Institutions profited after Shin Zu Shing Co., Ltd.'s (TWSE:3376) market cap rose NT$4.5b last week but retail investors profited the most

Key Insights

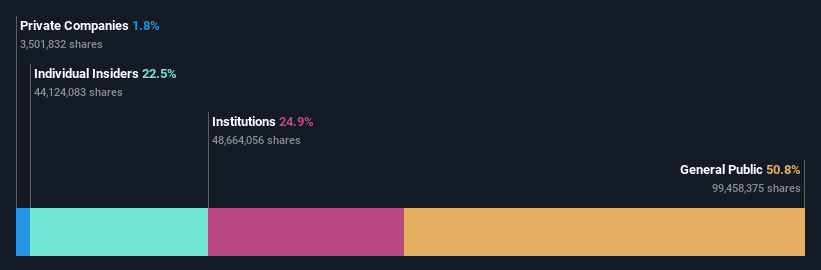

- The considerable ownership by retail investors in Shin Zu Shing indicates that they collectively have a greater say in management and business strategy

- The top 25 shareholders own 49% of the company

- Insider ownership in Shin Zu Shing is 23%

To get a sense of who is truly in control of Shin Zu Shing Co., Ltd. (TWSE:3376), it is important to understand the ownership structure of the business. The group holding the most number of shares in the company, around 51% to be precise, is retail investors. Put another way, the group faces the maximum upside potential (or downside risk).

Following a 11% increase in the stock price last week, retail investors profited the most, but institutions who own 25% stock also stood to gain from the increase.

In the chart below, we zoom in on the different ownership groups of Shin Zu Shing.

See our latest analysis for Shin Zu Shing

What Does The Institutional Ownership Tell Us About Shin Zu Shing?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

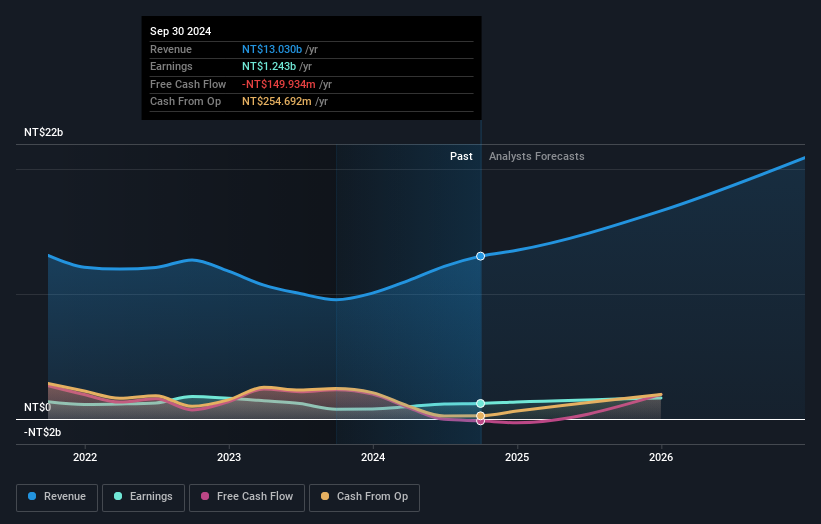

Shin Zu Shing already has institutions on the share registry. Indeed, they own a respectable stake in the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Shin Zu Shing's earnings history below. Of course, the future is what really matters.

Shin Zu Shing is not owned by hedge funds. Our data shows that Min-Wen Lu is the largest shareholder with 10% of shares outstanding. Sheng-Nan Lu is the second largest shareholder owning 9.0% of common stock, and Uni-President Assets Management Corp. holds about 3.4% of the company stock.

On studying our ownership data, we found that 25 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Shin Zu Shing

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our most recent data indicates that insiders own a reasonable proportion of Shin Zu Shing Co., Ltd.. Insiders own NT$10b worth of shares in the NT$46b company. That's quite meaningful. Most would be pleased to see the board is investing alongside them. You may wish to access this free chart showing recent trading by insiders.

General Public Ownership

The general public -- including retail investors -- own 51% of Shin Zu Shing. This size of ownership gives investors from the general public some collective power. They can and probably do influence decisions on executive compensation, dividend policies and proposed business acquisitions.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Shin Zu Shing better, we need to consider many other factors. Take risks for example - Shin Zu Shing has 1 warning sign we think you should be aware of.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3376

Shin Zu Shing

Engages in the research, design, development, production, assembly, testing, manufacturing, and trading of various precision springs, stamping parts, hinge components, CNC lathes, and metal injection molding in Taiwan, Singapore, and China.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives