- Taiwan

- /

- Aerospace & Defense

- /

- TWSE:2630

Benign Growth For Air Asia Co., Ltd. (TWSE:2630) Underpins Its Share Price

When close to half the companies operating in the Aerospace & Defense industry in Taiwan have price-to-sales ratios (or "P/S") above 2.6x, you may consider Air Asia Co., Ltd. (TWSE:2630) as an attractive investment with its 1.6x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Air Asia

What Does Air Asia's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Air Asia has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Air Asia's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Air Asia's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. As a result, it also grew revenue by 25% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 4.7% over the next year. Meanwhile, the rest of the industry is forecast to expand by 9.3%, which is noticeably more attractive.

In light of this, it's understandable that Air Asia's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Air Asia maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

You need to take note of risks, for example - Air Asia has 2 warning signs (and 1 which is significant) we think you should know about.

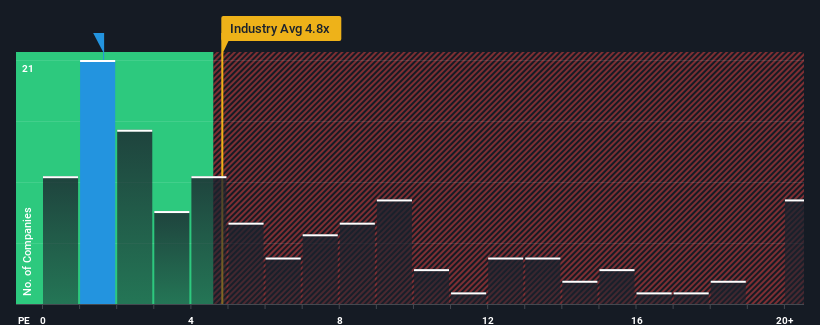

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2630

Air Asia

Operates as an aircraft maintenance company in Taiwan, rest of Asia, and internationally.

Solid track record with excellent balance sheet.