Are Dividend Investors Making A Mistake With Fulin Plastic Industry (Cayman) Holding Co., Ltd. (TPE:1341)?

Dividend paying stocks like Fulin Plastic Industry (Cayman) Holding Co., Ltd. (TPE:1341) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

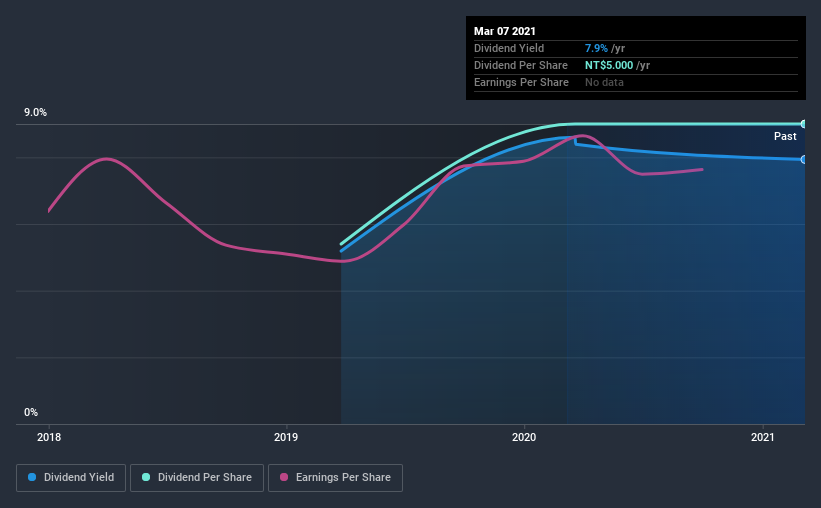

Fulin Plastic Industry (Cayman) Holding pays a 7.9% dividend yield, and has been paying dividends for the past two years. It's certainly an attractive yield, but readers are likely curious about its staying power. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Fulin Plastic Industry (Cayman) Holding paid out 91% of its profit as dividends, over the trailing twelve month period. This is quite a high payout ratio that suggests the dividend is not well covered by earnings.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. Fulin Plastic Industry (Cayman) Holding paid out 69% of its cash flow as dividends last year, which is within a reasonable range for the average corporation. It's good to see that while Fulin Plastic Industry (Cayman) Holding's dividends were not well covered by profits, at least they are affordable from a free cash flow perspective. Even so, if the company were to continue paying out almost all of its profits, we'd be concerned about whether the dividend is sustainable in a downturn.

Remember, you can always get a snapshot of Fulin Plastic Industry (Cayman) Holding's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. The company has been paying a stable dividend for a few years now, but we'd like to see more evidence of consistency over a longer period. During the past two-year period, the first annual payment was NT$3.0 in 2019, compared to NT$5.0 last year. This works out to be a compound annual growth rate (CAGR) of approximately 29% a year over that time.

The dividend has been growing pretty quickly, which could be enough to get us interested even though the dividend history is relatively short. Further research may be warranted.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. Fulin Plastic Industry (Cayman) Holding has grown its earnings per share at 6.2% per annum over the past three years. Although per-share earnings are growing at a credible rate, virtually all of the income is being paid out as dividends to shareholders. This is okay, but may limit growth in the company's future dividend payments.

We'd also point out that Fulin Plastic Industry (Cayman) Holding issued a meaningful number of new shares in the past year. Regularly issuing new shares can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. We're a bit uncomfortable with its high payout ratio, although at least the dividend was covered by free cash flow. Second, earnings growth has been ordinary, and its history of dividend payments is shorter than we'd like. With this information in mind, we think Fulin Plastic Industry (Cayman) Holding may not be an ideal dividend stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 2 warning signs for Fulin Plastic Industry (Cayman) Holding that you should be aware of before investing.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

When trading Fulin Plastic Industry (Cayman) Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1341

Fulin Plastic Industry (Cayman) Holding

Fulin Plastic Industry (Cayman) Holding Co., Ltd.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives