- Taiwan

- /

- Electrical

- /

- TWSE:2420

Dividend Stocks To Enhance Your Portfolio November 2024

Reviewed by Simply Wall St

As global markets experience broad-based gains with U.S. indexes approaching record highs and positive economic indicators such as declining jobless claims, investors are increasingly optimistic despite geopolitical uncertainties. Amidst this backdrop, dividend stocks can offer a stable income stream and potential for growth, making them an attractive option for enhancing portfolios in today's market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.69% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.30% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.88% | ★★★★★★ |

Click here to see the full list of 1948 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Zippy Technology (TWSE:2420)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zippy Technology Corp., along with its subsidiaries, designs, manufactures, and trades micro switches and power supplies across Taiwan, the United States, China, Germany, Italy and other international markets with a market cap of NT$10.41 billion.

Operations: Zippy Technology Corp.'s revenue is primarily derived from its micro switches and power supplies business across various international markets.

Dividend Yield: 4.4%

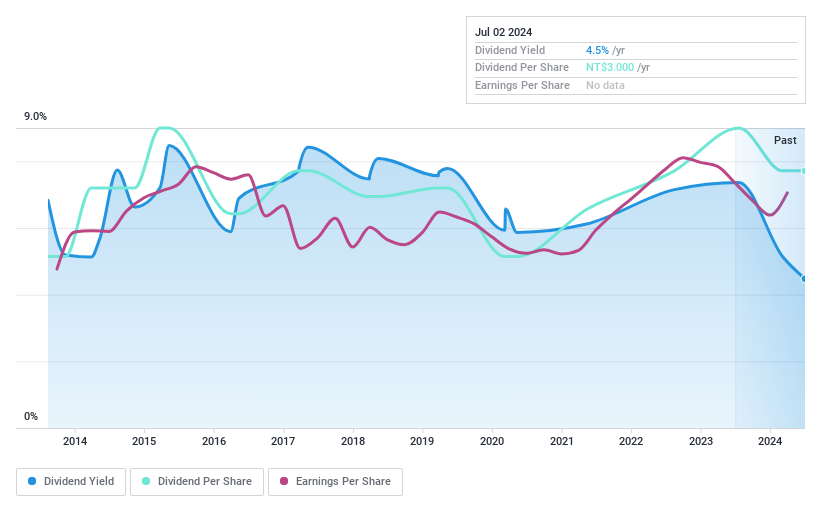

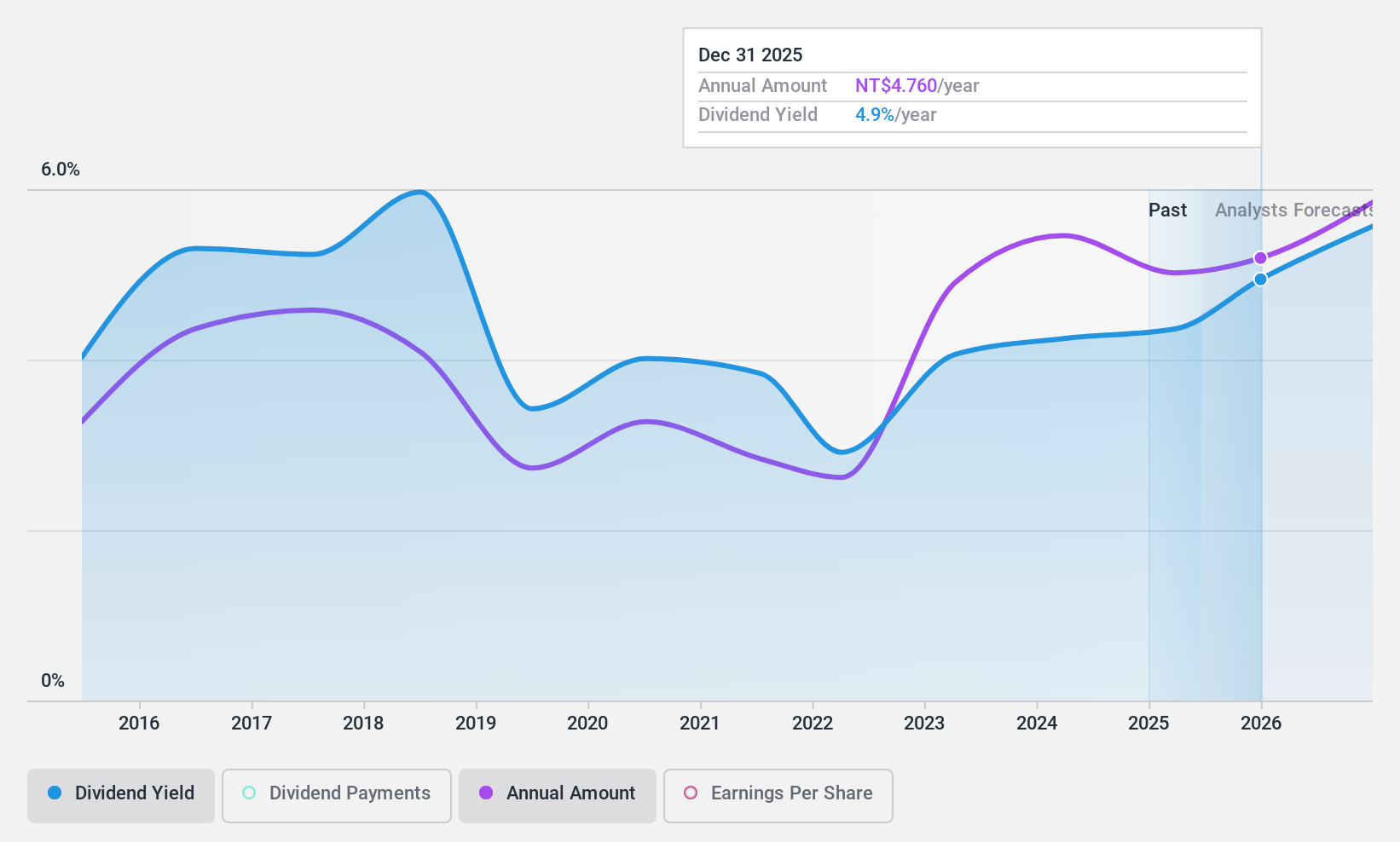

Zippy Technology trades at 47.1% below its estimated fair value, offering potential value for investors. Its dividend payments are covered by both earnings (payout ratio: 73.4%) and cash flows (cash payout ratio: 52.7%), but the dividend yield of 4.35% is slightly below the top tier in Taiwan's market. Despite recent earnings growth, Zippy's dividends have been volatile over the past decade, indicating an unstable track record for reliable income generation.

- Click to explore a detailed breakdown of our findings in Zippy Technology's dividend report.

- Our valuation report unveils the possibility Zippy Technology's shares may be trading at a discount.

Sercomm (TWSE:5388)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sercomm Corporation researches, develops, manufactures, and sells networking communication software and equipment across North America, Europe, and the Asia Pacific with a market cap of NT$32.17 billion.

Operations: Sercomm Corporation generates revenue of NT$58.99 billion from its Computer Networks segment.

Dividend Yield: 4.5%

Sercomm's dividend yield is among the top 25% in Taiwan, though its dividend history has been volatile and unreliable over the past decade. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios of 58.2% and 56.8%, respectively. The stock trades below fair value estimates, suggesting potential investment appeal. Recent earnings showed a decline in sales and net income compared to last year, highlighting some financial challenges.

- Click here to discover the nuances of Sercomm with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Sercomm's share price might be too pessimistic.

WW Holding (TWSE:8442)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WW Holding Inc. manufactures and sells sports equipment, clothing, accessories, handbags, belts, suitcases, and leather accessories in various international markets including the United States and Mainland China; it has a market cap of NT$6.94 billion.

Operations: WW Holding Inc.'s revenue segments include sports equipment, clothing, and accessories; handbags; belts; suitcases; and leather accessories across markets such as the United States, Mainland China, Belgium, France, Germany, and other international regions.

Dividend Yield: 5%

WW Holding's dividend yield is in the top 25% of Taiwan's market, supported by a reasonable payout ratio of 50.4% and a cash payout ratio of 40.2%. Despite only eight years of payments, dividends have been volatile. The stock trades below fair value estimates, offering potential appeal. Recent earnings showed increased sales but a decline in quarterly net income to TWD 140.4 million from TWD 226.46 million last year, indicating mixed financial performance.

- Get an in-depth perspective on WW Holding's performance by reading our dividend report here.

- Our valuation report here indicates WW Holding may be undervalued.

Where To Now?

- Click this link to deep-dive into the 1948 companies within our Top Dividend Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Zippy Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zippy Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2420

Zippy Technology

Engages in the designing, manufacturing, and trading of micro switches and power supplies in Taiwan, the United States, Mainland China, Germany, Italy and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives