Global Dividend Stocks And 2 More Income Generating Opportunities

Reviewed by Simply Wall St

As global markets respond to shifting economic data and rate cut speculations, U.S. equities have climbed to record highs, buoyed by hopes of a Federal Reserve rate reduction. Amidst this backdrop, dividend stocks continue to attract investors seeking stable income streams; these stocks often provide a reliable source of returns in uncertain market conditions.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.73% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.65% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.76% | ★★★★★★ |

| NCD (TSE:4783) | 4.68% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.00% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.07% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

| Daicel (TSE:4202) | 4.46% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

Click here to see the full list of 1379 stocks from our Top Global Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Taiwan Fructose (TPEX:4207)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Taiwan Fructose Co., Ltd. is involved in the manufacturing and processing of fructose, maltose, glucose, and starch in Taiwan with a market cap of NT$3.41 billion.

Operations: Taiwan Fructose Co., Ltd. generates revenue through its manufacturing and processing of fructose, maltose, glucose, and starch in Taiwan.

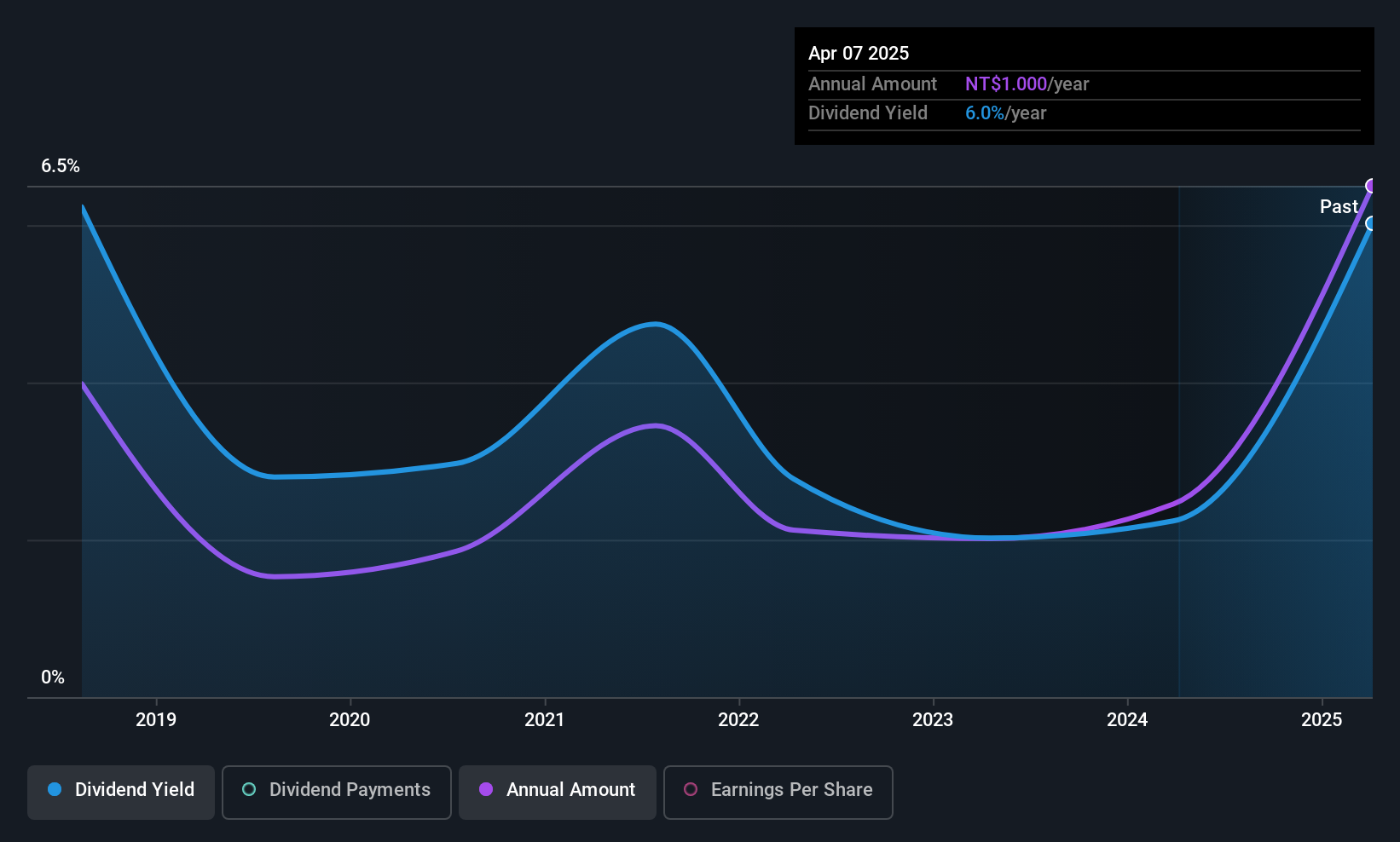

Dividend Yield: 5.6%

Taiwan Fructose's dividend profile is mixed, with a 5.6% yield placing it in the top 25% of Taiwanese dividend payers, supported by a cash payout ratio of 33.9%. However, its dividends have been volatile over the past decade. Despite earnings growth of 13% last year and dividends being covered by earnings (77% payout ratio), recent revenue declines may raise concerns about future stability. Recent amendments to company bylaws indicate ongoing governance adjustments.

- Unlock comprehensive insights into our analysis of Taiwan Fructose stock in this dividend report.

- Upon reviewing our latest valuation report, Taiwan Fructose's share price might be too pessimistic.

Hong Ho Precision TextileLtd (TWSE:1446)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hong Ho Precision Textile Co., Ltd. is a Taiwan-based company that manufactures and sells various textiles, with a market cap of NT$3.12 billion.

Operations: Hong Ho Precision Textile Ltd's revenue segments include the manufacture and sale of various textiles in Taiwan.

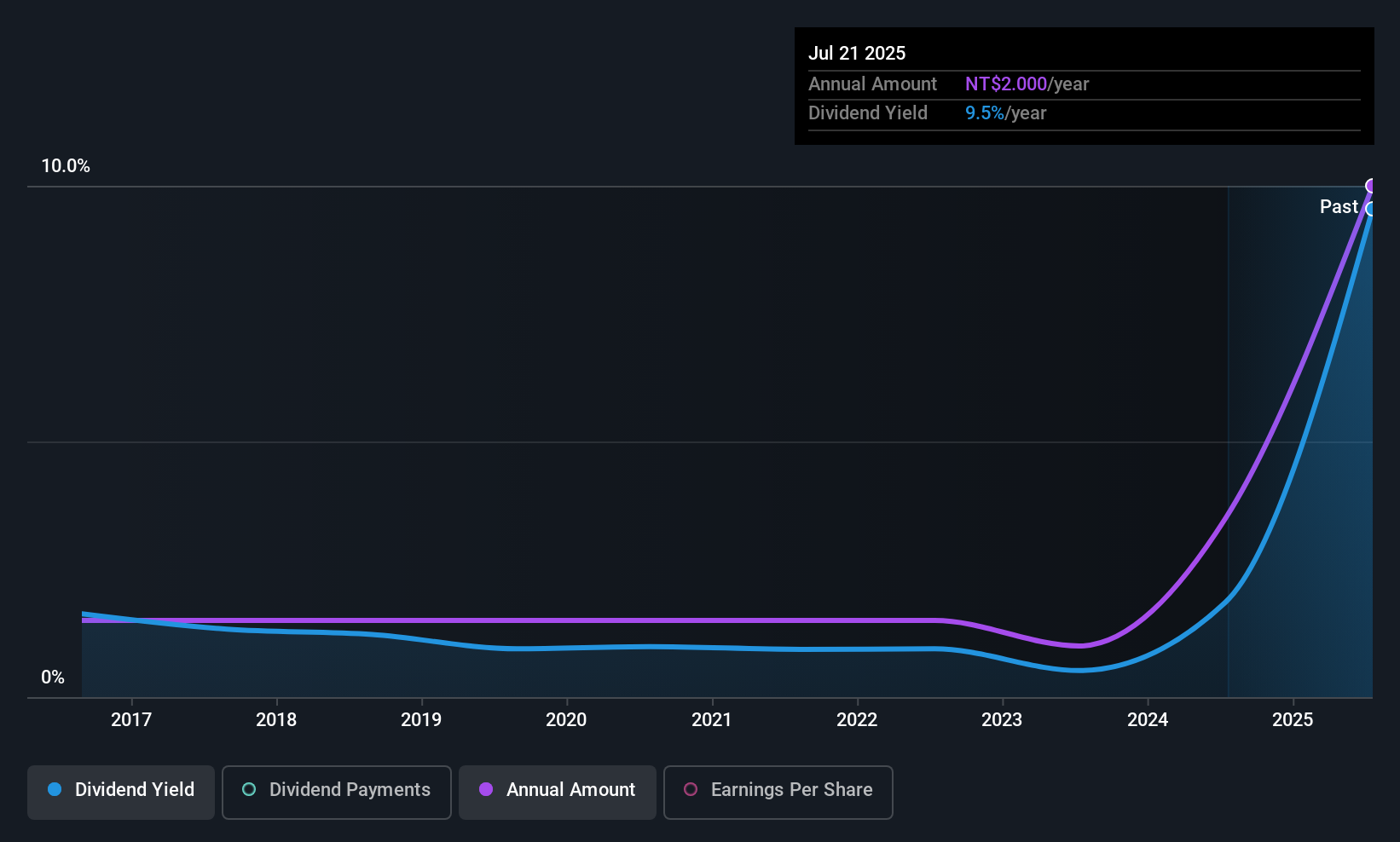

Dividend Yield: 8.9%

Hong Ho Precision Textile Ltd. offers a compelling dividend yield of 8.89%, ranking it among the top 25% in Taiwan, with dividends well-covered by earnings (28.1% payout ratio) and cash flows (14.6% cash payout ratio). However, its dividend history is marked by volatility and unreliability over the past decade, despite recent growth in earnings by 38.7%. Recent earnings reports show significant declines in sales and net income compared to last year, which may impact future payouts.

- Navigate through the intricacies of Hong Ho Precision TextileLtd with our comprehensive dividend report here.

- Our valuation report here indicates Hong Ho Precision TextileLtd may be undervalued.

Eclat Textile (TWSE:1476)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eclat Textile Co., Ltd. is involved in the design, manufacturing, processing, trading, marketing, and sale of knitted fabrics, clothing, garments, and textile raw materials both in Taiwan and internationally with a market cap of NT$114.41 billion.

Operations: Eclat Textile Co., Ltd. generates revenue primarily from its Knitting Division, contributing NT$19.25 billion, and its Apparels Division, contributing NT$31.70 billion.

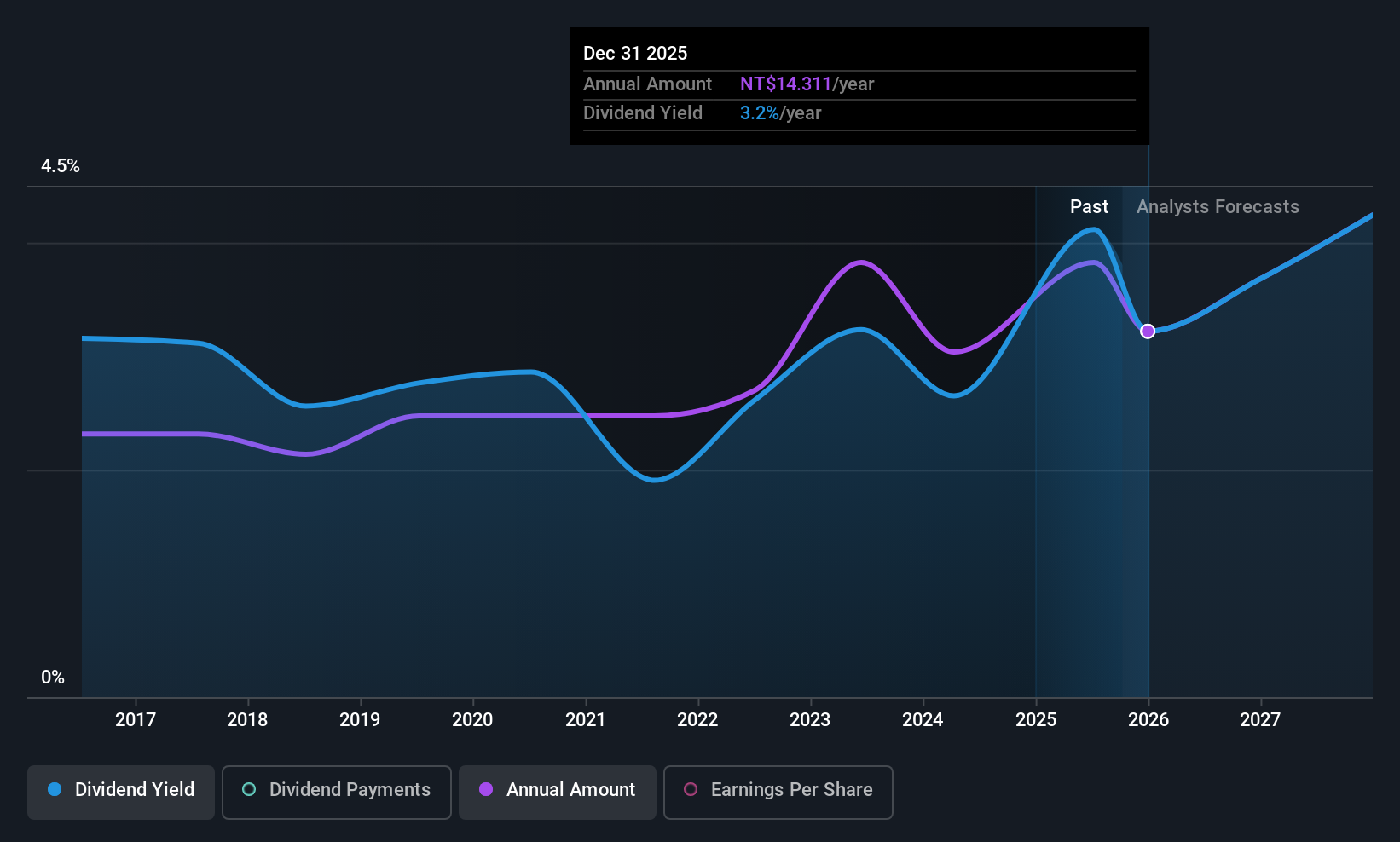

Dividend Yield: 4.1%

Eclat Textile's recent dividend distribution of TWD 17.00 per share reflects a commitment to shareholder returns, despite a volatile and historically unreliable dividend history. The company's dividends are adequately covered by earnings (80.9% payout ratio) and cash flows (69.3% cash payout ratio), although the yield remains below top-tier levels in Taiwan. Recent earnings results show decreased net income, which could affect future stability in payouts, despite ongoing revenue growth over the past six months.

- Click here to discover the nuances of Eclat Textile with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Eclat Textile is priced higher than what may be justified by its financials.

Next Steps

- Unlock more gems! Our Top Global Dividend Stocks screener has unearthed 1376 more companies for you to explore.Click here to unveil our expertly curated list of 1379 Top Global Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Fructose might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:4207

Taiwan Fructose

Engages in the manufacturing and processing of fructose, maltose, glucose, and starch in Taiwan.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

The "Google Maps" of Cancer Biology – Data is the Moat

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026