We Think Rechi Precision's (TWSE:4532) Solid Earnings Are Understated

Despite posting healthy earnings, Rechi Precision Co., Ltd.'s (TWSE:4532 ) stock has been quite weak. We have done some analysis, and found some encouraging factors that we believe the shareholders should consider.

View our latest analysis for Rechi Precision

Examining Cashflow Against Rechi Precision's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

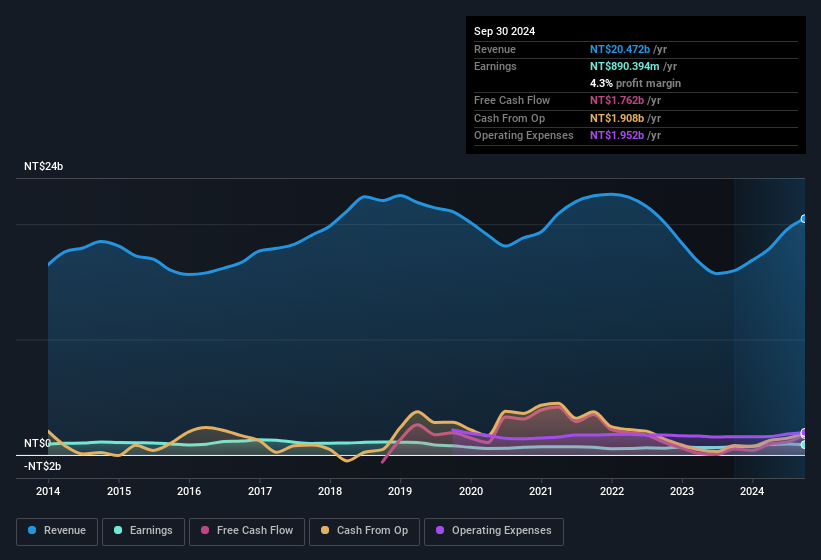

Rechi Precision has an accrual ratio of -0.11 for the year to September 2024. That indicates that its free cash flow was a fair bit more than its statutory profit. In fact, it had free cash flow of NT$1.8b in the last year, which was a lot more than its statutory profit of NT$890.4m. Rechi Precision shareholders are no doubt pleased that free cash flow improved over the last twelve months.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Rechi Precision's Profit Performance

As we discussed above, Rechi Precision has perfectly satisfactory free cash flow relative to profit. Based on this observation, we consider it likely that Rechi Precision's statutory profit actually understates its earnings potential! And the EPS is up 34% annually, over the last three years. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. For example - Rechi Precision has 1 warning sign we think you should be aware of.

Today we've zoomed in on a single data point to better understand the nature of Rechi Precision's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

If you're looking to trade Rechi Precision, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:4532

Rechi Precision

Together with its subsidiary, engages in the assembly, processing, manufacture, repair, and trading of refrigerant compressors and design services worldwide.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives