- Taiwan

- /

- Electrical

- /

- TWSE:3665

Bizlink Holding Inc. (TWSE:3665) Stock Rockets 28% But Many Are Still Ignoring The Company

Bizlink Holding Inc. (TWSE:3665) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Unfortunately, despite the strong performance over the last month, the full year gain of 7.5% isn't as attractive.

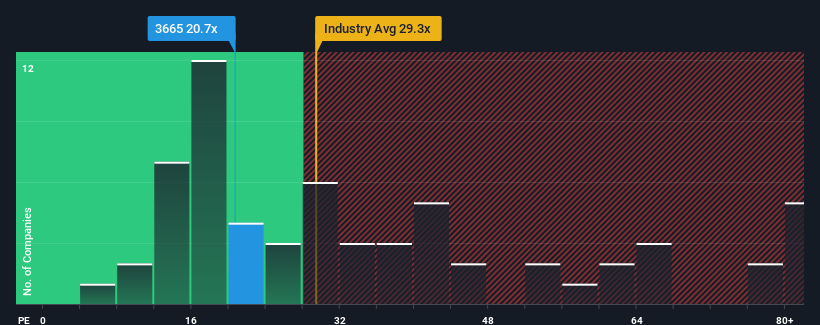

Even after such a large jump in price, it's still not a stretch to say that Bizlink Holding's price-to-earnings (or "P/E") ratio of 20.7x right now seems quite "middle-of-the-road" compared to the market in Taiwan, where the median P/E ratio is around 23x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times haven't been advantageous for Bizlink Holding as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

View our latest analysis for Bizlink Holding

Does Growth Match The P/E?

Bizlink Holding's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 45%. The last three years don't look nice either as the company has shrunk EPS by 3.5% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 24% per annum during the coming three years according to the nine analysts following the company. With the market only predicted to deliver 12% each year, the company is positioned for a stronger earnings result.

In light of this, it's curious that Bizlink Holding's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Its shares have lifted substantially and now Bizlink Holding's P/E is also back up to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Bizlink Holding's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Having said that, be aware Bizlink Holding is showing 1 warning sign in our investment analysis, you should know about.

Of course, you might also be able to find a better stock than Bizlink Holding. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Bizlink Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3665

Bizlink Holding

Researches, designs, develops, manufactures, and sells interconnect products for cable harnesses in the United States, China, Germany, Malaysia, Taiwan, Italy, and internationally.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives