- Taiwan

- /

- Professional Services

- /

- TWSE:3130

Three Prominent Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a mix of economic signals, with U.S. stocks closing out another strong year despite recent volatility, investors are increasingly looking to dividend stocks as a potential source of stability and income. In the current environment, characterized by mixed performance across major indices and cautious optimism regarding future growth, selecting dividend stocks with solid fundamentals can be an effective strategy for those seeking consistent returns amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.13% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.57% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.02% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.01% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 2019 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

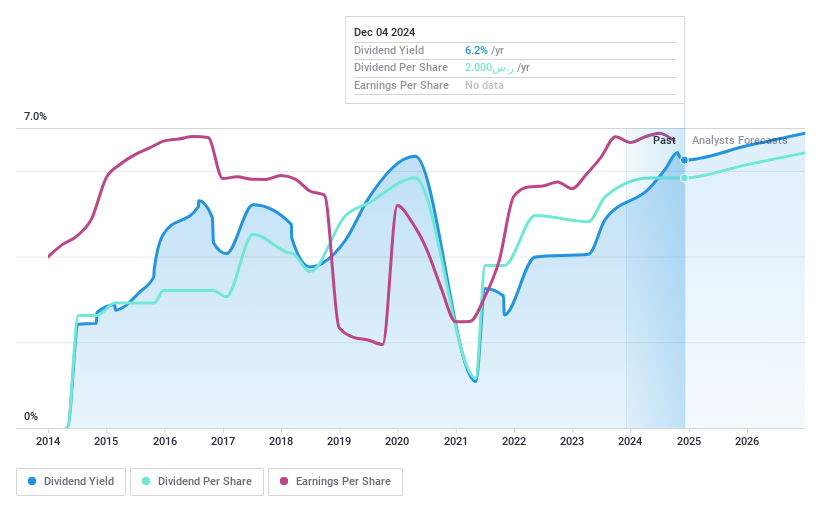

Banque Saudi Fransi (SASE:1050)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banque Saudi Fransi offers banking and financial services to individuals and businesses both in the Kingdom of Saudi Arabia and internationally, with a market cap of SAR38.40 billion.

Operations: Banque Saudi Fransi's revenue is primarily derived from its Retail Banking segment at SAR6.37 billion, followed by Corporate Banking at SAR5.41 billion, and Investment Banking & Brokerage at SAR541.34 million, while the Treasury segment recorded a negative amount of SAR4.28 billion.

Dividend Yield: 6.2%

Banque Saudi Fransi offers a dividend yield of 6.17%, placing it in the top 25% of dividend payers in the Saudi Arabian market. While its dividends are currently covered by earnings with a payout ratio of 59.7% and forecasted to remain covered, its track record shows volatility over the past decade. Despite this, analysts expect revenue growth and potential stock price appreciation, supported by an attractive price-to-earnings ratio of 9.7x compared to the market average.

- Click here to discover the nuances of Banque Saudi Fransi with our detailed analytical dividend report.

- According our valuation report, there's an indication that Banque Saudi Fransi's share price might be on the cheaper side.

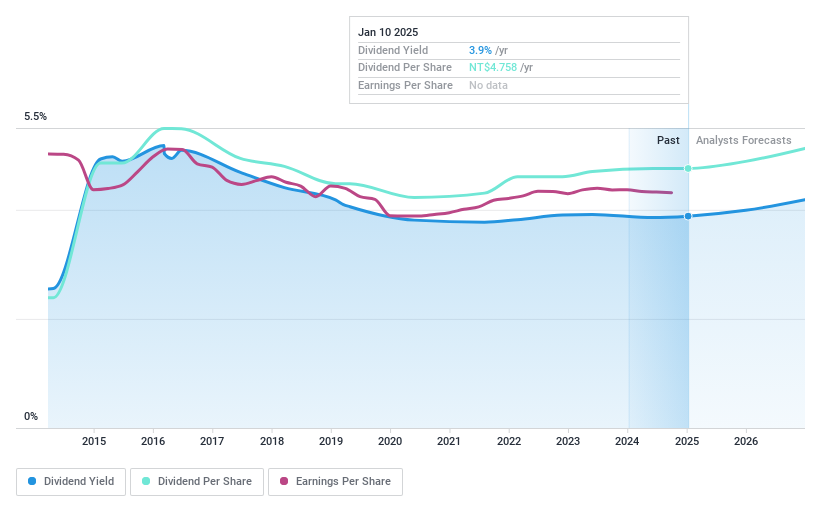

Chunghwa Telecom (TWSE:2412)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chunghwa Telecom Co., Ltd., along with its subsidiaries, offers telecommunication services both in Taiwan and internationally, with a market capitalization of NT$958.04 billion.

Operations: Chunghwa Telecom generates revenue primarily from its Consumer Business at NT$141.79 billion, followed by the Enterprise Business at NT$73.95 billion, and the International Business contributing NT$11.06 billion.

Dividend Yield: 3.9%

Chunghwa Telecom's dividend yield of 3.85% is below the top 25% in Taiwan, with dividends not well covered by earnings due to a high payout ratio of 101.1%. However, dividends have been stable and growing over the past decade, supported by cash flows despite recent executive changes. The company reported steady revenue growth for Q3 2024 but saw a slight decline in net income compared to the previous year, impacting overall dividend sustainability.

- Unlock comprehensive insights into our analysis of Chunghwa Telecom stock in this dividend report.

- Our valuation report unveils the possibility Chunghwa Telecom's shares may be trading at a discount.

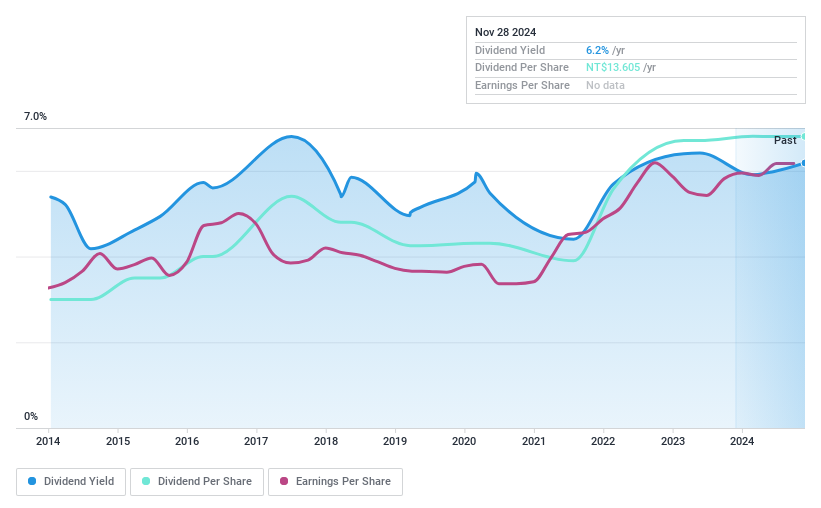

104 (TWSE:3130)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: 104 Corporation operates in the information technology, general advertising, employment, and human resource consultancy sectors both in Taiwan and internationally, with a market cap of NT$7.25 billion.

Operations: 104 Corporation generates revenue from its Staffing & Outsourcing Services segment, amounting to NT$2.45 billion.

Dividend Yield: 6.2%

104 Corporation's dividend yield of 6.2% ranks in the top 25% in Taiwan, but is not well covered by earnings due to a high payout ratio of 96.5%. Despite this, dividends have been stable and growing over the past decade, supported by cash flows with a reasonable cash payout ratio of 72%. Recent Q3 results show steady revenue growth and consistent net income year-over-year, which may provide some support for continued dividend reliability.

- Delve into the full analysis dividend report here for a deeper understanding of 104.

- Upon reviewing our latest valuation report, 104's share price might be too pessimistic.

Seize The Opportunity

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 2016 more companies for you to explore.Click here to unveil our expertly curated list of 2019 Top Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3130

104

Engages in the information technology, general advertising, employment, and human resource consultancy services in Taiwan and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives