If EPS Growth Is Important To You, Kaori Heat Treatment (TWSE:8996) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Kaori Heat Treatment (TWSE:8996). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Kaori Heat Treatment

Kaori Heat Treatment's Improving Profits

Over the last three years, Kaori Heat Treatment has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. In impressive fashion, Kaori Heat Treatment's EPS grew from NT$3.37 to NT$6.45, over the previous 12 months. It's not often a company can achieve year-on-year growth of 92%. That could be a sign that the business has reached a true inflection point.

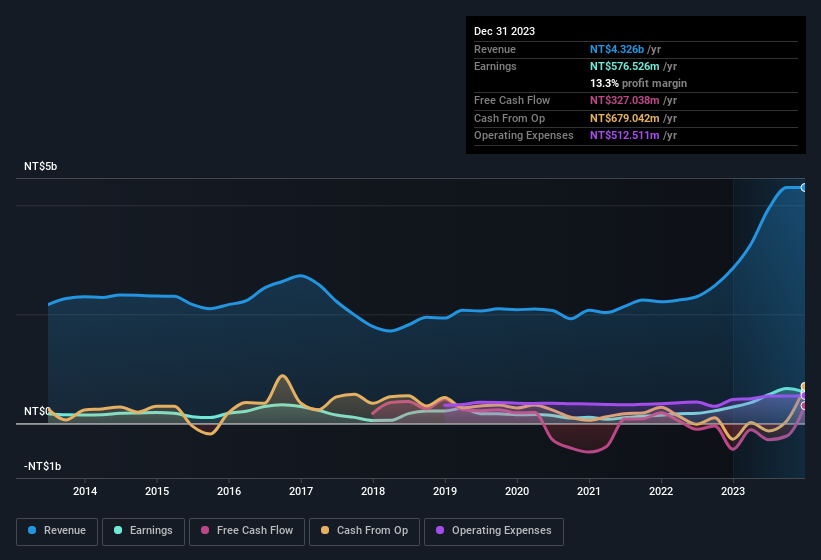

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Kaori Heat Treatment shareholders can take confidence from the fact that EBIT margins are up from 12% to 16%, and revenue is growing. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Kaori Heat Treatment's forecast profits?

Are Kaori Heat Treatment Insiders Aligned With All Shareholders?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. So it is good to see that Kaori Heat Treatment insiders have a significant amount of capital invested in the stock. Indeed, they have a considerable amount of wealth invested in it, currently valued at NT$4.5b. Coming in at 13% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. For companies with market capitalisations between NT$13b and NT$52b, like Kaori Heat Treatment, the median CEO pay is around NT$12m.

The CEO of Kaori Heat Treatment only received NT$4.7m in total compensation for the year ending December 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Kaori Heat Treatment Worth Keeping An Eye On?

Kaori Heat Treatment's earnings have taken off in quite an impressive fashion. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Big growth can make big winners, so the writing on the wall tells us that Kaori Heat Treatment is worth considering carefully. We should say that we've discovered 1 warning sign for Kaori Heat Treatment that you should be aware of before investing here.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in TW with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kaori Heat Treatment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:8996

Kaori Heat Treatment

Engages in the research, development, manufacture, and sale of heat exchanger solutions in Taiwan, rest of Asia, the United States, Europe, and internationally.

Exceptional growth potential with excellent balance sheet.