3 Reliable Dividend Stocks With Yields Up To 4.7% For Steady Income

Reviewed by Simply Wall St

Amidst a backdrop of tariff uncertainties and mixed economic signals, global markets have experienced fluctuations, with U.S. stocks ending the week on a lower note and European indices showing resilience. In such an environment, investors often turn to dividend stocks for their potential to provide steady income streams, as they can offer some stability against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.78% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.48% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.19% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.69% | ★★★★★★ |

Click here to see the full list of 1965 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

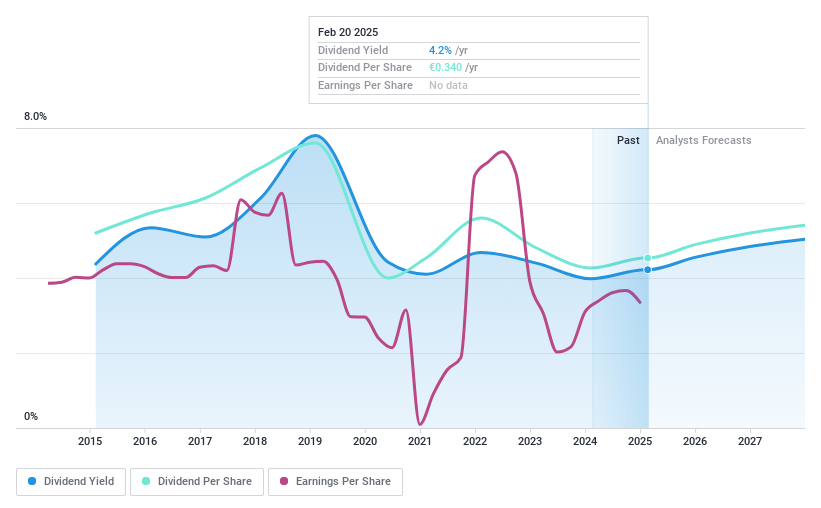

Sampo Oyj (HLSE:SAMPO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sampo Oyj, with a market cap of €21.95 billion, operates through its subsidiaries to provide non-life insurance products and services across Finland, Sweden, Norway, Denmark, Estonia, Lithuania, Latvia, and the United Kingdom.

Operations: Sampo Oyj's revenue is primarily derived from its segments If (€5.72 billion), Hastings (€1.70 billion), and Topdanmark (€1.53 billion).

Dividend Yield: 4.2%

Sampo Oyj proposed a regular dividend of €0.34 per share for 2024, adjusted for a recent share split, marking a 6% increase from the prior year. Despite its reasonable payout ratio of 73.8% and cash payout ratio of 77.2%, ensuring coverage by earnings and cash flows, Sampo's dividend history has been volatile over the past decade. Earnings have grown annually by 6% over five years, yet the dividend yield remains lower than top-tier Finnish payers at 4.17%.

- Unlock comprehensive insights into our analysis of Sampo Oyj stock in this dividend report.

- According our valuation report, there's an indication that Sampo Oyj's share price might be on the cheaper side.

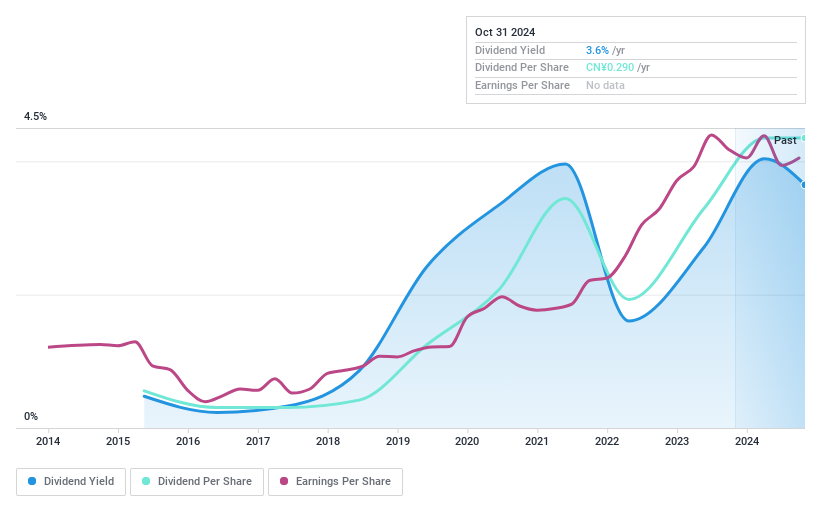

JDM JingDaMachine (Ningbo)Ltd (SHSE:603088)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JDM JingDaMachine (Ningbo) Co. Ltd specializes in the production and sale of precision stamping parts both in China and internationally, with a market cap of CN¥4.16 billion.

Operations: JDM JingDaMachine (Ningbo) Co. Ltd generates revenue from its Metal Forming Machine Tool Manufacturing segment, which amounts to CN¥783.71 million.

Dividend Yield: 3%

JingDaMachine's dividend yield of 3.05% places it in the top 25% of payers in the CN market, but sustainability is a concern due to its high payout ratio (80.6%) and inadequate cash flow coverage (97%). Despite earnings growth of 2.2% last year, the company's dividends have been volatile over a decade, with significant annual drops exceeding 20%. The share price has also been highly volatile recently, adding to investor risk considerations.

- Get an in-depth perspective on JDM JingDaMachine (Ningbo)Ltd's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of JDM JingDaMachine (Ningbo)Ltd shares in the market.

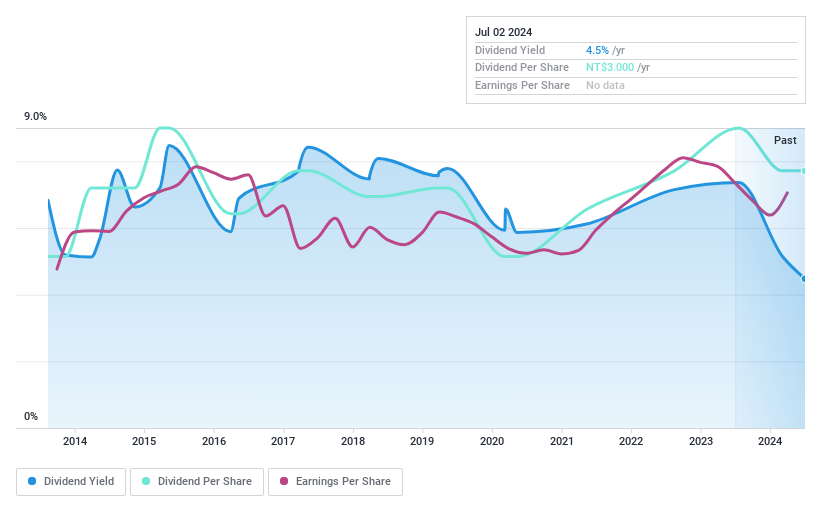

Zippy Technology (TWSE:2420)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zippy Technology Corp. designs, manufactures, and trades micro switches and power supplies across Taiwan, the United States, Mainland China, Germany, Italy and internationally with a market cap of NT$9.69 billion.

Operations: Zippy Technology Corp.'s revenue is derived from its Power Business Unit, generating NT$1.40 billion, and its Switch Business Unit, contributing NT$1.85 billion.

Dividend Yield: 4.7%

Zippy Technology's dividend yield of 4.72% ranks in the top 25% in the TW market, supported by a sustainable payout ratio of 73.4% and cash payout ratio of 52.9%. Despite a volatile dividend history, recent earnings growth and increased payments over the past decade indicate potential stability. The company reported improved sales and net income for Q3 2024, suggesting positive financial momentum that could support future dividends.

- Click here to discover the nuances of Zippy Technology with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Zippy Technology shares in the market.

Make It Happen

- Navigate through the entire inventory of 1965 Top Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603088

JDM JingDaMachine (Ningbo)Ltd

Produces and sells precision stamping parts in China and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives