3 Asian Stocks Estimated To Be Undervalued By As Much As 40.3%

Reviewed by Simply Wall St

As global markets grapple with concerns over inflated AI stock valuations and economic uncertainties, Asian markets have also experienced their share of volatility. Despite these challenges, opportunities may exist for discerning investors who seek undervalued stocks that could potentially offer value in a fluctuating market environment.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SRE Holdings (TSE:2980) | ¥3120.00 | ¥6130.72 | 49.1% |

| Raksul (TSE:4384) | ¥1148.00 | ¥2276.91 | 49.6% |

| Q & M Dental Group (Singapore) (SGX:QC7) | SGD0.485 | SGD0.95 | 49% |

| PharmaEssentia (TWSE:6446) | NT$487.50 | NT$950.77 | 48.7% |

| Nippon Thompson (TSE:6480) | ¥706.00 | ¥1407.35 | 49.8% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.10 | CN¥26.16 | 49.9% |

| New Zealand King Salmon Investments (NZSE:NZK) | NZ$0.196 | NZ$0.39 | 49.2% |

| Foxconn Industrial Internet (SHSE:601138) | CN¥55.94 | CN¥111.71 | 49.9% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.63 | CN¥56.42 | 49.3% |

| Alibaba Health Information Technology (SEHK:241) | HK$5.73 | HK$11.27 | 49.2% |

Let's take a closer look at a couple of our picks from the screened companies.

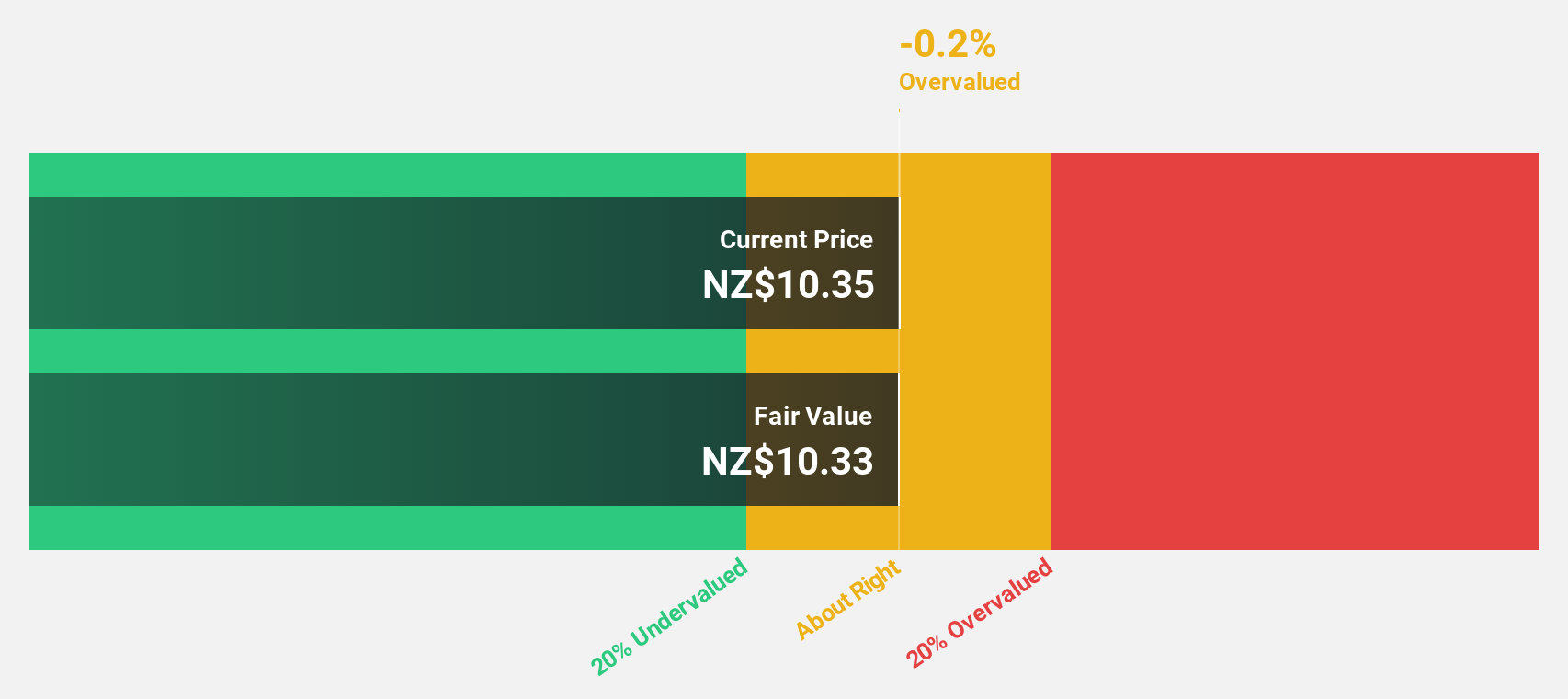

Gentrack Group (NZSE:GTK)

Overview: Gentrack Group Limited develops, integrates, and supports enterprise billing and customer management software solutions for the energy, water utility, and airport industries, with a market cap of NZ$999.71 million.

Operations: The company's revenue is derived from its utility segment, which generated NZ$187.58 million, and its airport segment, contributing NZ$35.65 million.

Estimated Discount To Fair Value: 10.1%

Gentrack Group's recent earnings report highlights a substantial increase in net income, reaching NZ$20.87 million from NZ$9.55 million the previous year, with sales rising to NZ$230.19 million. The stock trades at NZ$9.28, slightly below its estimated fair value of NZ$10.32, suggesting it may be undervalued based on cash flows despite high share price volatility and modest return on equity forecasts (11.8%). Earnings are projected to grow significantly by 27.7% annually over the next three years.

- According our earnings growth report, there's an indication that Gentrack Group might be ready to expand.

- Take a closer look at Gentrack Group's balance sheet health here in our report.

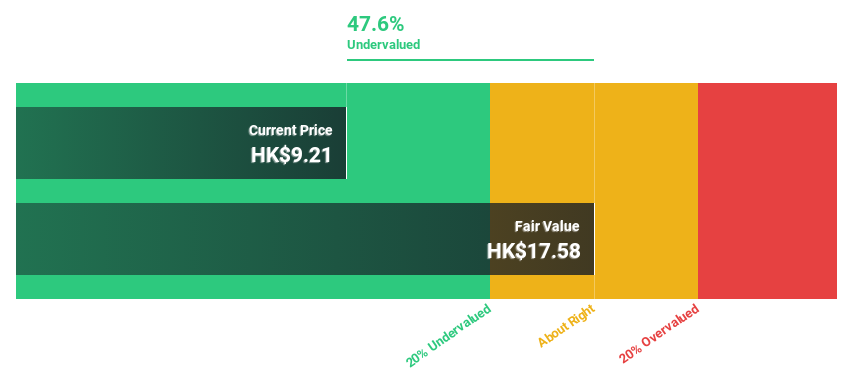

Consun Pharmaceutical Group (SEHK:1681)

Overview: Consun Pharmaceutical Group Limited focuses on the research, development, manufacturing, and sale of Chinese medicines and medical contrast medium products in the People’s Republic of China, with a market cap of HK$12.76 billion.

Operations: The company's revenue is derived from the Consun Pharmaceutical Segment, contributing CN¥2.82 billion, and the Yulin Pharmaceutical Segment, which adds CN¥469.22 million.

Estimated Discount To Fair Value: 40.3%

Consun Pharmaceutical Group is trading at HK$15.13, well below its estimated fair value of HK$25.33, indicating potential undervaluation based on cash flows. Analysts forecast earnings growth at 12.5% annually, outpacing the Hong Kong market's average. Despite a high future return on equity projection (25.3%), the company has an unstable dividend track record and recent board changes may impact strategic direction as Professor Zhu Quan transitions to a non-executive role amidst bylaw amendments for treasury shares management.

- Our growth report here indicates Consun Pharmaceutical Group may be poised for an improving outlook.

- Dive into the specifics of Consun Pharmaceutical Group here with our thorough financial health report.

C Sun Mfg (TWSE:2467)

Overview: C Sun Mfg Ltd., along with its subsidiaries, supplies a range of processing equipment in Taiwan, China, and globally, with a market cap of NT$27.14 billion.

Operations: C Sun Mfg Ltd. generates its revenue from providing diverse processing equipment across Taiwan, China, and international markets.

Estimated Discount To Fair Value: 19.8%

C Sun Mfg Ltd. trades at NT$180, below its estimated fair value of NT$224.35, reflecting potential undervaluation based on cash flows. Earnings are projected to grow significantly at 38.6% annually, surpassing the Taiwan market average of 20.1%. Recent earnings for Q3 showed sales rising to TWD 1,536.11 million from TWD 1,053.62 million year-over-year with net income increasing to TWD 211.57 million from TWD 164.98 million, despite a volatile share price and unsustainable dividend coverage by earnings or free cash flows.

- The growth report we've compiled suggests that C Sun Mfg's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in C Sun Mfg's balance sheet health report.

Next Steps

- Embark on your investment journey to our 276 Undervalued Asian Stocks Based On Cash Flows selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1681

Consun Pharmaceutical Group

Researches and develops, manufactures, and sells Chinese medicines and medical contrast medium products in the People’s Republic of China.

Very undervalued with outstanding track record and pays a dividend.

Market Insights

Community Narratives