As global markets navigate the uncertainties of a new U.S. administration, small-cap stocks have shown both resilience and volatility amid shifting economic policies and interest rate expectations. With the S&P 600 experiencing fluctuations in response to these dynamics, investors may find opportunities in lesser-known companies that demonstrate strong fundamentals and adaptability to changing market conditions. Identifying such undiscovered gems involves looking for stocks with solid financial health, growth potential, and a clear strategy to capitalize on current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Arab Insurance Group (B.S.C.) | NA | -59.46% | 20.33% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Shree Digvijay Cement | 21.42% | 13.22% | 13.00% | ★★★★★☆ |

| Interarch Building Products | 2.55% | 10.02% | 28.21% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

YFY (TWSE:1907)

Simply Wall St Value Rating: ★★★★★☆

Overview: YFY Inc. is an investment holding company that focuses on the manufacturing and sale of paper and paper-related products in Taiwan, with a market cap of NT$50.89 billion.

Operations: YFY generates revenue primarily from the manufacturing and sale of paper and paper-related products in Taiwan. The company has a market capitalization of NT$50.89 billion.

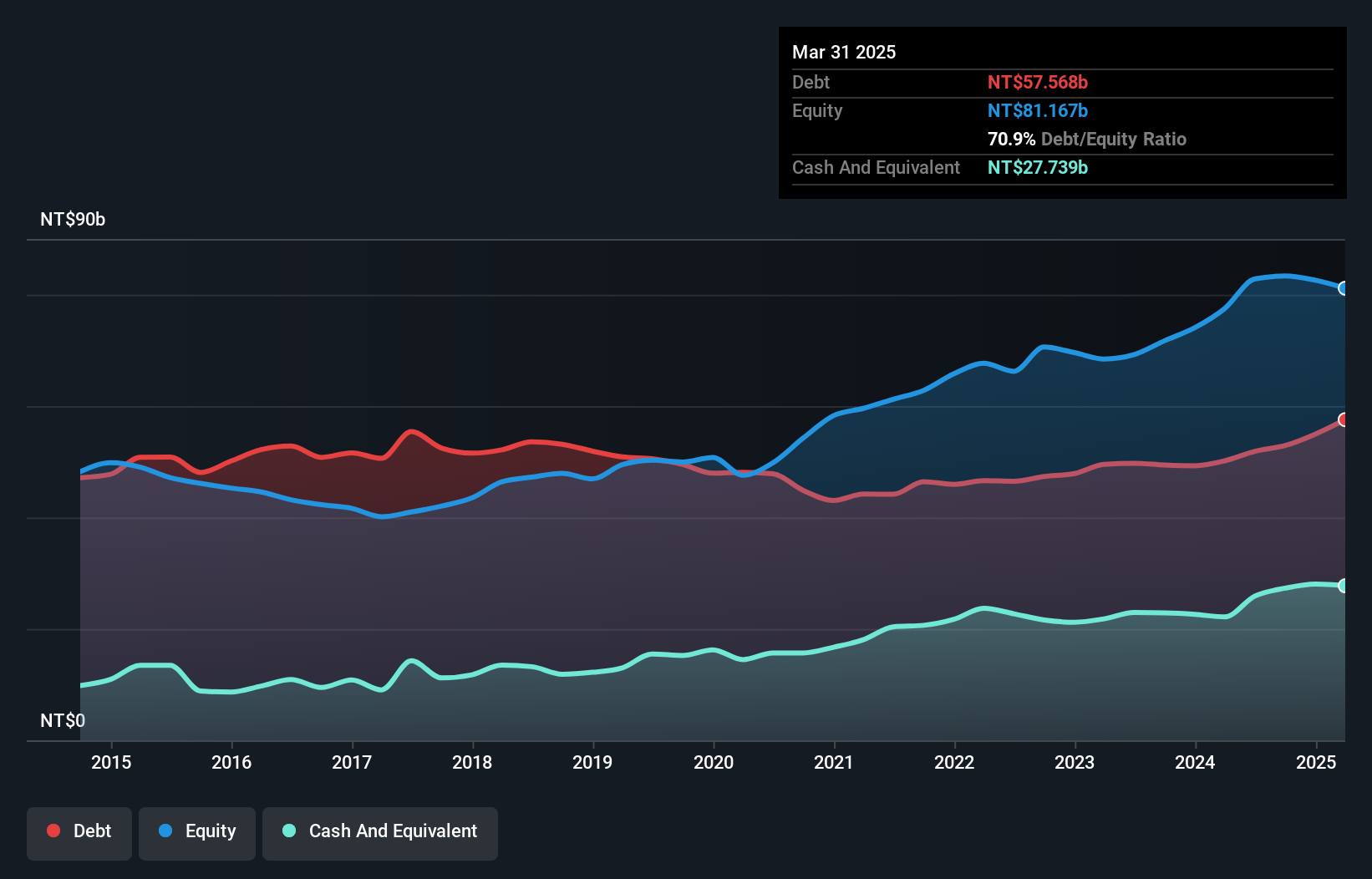

YFY, a nimble player in its sector, showcases robust earnings growth of 45.2% over the past year, outpacing the Forestry industry's -3.9%. Despite a satisfactory net debt to equity ratio of 31.6%, earnings have seen a yearly decline of 12.7% over five years. Recent financials reveal Q3 sales at TWD 16,805 million and revenue at TWD 20,075 million; however, net income dipped to TWD 780.8 million from last year's TWD 1,133.82 million. With high-quality past earnings and positive free cash flow status, YFY remains profitable with no immediate cash runway concerns.

- Dive into the specifics of YFY here with our thorough health report.

Gain insights into YFY's historical performance by reviewing our past performance report.

Merry Electronics (TWSE:2439)

Simply Wall St Value Rating: ★★★★★☆

Overview: Merry Electronics Co., Ltd. operates in the manufacture, processing, repair, and sale of a wide range of electronic products and components across various regions including the United States, Taiwan, Europe, China, and other international markets with a market capitalization of NT$25.91 billion.

Operations: Merry Electronics generates revenue primarily from Taiwan, contributing NT$32.85 billion, followed by Shenzhen and Singapore with NT$13.24 billion and NT$8.02 billion respectively. The company faces a notable elimination of profit and loss between departments amounting to -NT$23.23 billion, impacting its overall financial performance.

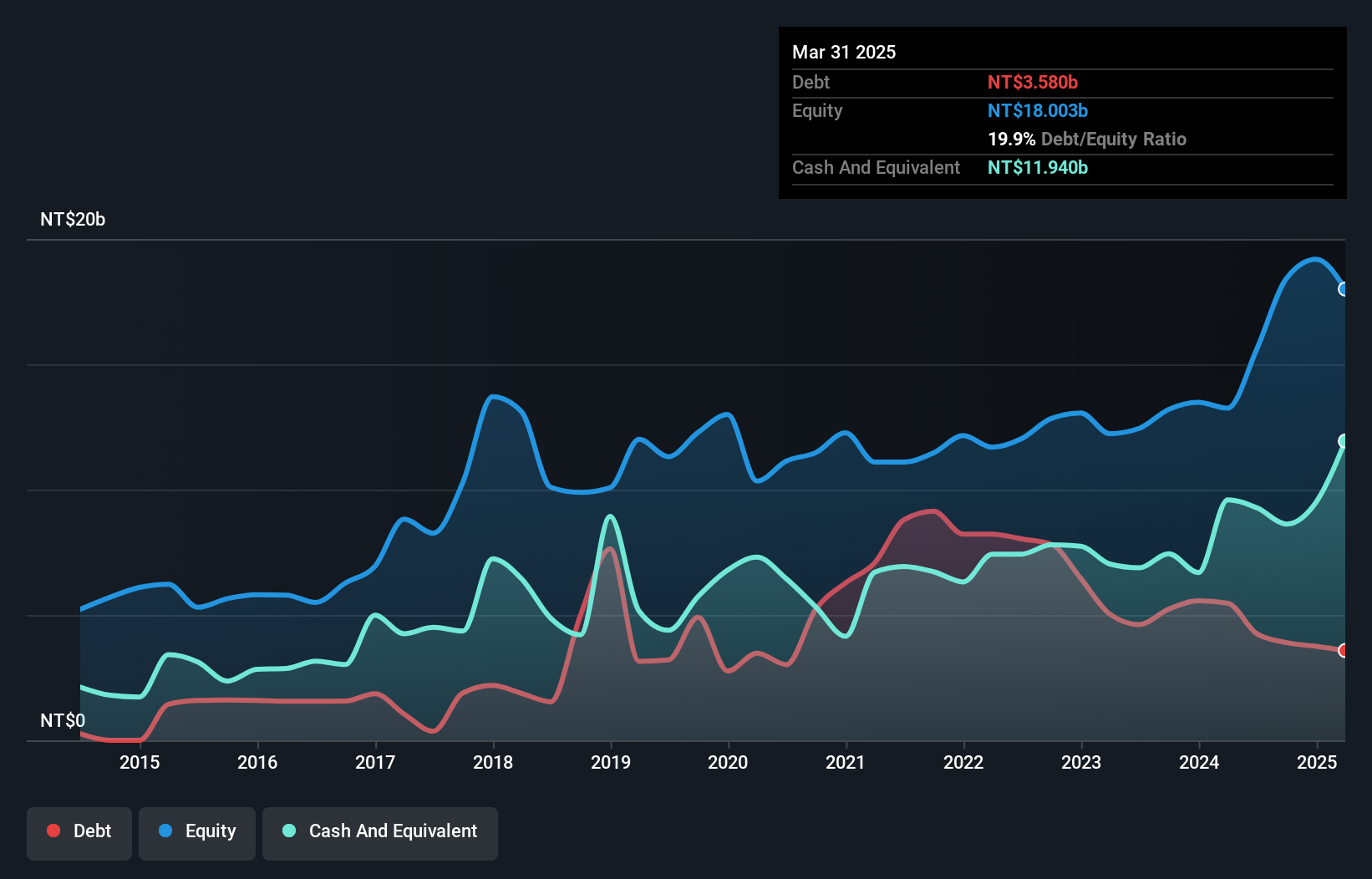

Merry Electronics, a nimble player in the Consumer Durables sector, has demonstrated impressive growth with earnings soaring 62.7% over the past year, outpacing the industry average of 8.8%. Despite recent shareholder dilution through an equity offering of TWD 475 million, its financial health remains robust with more cash than total debt and a reduced debt-to-equity ratio from 40% to 21.1% over five years. The company trades at a favorable price-to-earnings ratio of 13.4x compared to the TW market's 20.5x, suggesting good relative value amidst fluctuating monthly sales figures like October's TWD 4,116 million sales dip by 9.34%.

EnTie Commercial Bank (TWSE:2849)

Simply Wall St Value Rating: ★★★★★★

Overview: EnTie Commercial Bank Co., Ltd. offers a range of banking products and services mainly in Taiwan, with a market capitalization of NT$27.99 billion.

Operations: EnTie Commercial Bank generates revenue primarily through its banking products and services in Taiwan. The bank's financial performance is reflected in its market capitalization of NT$27.99 billion.

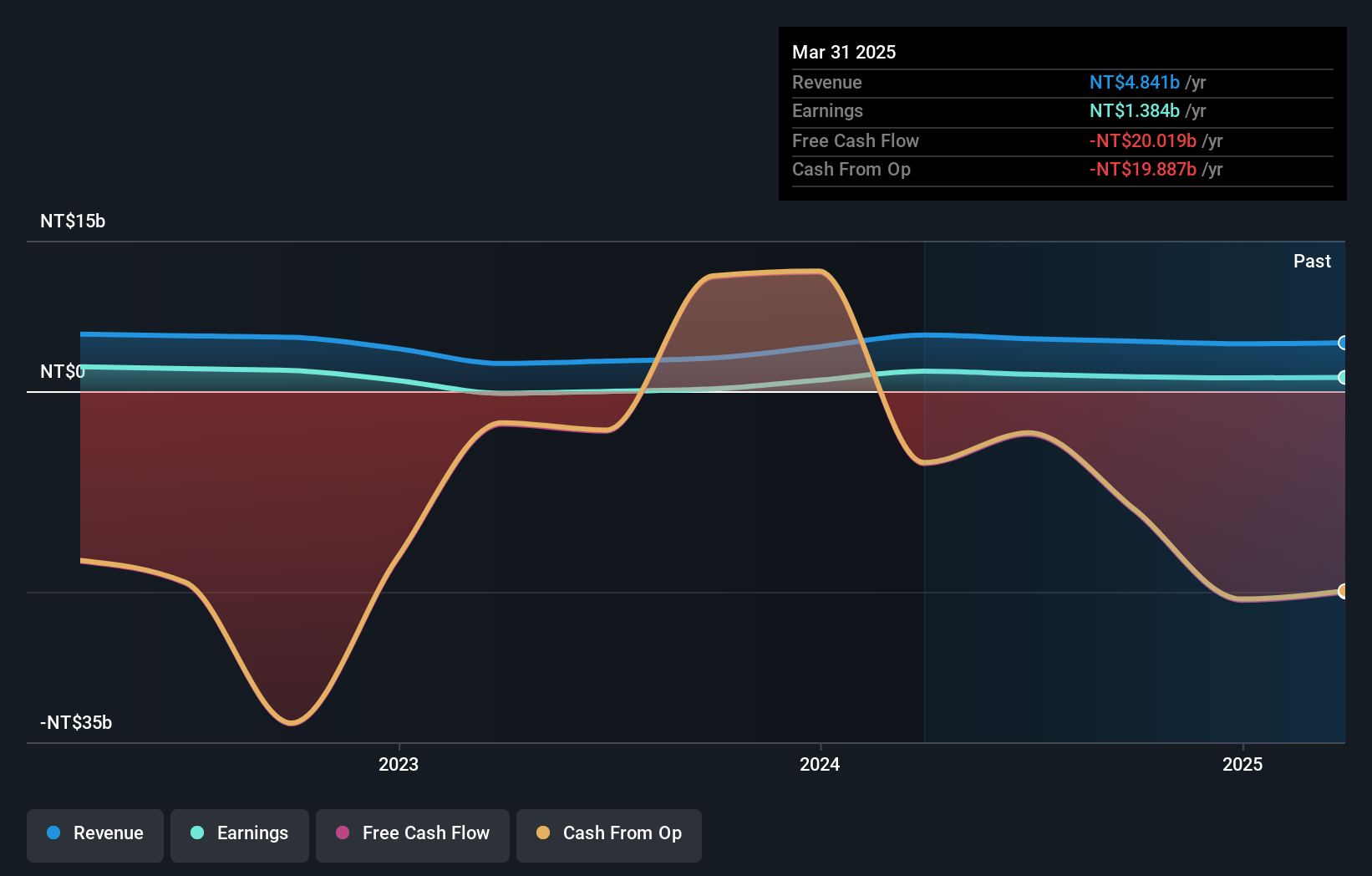

EnTie Commercial Bank, a smaller player in the financial sector, has been making waves with its robust earnings growth of 559.6% over the past year, outpacing the industry average of 1.5%. With total assets at NT$355.6 billion and equity at NT$34.4 billion, it boasts a solid foundation supported by customer deposits as its primary funding source—98% of liabilities are low-risk. The bank's net income for Q3 was TWD 453.8 million compared to TWD 694 million last year, reflecting some challenges despite high-quality past earnings and an appropriate bad loan ratio of just 0.5%.

- Unlock comprehensive insights into our analysis of EnTie Commercial Bank stock in this health report.

Assess EnTie Commercial Bank's past performance with our detailed historical performance reports.

Key Takeaways

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4643 more companies for you to explore.Click here to unveil our expertly curated list of 4646 Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EnTie Commercial Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2849

Excellent balance sheet unattractive dividend payer.

Market Insights

Community Narratives