Investors Appear Satisfied With Zhong Yang Technology Co.,Ltd's (TWSE:6668) Prospects As Shares Rocket 25%

Zhong Yang Technology Co.,Ltd (TWSE:6668) shares have continued their recent momentum with a 25% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 46% in the last year.

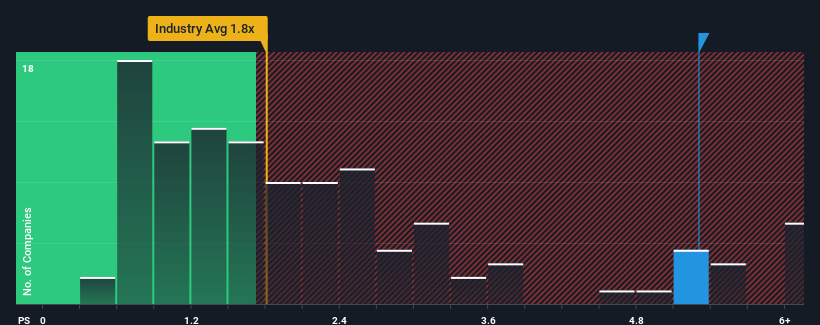

Since its price has surged higher, given around half the companies in Taiwan's Machinery industry have price-to-sales ratios (or "P/S") below 1.8x, you may consider Zhong Yang TechnologyLtd as a stock to avoid entirely with its 5.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Zhong Yang TechnologyLtd

How Zhong Yang TechnologyLtd Has Been Performing

Zhong Yang TechnologyLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zhong Yang TechnologyLtd.Is There Enough Revenue Growth Forecasted For Zhong Yang TechnologyLtd?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Zhong Yang TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 22% decrease to the company's top line. As a result, revenue from three years ago have also fallen 45% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 35% during the coming year according to the lone analyst following the company. With the industry only predicted to deliver 14%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Zhong Yang TechnologyLtd's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Zhong Yang TechnologyLtd's P/S

Shares in Zhong Yang TechnologyLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Zhong Yang TechnologyLtd shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You need to take note of risks, for example - Zhong Yang TechnologyLtd has 3 warning signs (and 2 which are a bit unpleasant) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Zhong Yang TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6668

Zhong Yang TechnologyLtd

Zhong Yang Technology Co., Ltd., together with its subsidiaries, engages in the research, development, manufacture, and sale of optical lens molds in Taiwan, China, Korea, and internationally.

Slight with mediocre balance sheet.

Market Insights

Community Narratives