- Taiwan

- /

- Construction

- /

- TWSE:2543

Hwang Chang General Contractor Co., Ltd (TWSE:2543) Looks Just Right With A 32% Price Jump

Hwang Chang General Contractor Co., Ltd (TWSE:2543) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. The annual gain comes to 283% following the latest surge, making investors sit up and take notice.

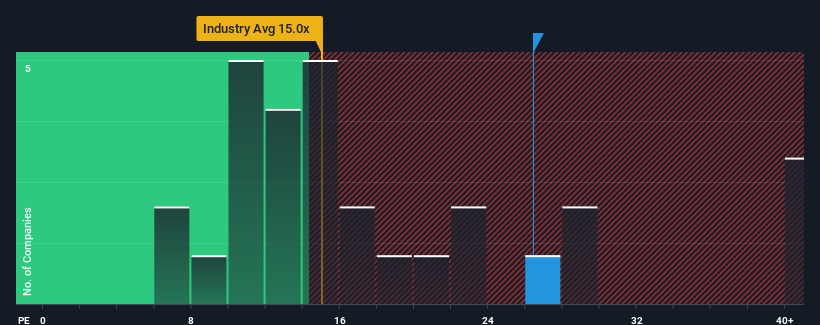

Since its price has surged higher, Hwang Chang General Contractor may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 26.4x, since almost half of all companies in Taiwan have P/E ratios under 21x and even P/E's lower than 15x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

For instance, Hwang Chang General Contractor's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

See our latest analysis for Hwang Chang General Contractor

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Hwang Chang General Contractor would need to produce impressive growth in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 39%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 645% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 22% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Hwang Chang General Contractor is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Final Word

Hwang Chang General Contractor shares have received a push in the right direction, but its P/E is elevated too. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Hwang Chang General Contractor revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 2 warning signs for Hwang Chang General Contractor (1 is potentially serious!) that we have uncovered.

Of course, you might also be able to find a better stock than Hwang Chang General Contractor. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hwang Chang General Contractor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2543

Hwang Chang General Contractor

Engages in the contracting business of civil engineering projects in Taiwan.

Solid track record with excellent balance sheet.