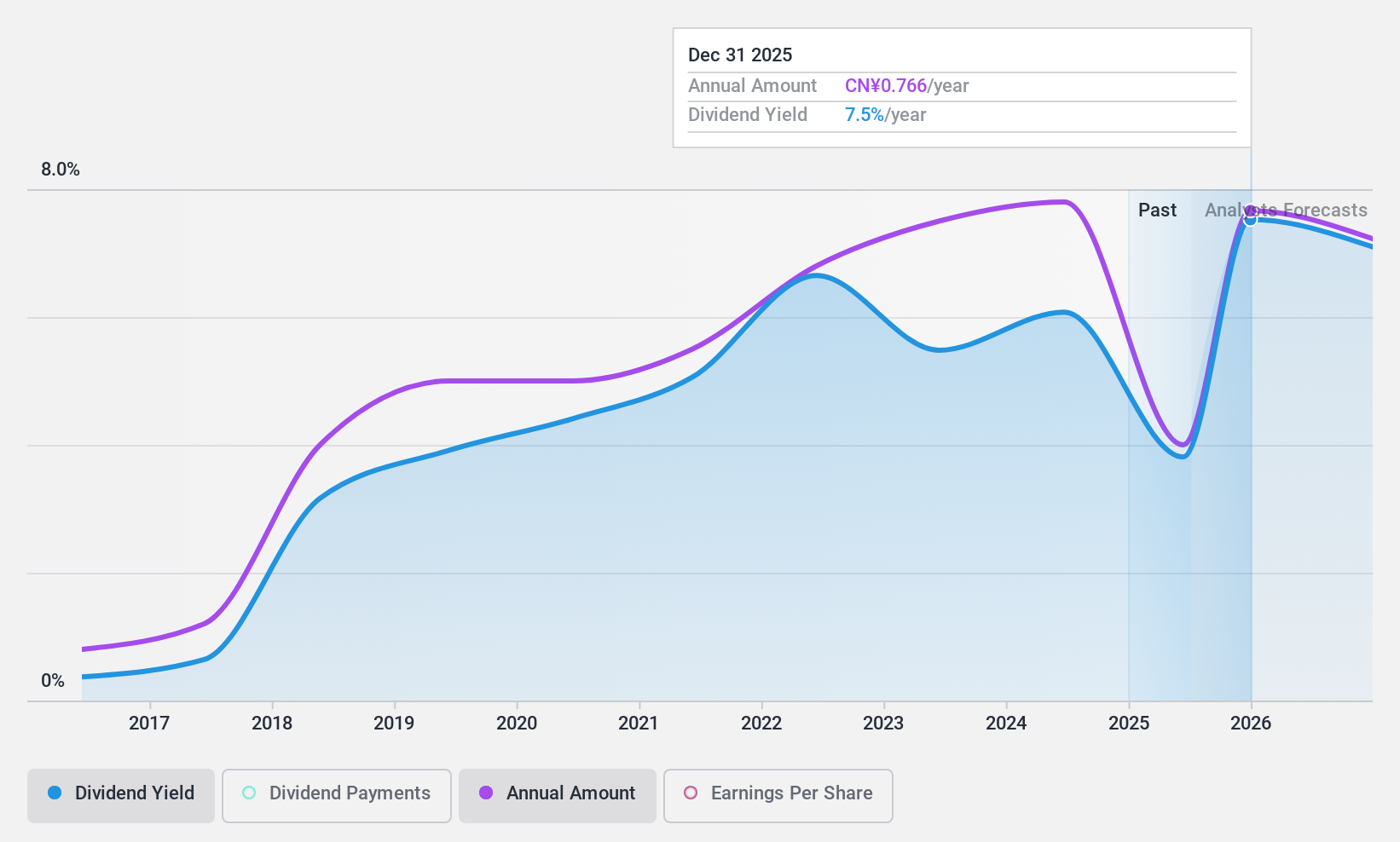

Chinese Universe Publishing and Media Group (SHSE:600373)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chinese Universe Publishing and Media Group Co., Ltd. (SHSE:600373) operates in the publishing and media industry with a market capitalization of approximately CN¥18.46 billion.

Operations: Chinese Universe Publishing and Media Group Co., Ltd. (SHSE:600373) generates its revenue from various segments within the publishing and media industry.

Dividend Yield: 5.9%

Chinese Universe Publishing and Media Group offers a high dividend yield of 5.92%, placing it among the top 25% of dividend payers in China. However, recent earnings have declined, with net income dropping to CNY 727.99 million for the nine months ended September 2024. The company’s dividends are not well covered by free cash flows, indicated by a high cash payout ratio of 145.9%. Despite this, its price-to-earnings ratio suggests good value compared to the broader market.

- Navigate through the intricacies of Chinese Universe Publishing and Media Group with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Chinese Universe Publishing and Media Group is priced lower than what may be justified by its financials.

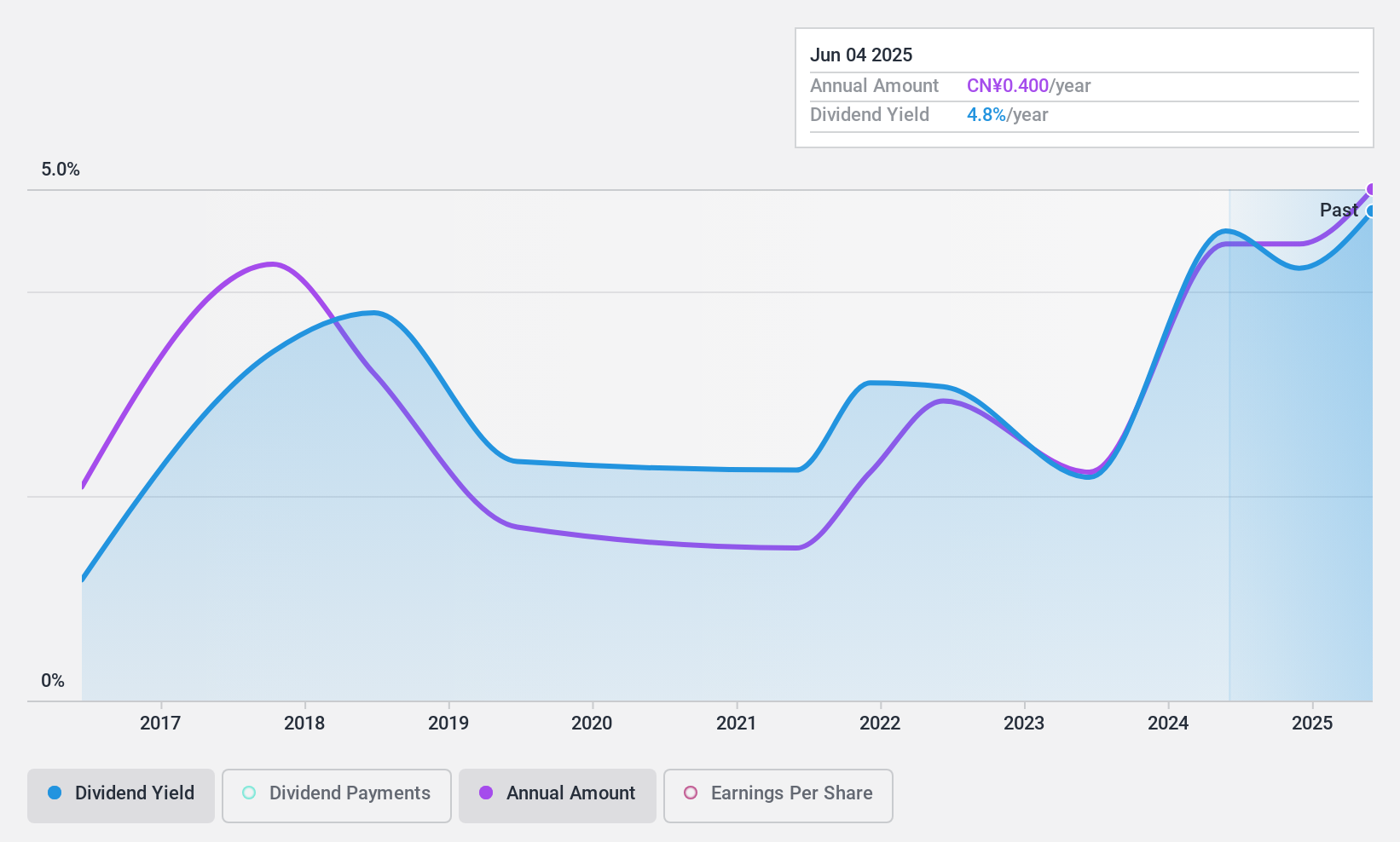

Time Publishing and Media (SHSE:600551)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Time Publishing and Media Co., Ltd. is a Chinese company that publishes various books and periodicals, with a market cap of CN¥5.87 billion.

Operations: Time Publishing and Media Co., Ltd. generates its revenue primarily from the publication of books and periodicals in China.

Dividend Yield: 4.1%

Time Publishing and Media's dividend yield of 4.12% ranks it in the top 25% of Chinese dividend payers, supported by a low payout ratio (43.7%) and cash payout ratio (30.8%). Despite stable coverage, dividends have been volatile over the past decade. The company trades at an attractive valuation, significantly below its estimated fair value, but faces declining earnings projections over the next three years. Recent earnings showed slight revenue growth but stagnant net income year-over-year.

- Delve into the full analysis dividend report here for a deeper understanding of Time Publishing and Media.

- Insights from our recent valuation report point to the potential undervaluation of Time Publishing and Media shares in the market.

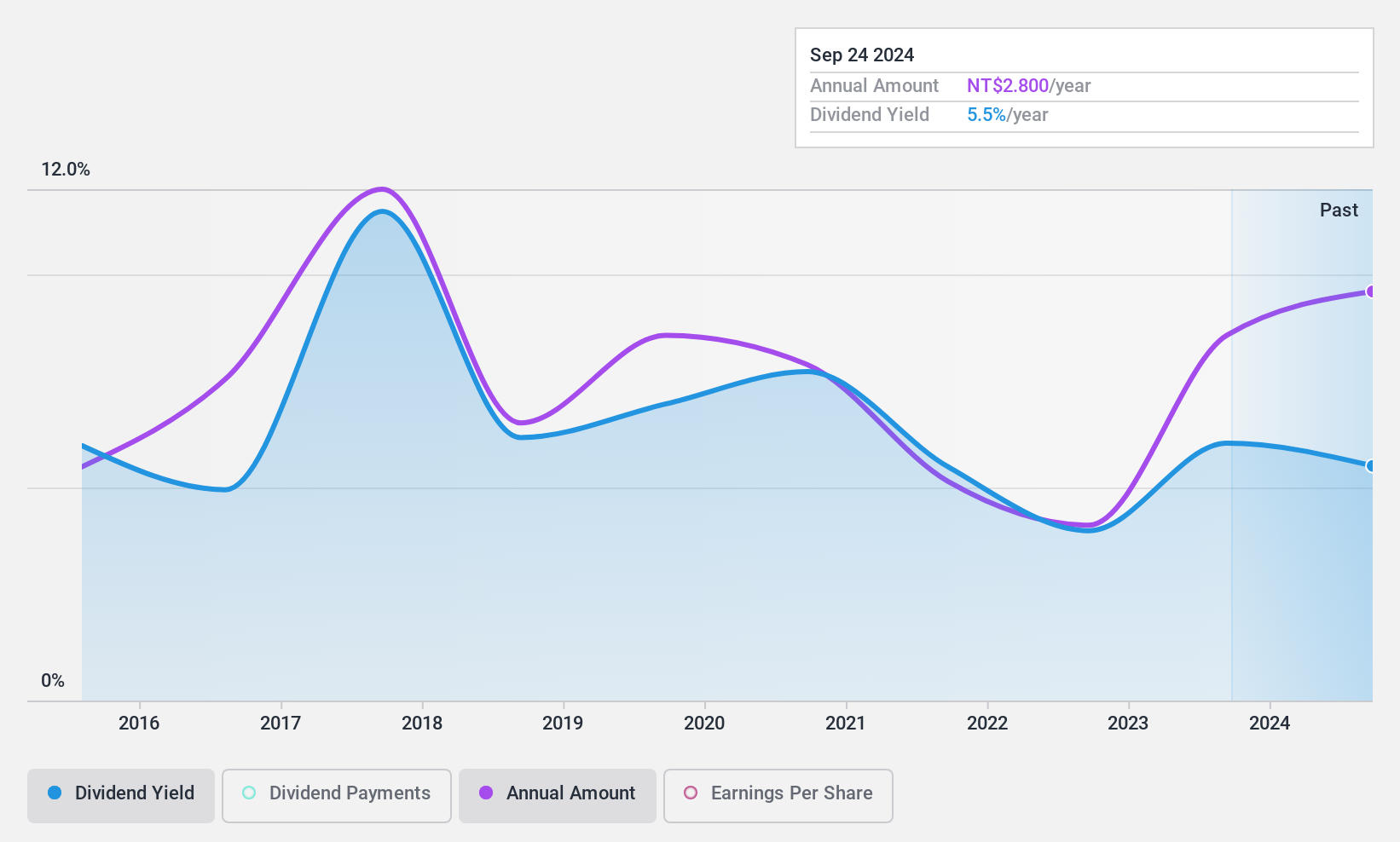

Hanpin Electron (TWSE:2488)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hanpin Electron Co., Ltd. designs, manufactures, and sells electronic consumer products, professional audio products, and DJ equipment in Taiwan, China, Hong Kong, and Singapore with a market cap of NT$4.11 billion.

Operations: Hanpin Electron Co., Ltd. generates its revenue through the production and sale of electronic consumer products, professional audio products, and DJ equipment across Taiwan, China, Hong Kong, and Singapore.

Dividend Yield: 5.4%

Hanpin Electron's dividend yield of 5.45% places it among the top 25% of Taiwan's dividend payers, backed by a reasonable payout ratio (60.1%) and low cash payout ratio (24.7%). However, dividends have been volatile over the past decade despite growth in payments. The company trades significantly below its estimated fair value and recent earnings show increased sales but decreased quarterly net income year-over-year, indicating potential challenges in sustaining dividends long-term.

- Click to explore a detailed breakdown of our findings in Hanpin Electron's dividend report.

- Our valuation report unveils the possibility Hanpin Electron's shares may be trading at a discount.

Turning Ideas Into Actions

- Discover the full array of 1936 Top Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600373

Chinese Universe Publishing and Media Group

Chinese Universe Publishing and Media Group Co., Ltd.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives