- Taiwan

- /

- Electrical

- /

- TWSE:3550

While shareholders of Copartner Technology (TWSE:3550) are in the black over 5 years, those who bought a week ago aren't so fortunate

The Copartner Technology Corporation (TWSE:3550) share price has had a bad week, falling 12%. On the bright side the share price is up over the last half decade. Unfortunately its return of 83% is below the market return of 141%.

Since the long term performance has been good but there's been a recent pullback of 12%, let's check if the fundamentals match the share price.

Check out our latest analysis for Copartner Technology

Copartner Technology isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Copartner Technology saw its revenue grow at 1.3% per year. That's not a very high growth rate considering the bottom line. Like its revenue, its share price gained over the period. The increase of 13% per year probably reflects the modest revenue growth. If profitability is likely in the near term, then this might be one to add to your watchlist.

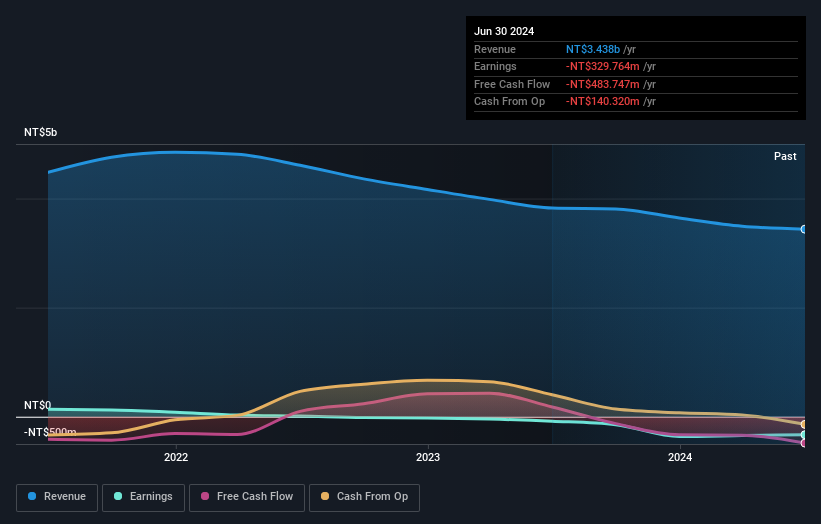

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Copartner Technology's TSR for the last 5 years was 106%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Copartner Technology shareholders have received a total shareholder return of 69% over the last year. And that does include the dividend. That's better than the annualised return of 16% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 5 warning signs we've spotted with Copartner Technology (including 4 which make us uncomfortable) .

But note: Copartner Technology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3550

Copartner Technology

Engages in manufacturing of cable and wire products for information, communications, and electronics industries worldwide.

Moderate and slightly overvalued.