Apex Science & Engineering Corp. (TWSE:3052) has announced that it will pay a dividend of NT$0.40 per share on the 19th of September. The dividend yield is 3.0% based on this payment, which is a little bit low compared to the other companies in the industry.

Check out our latest analysis for Apex Science & Engineering

Apex Science & Engineering's Payment Has Solid Earnings Coverage

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. However, Apex Science & Engineering's earnings easily cover the dividend. This means that most of what the business earns is being used to help it grow.

Over the next year, EPS could expand by 15.2% if recent trends continue. If the dividend continues on this path, the payout ratio could be 32% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

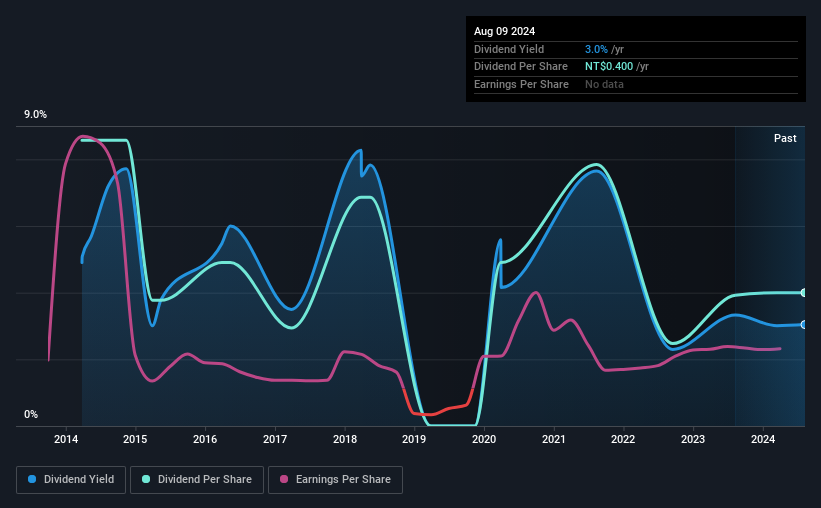

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2014, the dividend has gone from NT$0.857 total annually to NT$0.40. The dividend has shrunk at around 7.3% a year during that period. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Looks Likely To Grow

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Apex Science & Engineering has seen EPS rising for the last five years, at 15% per annum. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

We Really Like Apex Science & Engineering's Dividend

Overall, we like to see the dividend staying consistent, and we think Apex Science & Engineering might even raise payments in the future. The company is easily earning enough to cover its dividend payments and it is great to see that these earnings are being translated into cash flow. Taking this all into consideration, this looks like it could be a good dividend opportunity.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 3 warning signs for Apex Science & Engineering that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3052

Apex Science & Engineering

Operates as an engineering and construction company in Taiwan.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026