Why We're Not Concerned Yet About Zhong Yang Technology Co.,Ltd's (TWSE:6668) 26% Share Price Plunge

Unfortunately for some shareholders, the Zhong Yang Technology Co.,Ltd (TWSE:6668) share price has dived 26% in the last thirty days, prolonging recent pain. Longer-term, the stock has been solid despite a difficult 30 days, gaining 25% in the last year.

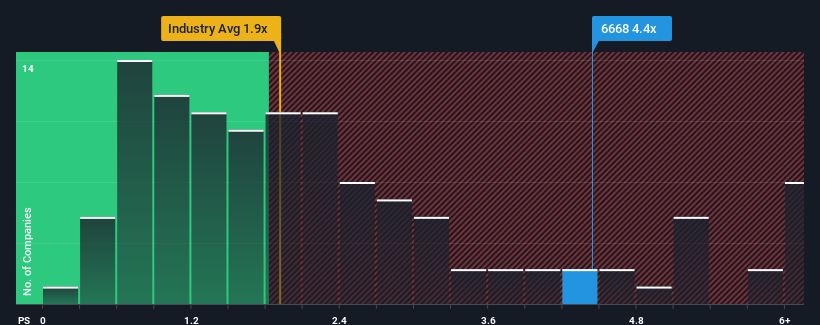

Even after such a large drop in price, given around half the companies in Taiwan's Machinery industry have price-to-sales ratios (or "P/S") below 1.9x, you may still consider Zhong Yang TechnologyLtd as a stock to avoid entirely with its 4.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Zhong Yang TechnologyLtd

What Does Zhong Yang TechnologyLtd's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Zhong Yang TechnologyLtd's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Zhong Yang TechnologyLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Zhong Yang TechnologyLtd would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 22%. The last three years don't look nice either as the company has shrunk revenue by 44% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 47% during the coming year according to the sole analyst following the company. With the industry only predicted to deliver 16%, the company is positioned for a stronger revenue result.

With this information, we can see why Zhong Yang TechnologyLtd is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Zhong Yang TechnologyLtd's P/S?

Even after such a strong price drop, Zhong Yang TechnologyLtd's P/S still exceeds the industry median significantly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Zhong Yang TechnologyLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Before you take the next step, you should know about the 2 warning signs for Zhong Yang TechnologyLtd (1 is significant!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Zhong Yang TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6668

Zhong Yang TechnologyLtd

Zhong Yang Technology Co., Ltd., together with its subsidiaries, engages in the research, development, manufacture, and sale of optical lens molds in Taiwan, China, Korea, and internationally.

Excellent balance sheet with limited growth.