Improved Earnings Required Before Yi Jinn Industrial Co., Ltd. (TWSE:1457) Stock's 28% Jump Looks Justified

Yi Jinn Industrial Co., Ltd. (TWSE:1457) shares have continued their recent momentum with a 28% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

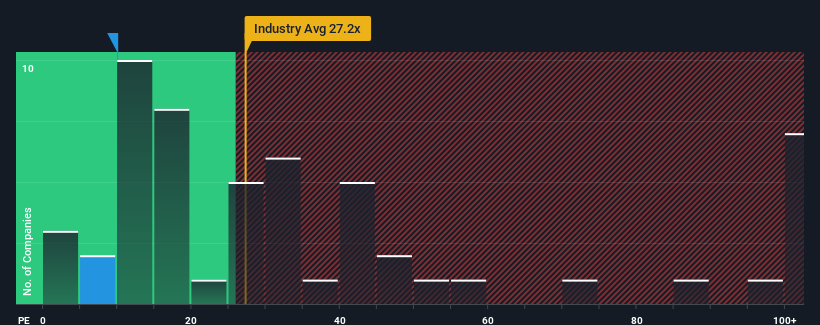

Even after such a large jump in price, given about half the companies in Taiwan have price-to-earnings ratios (or "P/E's") above 24x, you may still consider Yi Jinn Industrial as a highly attractive investment with its 10x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

For example, consider that Yi Jinn Industrial's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Yi Jinn Industrial

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Yi Jinn Industrial would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 44%. As a result, earnings from three years ago have also fallen 21% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 26% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we are not surprised that Yi Jinn Industrial is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

The Key Takeaway

Shares in Yi Jinn Industrial are going to need a lot more upward momentum to get the company's P/E out of its slump. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Yi Jinn Industrial maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 3 warning signs we've spotted with Yi Jinn Industrial (including 1 which shouldn't be ignored).

If these risks are making you reconsider your opinion on Yi Jinn Industrial, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1457

Yi Jinn Industrial

Engages in the research and development, production, and sale of polyester textured yarns in Taiwan, rest of Asia, America, Europe, and Africa.

Proven track record average dividend payer.