Do Investors Have Good Reason To Be Wary Of Formosa Taffeta Co., Ltd.'s (TPE:1434) 8.1% Dividend Yield?

Is Formosa Taffeta Co., Ltd. (TPE:1434) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

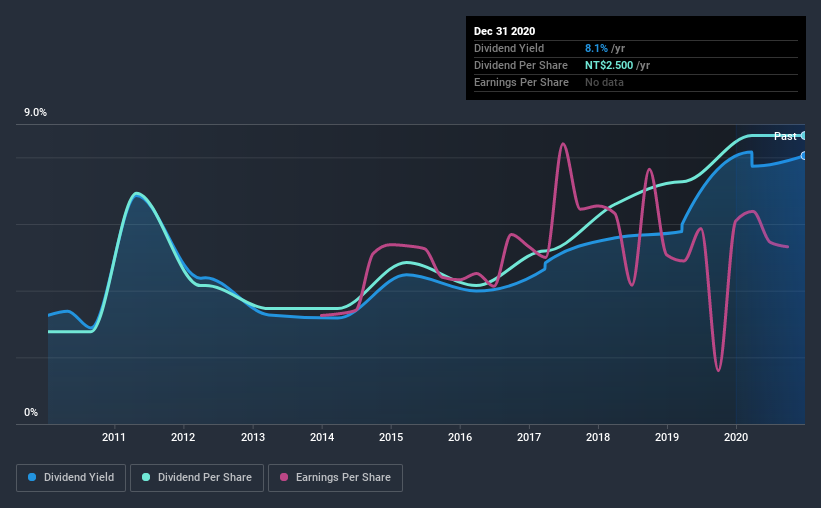

In this case, Formosa Taffeta likely looks attractive to investors, given its 8.1% dividend yield and a payment history of over ten years. It would not be a surprise to discover that many investors buy it for the dividends. Some simple research can reduce the risk of buying Formosa Taffeta for its dividend - read on to learn more.

Explore this interactive chart for our latest analysis on Formosa Taffeta!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. In the last year, Formosa Taffeta paid out 121% of its profit as dividends. Unless there are extenuating circumstances, from the perspective of an investor who hopes to own the company for many years, a payout ratio of above 100% is definitely a concern.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. With a cash payout ratio of 110%, Formosa Taffeta's dividend payments are poorly covered by cash flow. Cash is slightly more important than profit from a dividend perspective, but given Formosa Taffeta's payments were not well covered by either earnings or cash flow, we are concerned about the sustainability of this dividend.

Remember, you can always get a snapshot of Formosa Taffeta's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. Formosa Taffeta has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. Its dividend payments have declined on at least one occasion over the past 10 years. During the past 10-year period, the first annual payment was NT$0.8 in 2010, compared to NT$2.5 last year. This works out to be a compound annual growth rate (CAGR) of approximately 12% a year over that time. The dividends haven't grown at precisely 12% every year, but this is a useful way to average out the historical rate of growth.

So, its dividends have grown at a rapid rate over this time, but payments have been cut in the past. The stock may still be worth considering as part of a diversified dividend portfolio.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Earnings have grown at around 3.8% a year for the past five years, which is better than seeing them shrink! This level of earnings growth is low, and the company is paying out 121% of its profit. Limited recent earnings growth and a high payout ratio makes it hard for us to envision strong future dividend growth, unless the company should have substantial pricing power or some form of competitive advantage.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Formosa Taffeta paid out almost all of its cash flow and profit as dividends, leaving little to reinvest in the business. Second, earnings growth has been ordinary, and its history of dividend payments is chequered - having cut its dividend at least once in the past. There are a few too many issues for us to get comfortable with Formosa Taffeta from a dividend perspective. Businesses can change, but we would struggle to identify why an investor should rely on this stock for their income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for Formosa Taffeta that investors should take into consideration.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you’re looking to trade Formosa Taffeta, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1434

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026