- Taiwan

- /

- Electrical

- /

- TWSE:6409

Global Dividend Stocks To Watch In October 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of a U.S. government shutdown and shifting economic indicators, investors are keeping a close eye on potential Federal Reserve rate cuts and their impact on equity performance. With technology stocks leading gains and commodities like gold showing resilience, the current environment highlights the importance of seeking dividend stocks that offer stability and income potential amidst market volatility.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.22% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.72% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.16% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.82% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.91% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.90% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.02% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.28% | ★★★★★★ |

Click here to see the full list of 1359 stocks from our Top Global Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Aisan Industry (TSE:7283)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Aisan Industry Co., Ltd. manufactures and sells automotive parts both in Japan and internationally, with a market cap of ¥113 billion.

Operations: Aisan Industry Co., Ltd.'s revenue is segmented as follows: ¥142.60 billion from Asia, ¥135.19 billion from Japan, ¥15.48 billion from Europe, and ¥75.95 billion from the Americas.

Dividend Yield: 3.7%

Aisan Industry's dividend payments are well-covered by earnings and cash flows, with a payout ratio of 36.6% and a cash payout ratio of 54.3%. Despite an increase in dividends over the past decade, their reliability has been inconsistent due to volatility. Trading at 58.9% below its estimated fair value, Aisan offers good relative value compared to peers. Recent forecasts project ¥310 billion in net sales and ¥12 billion profit for fiscal year ending March 2026.

- Delve into the full analysis dividend report here for a deeper understanding of Aisan Industry.

- Insights from our recent valuation report point to the potential undervaluation of Aisan Industry shares in the market.

KSKLtd (TSE:9687)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: KSK Co., Ltd. operates in the LSI, software, hardware, customer service, and data entry sectors with a market capitalization of ¥25.97 billion.

Operations: KSK Co., Ltd.'s revenue is derived from its IT Solution Business generating ¥5.62 billion, System Core Business contributing ¥4.27 billion, and Network Service Business bringing in ¥14.28 billion.

Dividend Yield: 3.4%

KSKLtd's dividend payments have been stable and growing over the past decade, supported by a low payout ratio of 31.8% and a cash payout ratio of 59%, ensuring sustainability through earnings and cash flows. Although its 3.45% yield is below the top tier in Japan, it remains reliable with little volatility. Trading at 16.2% below estimated fair value, KSKLtd presents an attractive opportunity for dividend investors seeking stability and growth potential.

- Take a closer look at KSKLtd's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that KSKLtd is priced lower than what may be justified by its financials.

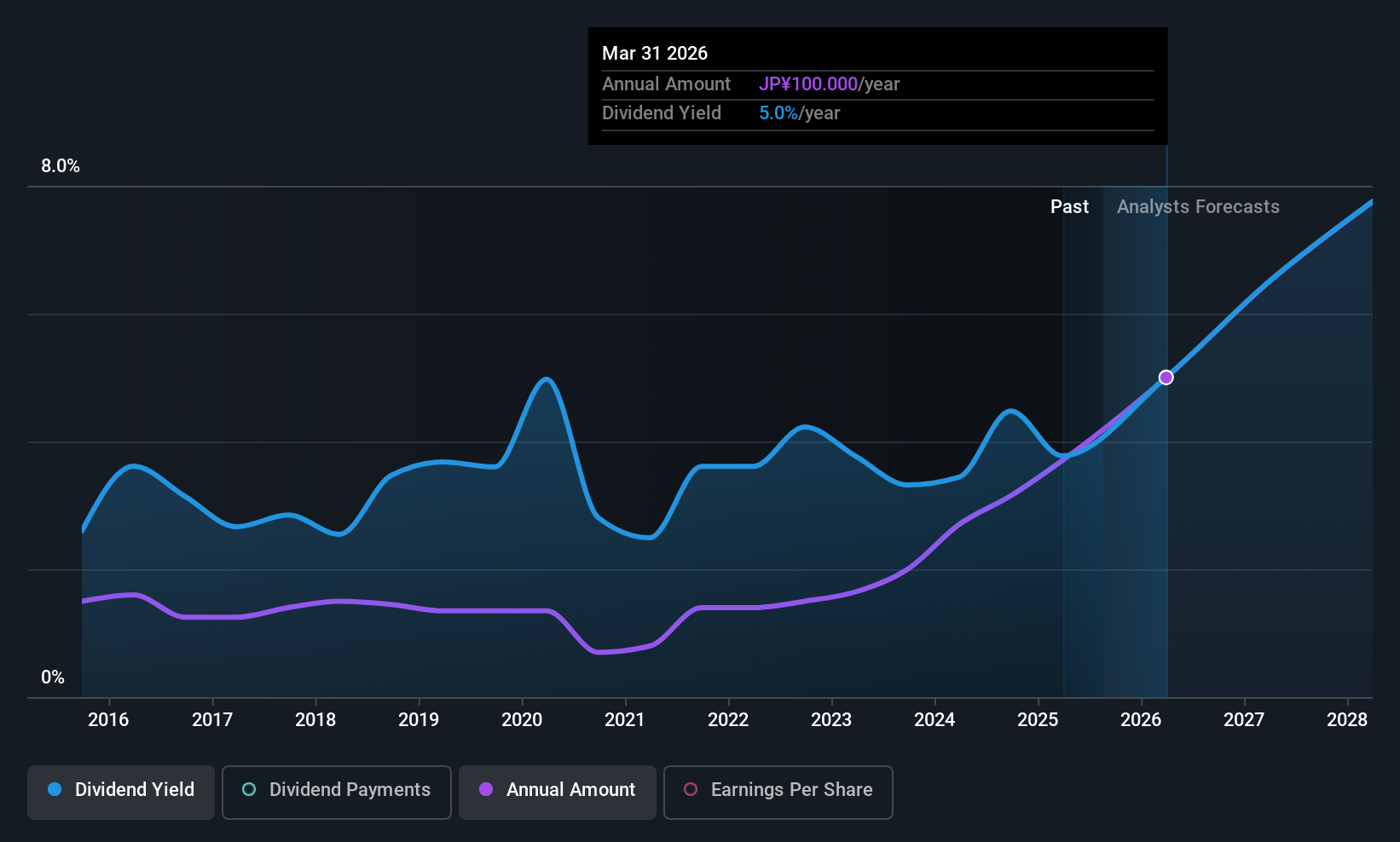

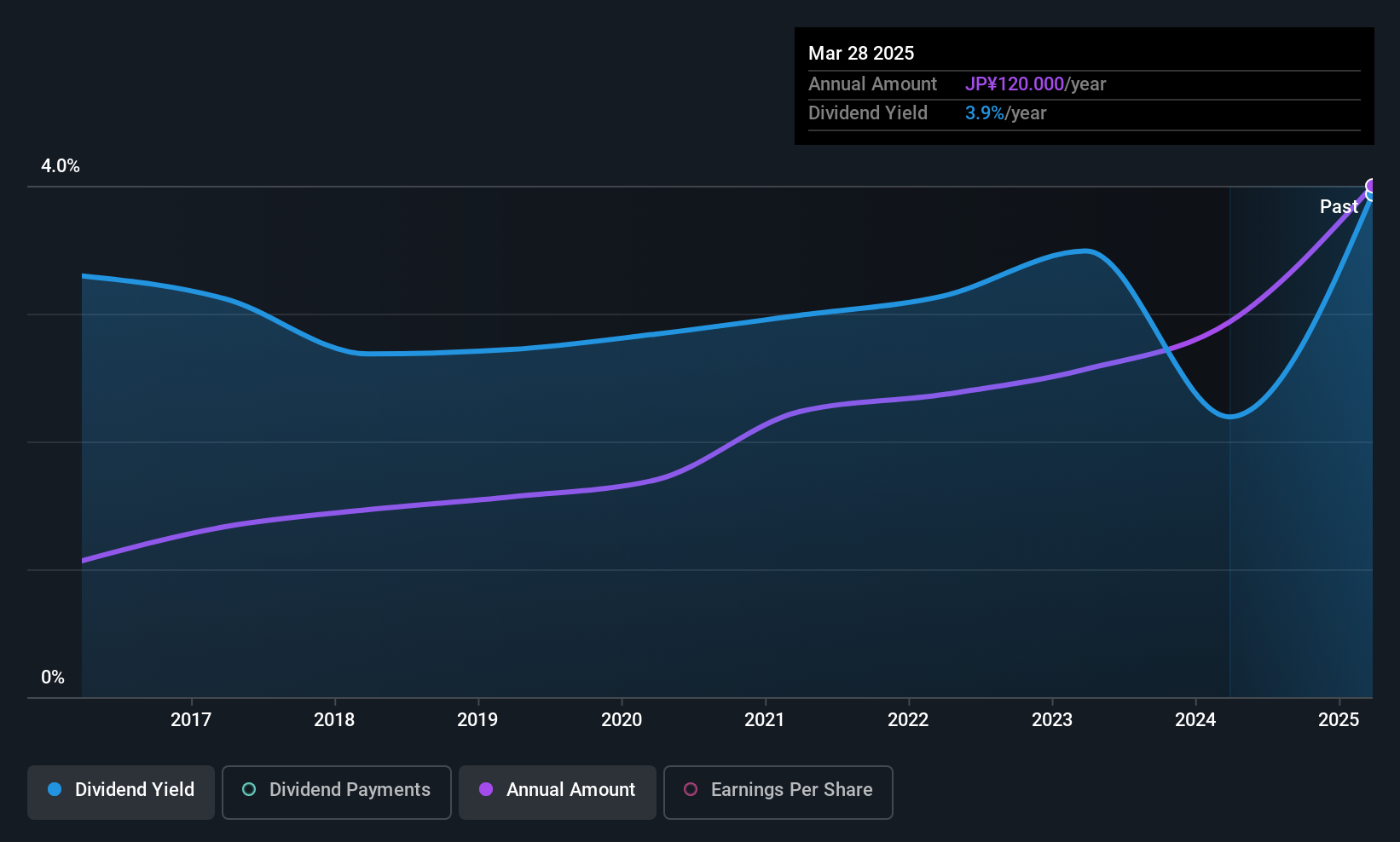

Voltronic Power Technology (TWSE:6409)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Voltronic Power Technology Corp., along with its subsidiaries, manufactures and sells uninterruptible power systems (UPS) in Taiwan and China, with a market cap of NT$80.96 billion.

Operations: Voltronic Power Technology Corp.'s revenue is primarily derived from the manufacturing and trading of uninterruptible power systems and inverters, amounting to NT$22.41 billion.

Dividend Yield: 3.8%

Voltronic Power Technology's dividends have been stable and increasing over the past 10 years, with a payout ratio of 78.9% and a cash payout ratio of 66.8%, indicating solid coverage by earnings and cash flows. Despite a lower yield of 3.8% compared to Taiwan's top dividend payers, its reliable payments are supported by recent earnings growth, as net income rose to TWD 1.5 billion in Q2 2025 from TWD 1.28 billion last year.

- Dive into the specifics of Voltronic Power Technology here with our thorough dividend report.

- Our valuation report unveils the possibility Voltronic Power Technology's shares may be trading at a premium.

Taking Advantage

- Get an in-depth perspective on all 1359 Top Global Dividend Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6409

Voltronic Power Technology

Manufactures and sells uninterruptible power systems (UPS) in Taiwan and China.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives