Do Fundamentals Have Any Role To Play In Driving Shinkong Textile Co.,Ltd.'s (TPE:1419) Stock Up Recently?

Shinkong TextileLtd's (TPE:1419) stock up by 3.1% over the past week. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to investigate if the company's decent financials had a hand to play in the recent price move. Particularly, we will be paying attention to Shinkong TextileLtd's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Shinkong TextileLtd

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Shinkong TextileLtd is:

3.9% = NT$323m ÷ NT$8.4b (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. So, this means that for every NT$1 of its shareholder's investments, the company generates a profit of NT$0.04.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Shinkong TextileLtd's Earnings Growth And 3.9% ROE

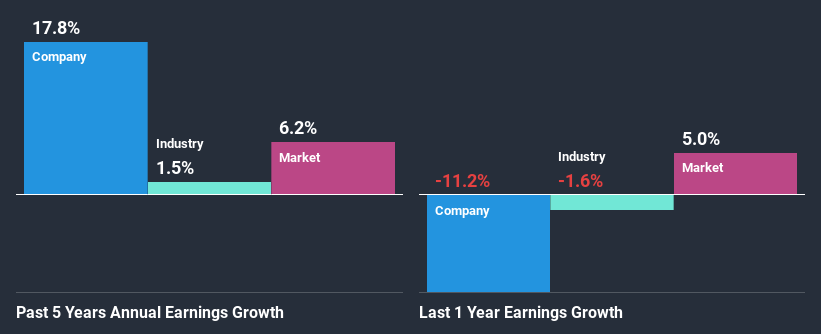

At first glance, Shinkong TextileLtd's ROE doesn't look very promising. Next, when compared to the average industry ROE of 7.1%, the company's ROE leaves us feeling even less enthusiastic. Although, we can see that Shinkong TextileLtd saw a modest net income growth of 18% over the past five years. So, the growth in the company's earnings could probably have been caused by other variables. For instance, the company has a low payout ratio or is being managed efficiently.

Next, on comparing with the industry net income growth, we found that Shinkong TextileLtd's growth is quite high when compared to the industry average growth of 1.5% in the same period, which is great to see.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Shinkong TextileLtd is trading on a high P/E or a low P/E, relative to its industry.

Is Shinkong TextileLtd Using Its Retained Earnings Effectively?

While Shinkong TextileLtd has a three-year median payout ratio of 83% (which means it retains 17% of profits), the company has still seen a fair bit of earnings growth in the past, meaning that its high payout ratio hasn't hampered its ability to grow.

Besides, Shinkong TextileLtd has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders.

Summary

On the whole, we do feel that Shinkong TextileLtd has some positive attributes. Namely, its high earnings growth. We do however feel that the earnings growth number could have been even higher, had the company been reinvesting more of its earnings and paid out less dividends. So far, we've only made a quick discussion around the company's earnings growth. So it may be worth checking this free detailed graph of Shinkong TextileLtd's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

If you’re looking to trade Shinkong TextileLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1419

Shinkong Textile

Engages in the production and sale of various synthetic fibers, fabrics, and finished fabrics in Taiwan and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026