- Taiwan

- /

- Auto Components

- /

- TWSE:2228

3 Asian Dividend Stocks Offering Up To 5.5% Yield

Reviewed by Simply Wall St

As global trade tensions escalate, Asian markets are navigating a complex landscape marked by policy uncertainties and economic adjustments. Amidst these challenges, dividend stocks in Asia offer investors potential income opportunities, with some yielding up to 5.5%. In this environment, selecting stocks that demonstrate resilience and consistent dividend payouts can be a prudent strategy for those seeking stability and income in their portfolios.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.89% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.01% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.83% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.24% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.79% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.57% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.53% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.20% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.41% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.47% | ★★★★★★ |

Click here to see the full list of 1213 stocks from our Top Asian Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

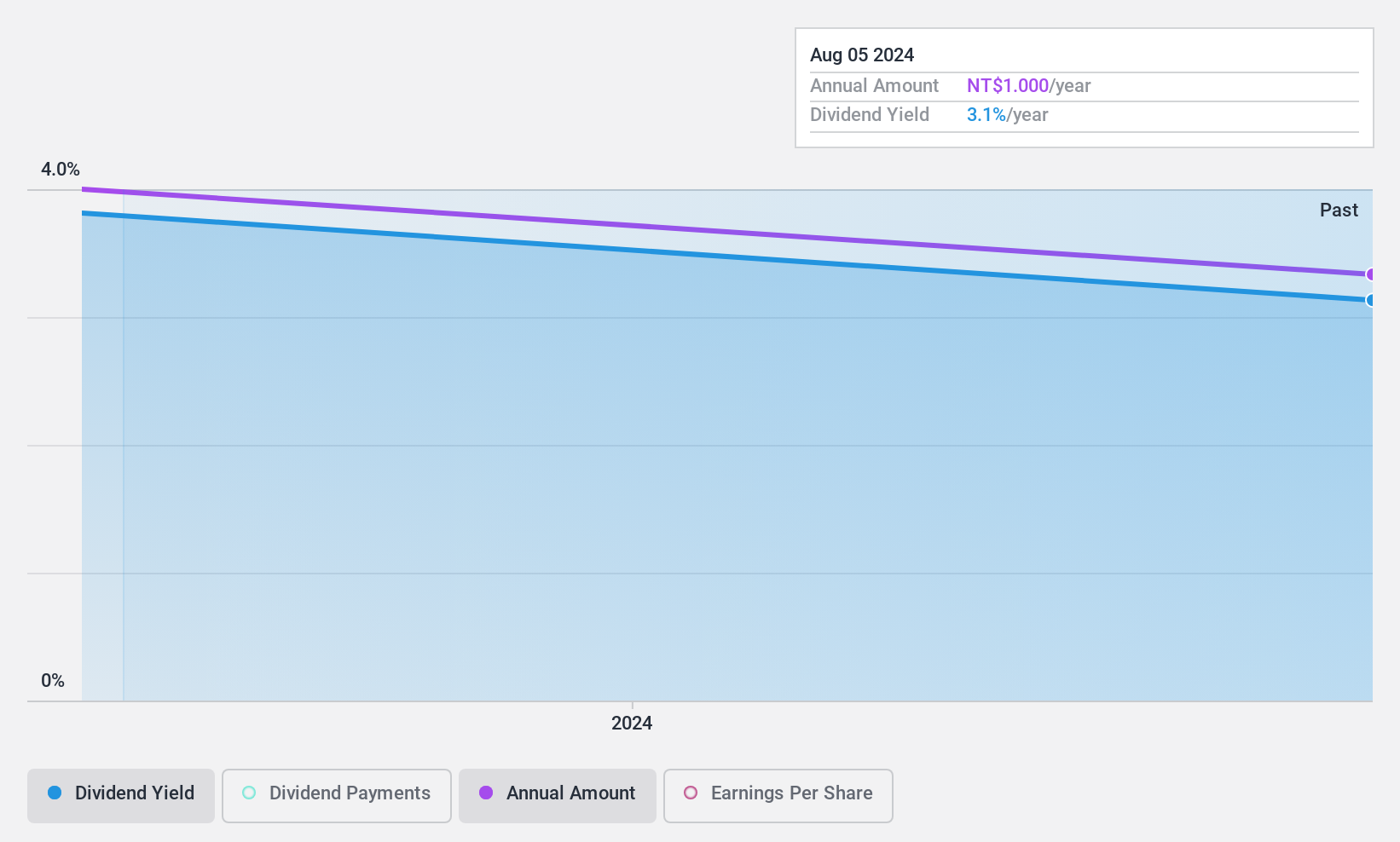

Jiin Yeeh Ding Enterprises (TPEX:8390)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiin Yeeh Ding Enterprises Corp. is a professional electronic waste recycling and treatment company that offers e-waste disposal services to technology companies in Taiwan, with a market cap of NT$6.08 billion.

Operations: Jiin Yeeh Ding Enterprises Corp. generates its revenue primarily from providing electronic waste recycling and treatment services to technology firms in Taiwan.

Dividend Yield: 3.9%

Jiin Yeeh Ding Enterprises has shown consistent dividend payments over the past decade, with dividends growing steadily and remaining stable. However, its current dividend yield of 3.95% is lower than the top quartile in Taiwan's market and not well covered by free cash flows, indicated by a high cash payout ratio of 153%. Recent earnings show an increase in sales to TWD 4.94 billion but a decline in net income, affecting profit margins and potentially impacting future payouts.

- Get an in-depth perspective on Jiin Yeeh Ding Enterprises' performance by reading our dividend report here.

- The analysis detailed in our Jiin Yeeh Ding Enterprises valuation report hints at an deflated share price compared to its estimated value.

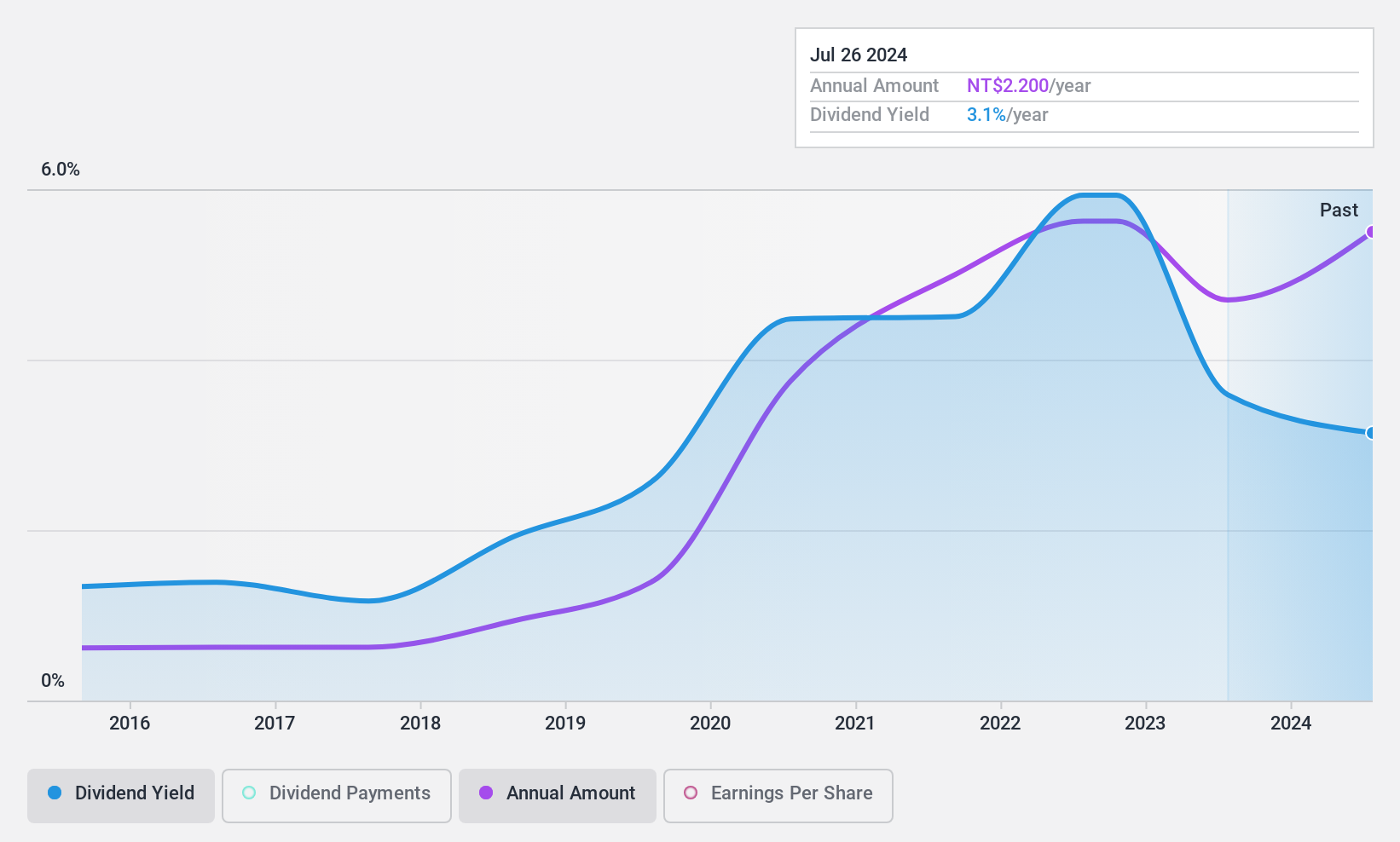

Iron Force Industrial (TWSE:2228)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Iron Force Industrial Co., Ltd. manufactures and trades airbag inflators for automotive safety systems both in Taiwan and internationally, with a market cap of NT$7.20 billion.

Operations: Iron Force Industrial Co., Ltd.'s revenue is derived from NT$0.68 billion in Europe, NT$1.98 billion in Taiwan, and NT$2.43 billion in the Mainland Area.

Dividend Yield: 5.5%

Iron Force Industrial's dividend yield of 5.52% ranks in the top 25% of Taiwan's market, yet its dividends have been volatile over the past decade. The company's payout ratio is reasonable at 52.5%, but a high cash payout ratio of 120.5% indicates insufficient free cash flow coverage, raising sustainability concerns. Recent earnings show growth with net income rising to TWD 731.03 million from TWD 513.82 million, though large one-off items affect earnings quality and reliability.

- Take a closer look at Iron Force Industrial's potential here in our dividend report.

- The valuation report we've compiled suggests that Iron Force Industrial's current price could be inflated.

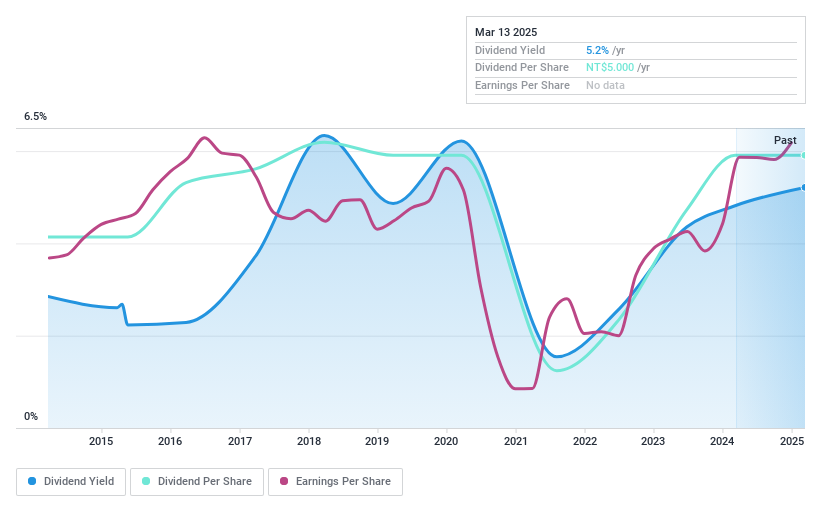

Optimax Technology (TWSE:3051)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Optimax Technology Corporation specializes in manufacturing and selling polarizers for LCD manufacturers in Taiwan, with a market cap of NT$4.58 billion.

Operations: Optimax Technology Corporation's revenue is primarily derived from its TFT segment, which generated NT$1.40 billion, followed by the TN/STN segment with NT$420.68 million.

Dividend Yield: 5.5%

Optimax Technology's dividend yield ranks in the top 25% of Taiwan's market, supported by a reasonable payout ratio of 74.6% and cash payout ratio of 61%, indicating coverage by earnings and cash flows. However, dividends have been unstable over the past two years with volatility exceeding 20%. Recent buyback programs aim to protect shareholder value while earnings grew significantly to TWD 337.27 million from TWD 172.53 million year-on-year.

- Click here to discover the nuances of Optimax Technology with our detailed analytical dividend report.

- Our expertly prepared valuation report Optimax Technology implies its share price may be too high.

Key Takeaways

- Get an in-depth perspective on all 1213 Top Asian Dividend Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2228

Iron Force Industrial

Manufactures and trades in airbag inflators for automotive safety systems in Taiwan and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives