Quang Viet Enterprise Co., Ltd. (TPE:4438) Stock's On A Decline: Are Poor Fundamentals The Cause?

With its stock down 5.8% over the past three months, it is easy to disregard Quang Viet Enterprise (TPE:4438). To decide if this trend could continue, we decided to look at its weak fundamentals as they shape the long-term market trends. In this article, we decided to focus on Quang Viet Enterprise's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Quang Viet Enterprise

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Quang Viet Enterprise is:

6.9% = NT$504m ÷ NT$7.4b (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. Another way to think of that is that for every NT$1 worth of equity, the company was able to earn NT$0.07 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Quang Viet Enterprise's Earnings Growth And 6.9% ROE

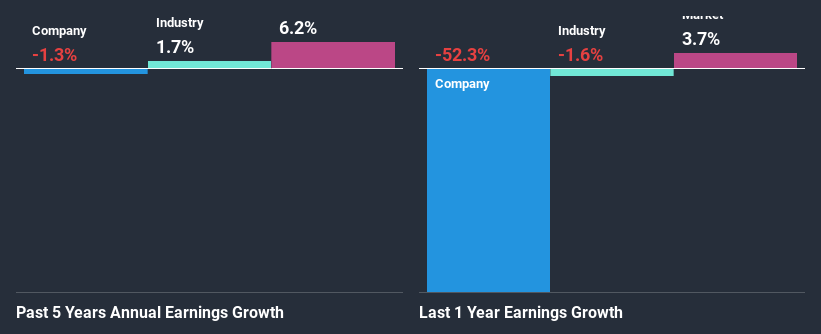

On the face of it, Quang Viet Enterprise's ROE is not much to talk about. Yet, a closer study shows that the company's ROE is similar to the industry average of 8.2%. However, Quang Viet Enterprise has seen a flattish net income growth over the past five years, which is not saying much. Remember, the company's ROE is not particularly great to begin with. Hence, this provides some context to the flat earnings growth seen by the company.

We then compared Quang Viet Enterprise's net income growth with the industry and found that the company's growth figure is a bit less than the average industry growth rate of 1.7% in the same period.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Is Quang Viet Enterprise fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Quang Viet Enterprise Efficiently Re-investing Its Profits?

With a high three-year median payout ratio of 77% (implying that the company keeps only 23% of its income) of its business to reinvest into its business), most of Quang Viet Enterprise's profits are being paid to shareholders, which explains the absence of growth in earnings.

Moreover, Quang Viet Enterprise has been paying dividends for five years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Summary

On the whole, Quang Viet Enterprise's performance is quite a big let-down. As a result of its low ROE and lack of mich reinvestment into the business, the company has seen a disappointing earnings growth rate. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

When trading Quang Viet Enterprise or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Quang Viet Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:4438

Quang Viet Enterprise

Manufactures, process, and sells garments in Taiwan.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026