O-TA Precision Industry (GTSM:8924) Has Gifted Shareholders With A Fantastic 196% Total Return On Their Investment

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. One great example is O-TA Precision Industry Co., Ltd. (GTSM:8924) which saw its share price drive 112% higher over five years. It's down 2.2% in the last seven days.

See our latest analysis for O-TA Precision Industry

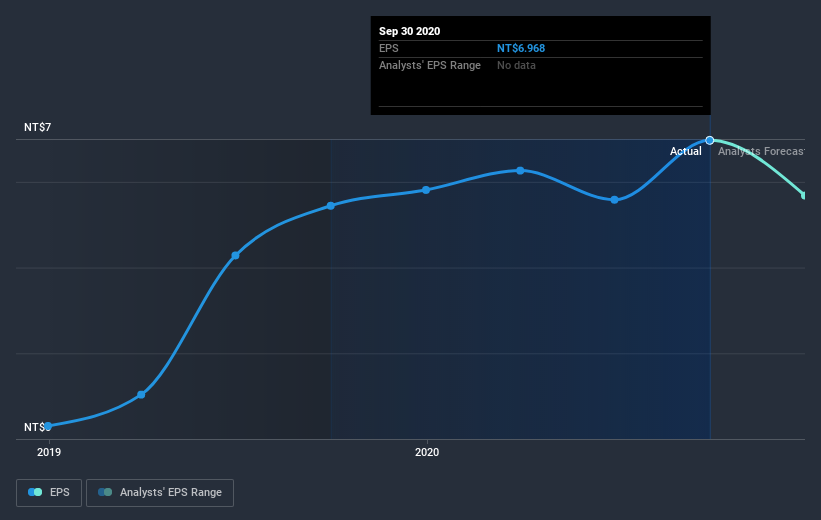

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, O-TA Precision Industry managed to grow its earnings per share at 100% a year. This EPS growth is higher than the 16% average annual increase in the share price. So one could conclude that the broader market has become more cautious towards the stock. This cautious sentiment is reflected in its (fairly low) P/E ratio of 8.27.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that O-TA Precision Industry has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between O-TA Precision Industry's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for O-TA Precision Industry shareholders, and that cash payout contributed to why its TSR of 196%, over the last 5 years, is better than the share price return.

A Different Perspective

O-TA Precision Industry shareholders gained a total return of 31% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 24% over half a decade This suggests the company might be improving over time. Is O-TA Precision Industry cheap compared to other companies? These 3 valuation measures might help you decide.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade O-TA Precision Industry, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:8924

O-TA Precision Industry

Engages in manufacturing, processing, and selling of golf club heads, shafts, semi-finished goods, and golf equipment.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives