- Singapore

- /

- Industrials

- /

- SGX:C07

Discover Jardine Cycle & Carriage And Two Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a mixed landscape with U.S. stocks wrapping up a strong year despite recent volatility, investors are keenly observing economic indicators like the Chicago PMI and GDP forecasts that hint at underlying challenges. Amidst these dynamics, dividend stocks continue to attract attention for their potential to offer steady income streams in uncertain times. In this article, we explore Jardine Cycle & Carriage along with two other prominent dividend stocks that exemplify qualities such as consistent payouts and resilience in fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.95% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.35% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Jardine Cycle & Carriage (SGX:C07)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jardine Cycle & Carriage Limited is an investment holding company involved in financial services, heavy equipment, mining, construction and energy, agribusiness, infrastructure and logistics, information technology, and property sectors in Indonesia and internationally with a market cap of SGD11.34 billion.

Operations: Jardine Cycle & Carriage Limited generates revenue from its diverse operations in financial services, heavy equipment, mining, construction and energy, agribusiness, infrastructure and logistics, information technology, and property sectors.

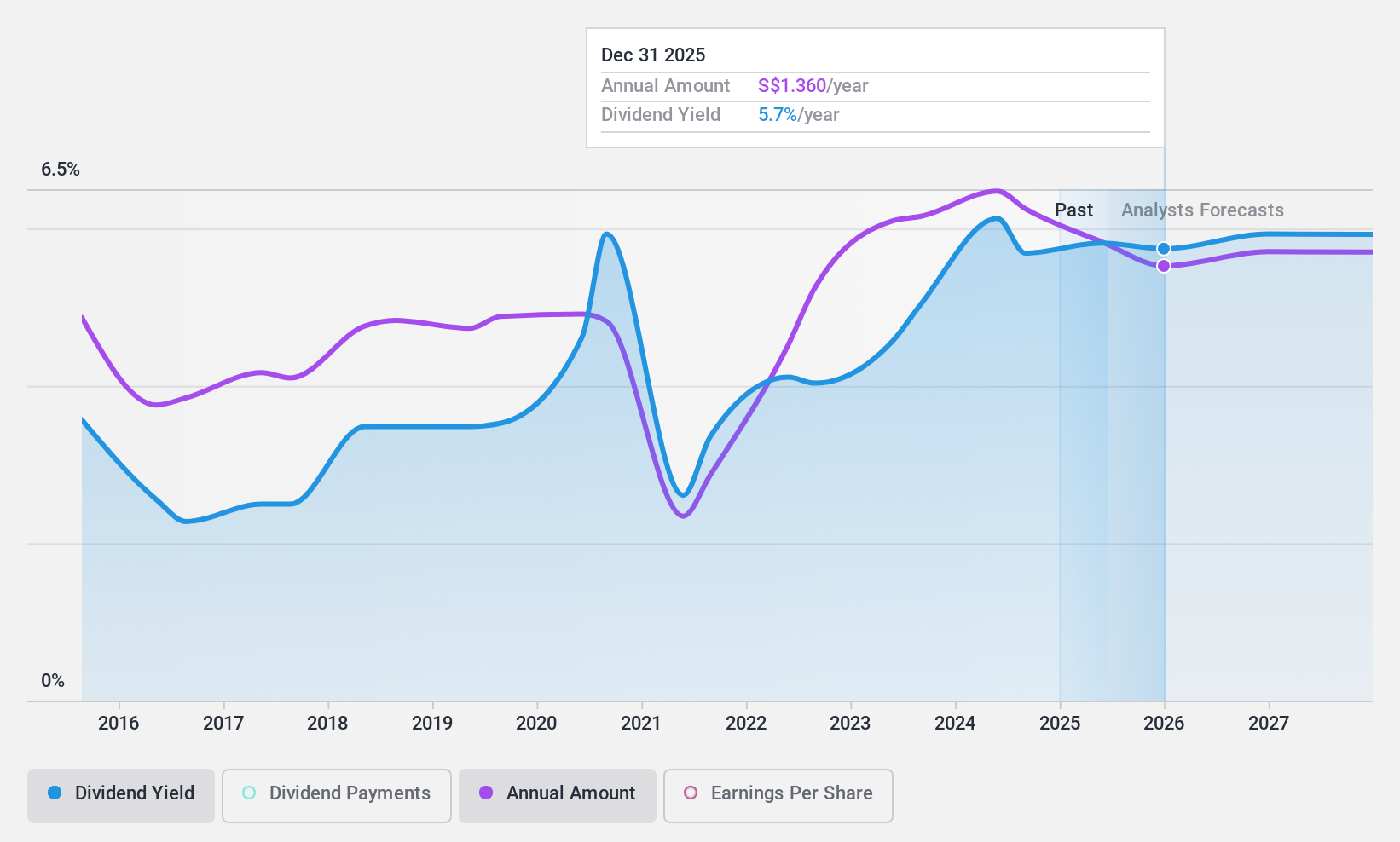

Dividend Yield: 5.6%

Jardine Cycle & Carriage offers a mixed profile for dividend investors. Trading at 46.7% below its estimated fair value, it presents good relative value compared to peers. Despite a reasonably low payout ratio of 44.4%, indicating dividends are well covered by earnings and cash flows, the dividend yield of 5.59% is below the top tier in Singapore's market. The company has increased dividends over the past decade but maintains an unstable track record with volatility exceeding 20%.

- Get an in-depth perspective on Jardine Cycle & Carriage's performance by reading our dividend report here.

- Our valuation report unveils the possibility Jardine Cycle & Carriage's shares may be trading at a discount.

ECOVE Environment (TPEX:6803)

Simply Wall St Dividend Rating: ★★★★★★

Overview: ECOVE Environment Corp. offers waste management services across Taiwan, Macau, China, Southeast Asia, the United States, and India with a market cap of NT$20.70 billion.

Operations: ECOVE Environment Corp.'s revenue primarily comes from Environmental Protection Services, totaling NT$9.74 billion.

Dividend Yield: 5.1%

ECOVE Environment's dividend yield of 5.09% ranks in the top 25% of Taiwan's market, supported by a payout ratio of 87.2%, ensuring coverage by earnings and cash flows with a cash payout ratio of 54.2%. The company's dividends have been stable and growing over the past decade, reflecting reliability. Recent financial results show modest earnings growth, with Q3 sales at TWD 2.29 billion and net income at TWD 353.19 million, suggesting continued dividend sustainability.

- Unlock comprehensive insights into our analysis of ECOVE Environment stock in this dividend report.

- Upon reviewing our latest valuation report, ECOVE Environment's share price might be too optimistic.

Taiwan Fire & Marine Insurance (TWSE:2832)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taiwan Fire & Marine Insurance Co., Ltd. offers a range of insurance products and services in Taiwan, with a market cap of NT$10.47 billion.

Operations: Taiwan Fire & Marine Insurance Co., Ltd. generates revenue primarily from its Property Insurance segment, amounting to NT$7.27 billion.

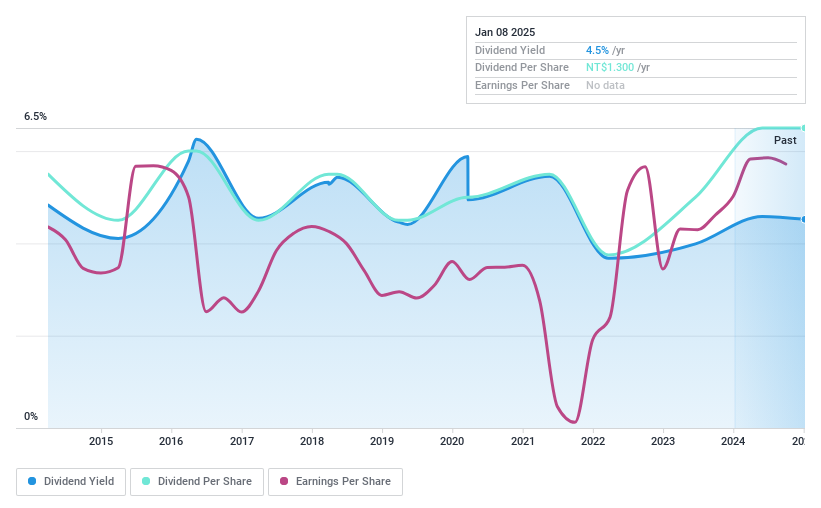

Dividend Yield: 4.5%

Taiwan Fire & Marine Insurance's dividend is supported by a low payout ratio of 42.2%, indicating coverage by earnings, while a cash payout ratio of 65.7% suggests adequate cash flow support. Despite this, the company's dividend history has been volatile, with significant annual drops over the past decade. However, recent earnings growth—net income reached TWD 987.81 million for nine months in 2024—may provide some stability moving forward.

- Delve into the full analysis dividend report here for a deeper understanding of Taiwan Fire & Marine Insurance.

- Our valuation report here indicates Taiwan Fire & Marine Insurance may be undervalued.

Next Steps

- Embark on your investment journey to our 1983 Top Dividend Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:C07

Jardine Cycle & Carriage

An investment holding company, engages in the financial services, heavy equipment, mining, construction and energy, agribusiness, infrastructure and logistics, information technology, and property businesses in Indonesia and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives