- Romania

- /

- Electric Utilities

- /

- BVB:SNN

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals and geopolitical developments, major U.S. stock indexes have shown divergent paths, with growth stocks outpacing their value counterparts significantly. Amid this backdrop, dividend stocks can offer investors a source of income and potential stability; selecting those with strong fundamentals and consistent payout histories might be particularly appealing in the current environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.95% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.58% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.49% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.78% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.47% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.33% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.84% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

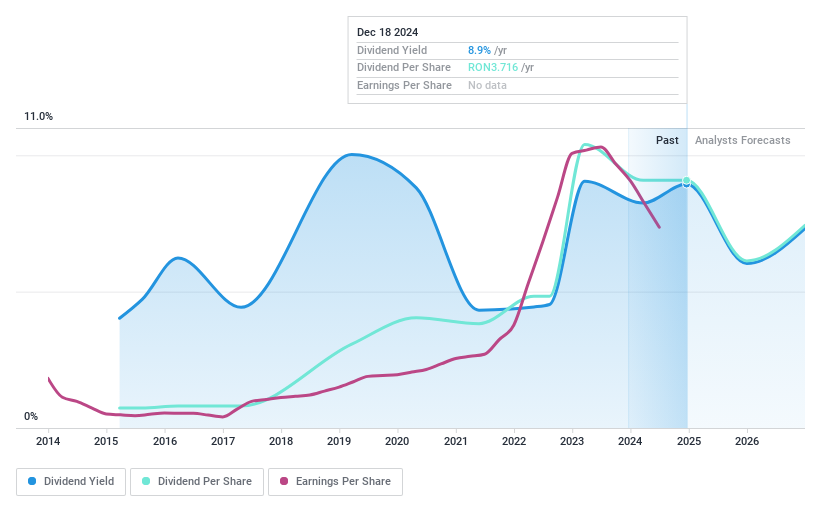

S.N. Nuclearelectrica (BVB:SNN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: S.N. Nuclearelectrica S.A. is a Romanian company involved in the production and transmission of electricity and thermal energy, with a market cap of RON12.28 billion.

Operations: S.N. Nuclearelectrica S.A.'s revenue is primarily derived from its non-regulated utility segment, amounting to RON5.93 billion.

Dividend Yield: 8.9%

S.N. Nuclearelectrica offers a compelling dividend yield of 8.86%, ranking in the top quartile among Romanian dividend payers. However, while dividends have grown and remained stable over the past decade, they are not well covered by free cash flows, with a high cash payout ratio of 115%. The company's earnings are expected to decline significantly over the next three years, posing potential risks to future dividend sustainability despite its current attractive valuation below fair value estimates.

- Get an in-depth perspective on S.N. Nuclearelectrica's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that S.N. Nuclearelectrica is priced lower than what may be justified by its financials.

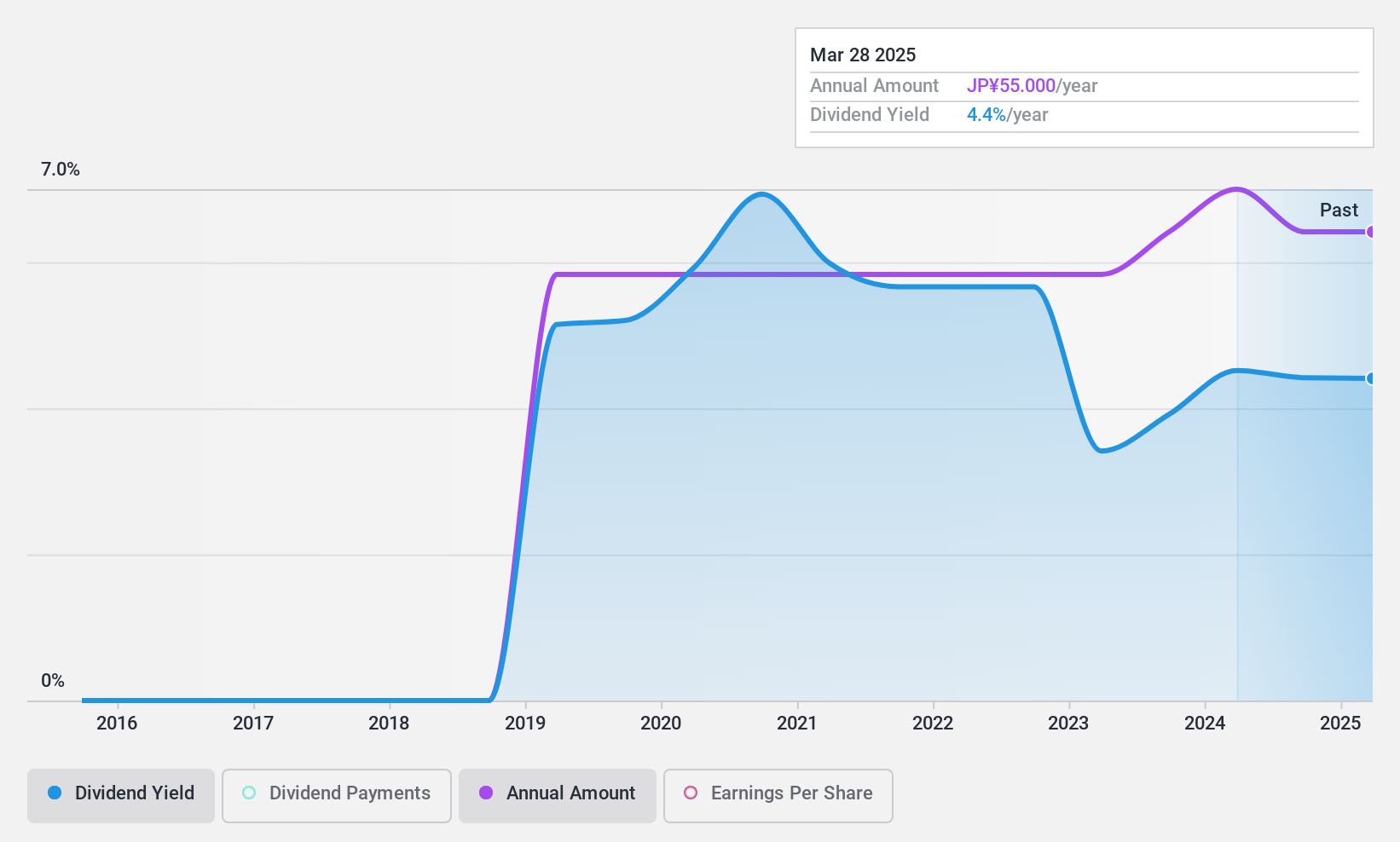

FujishojiLtd (TSE:6257)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fujishoji Co., Ltd. develops, manufactures, and sells gaming machines in Japan with a market cap of ¥28.94 billion.

Operations: Fujishoji Co., Ltd. generates revenue primarily from the development, manufacturing, and sales of gaming machines in Japan.

Dividend Yield: 4%

Fujishoji Ltd. offers a dividend yield of 3.97%, placing it in the top 25% of Japanese dividend payers, with dividends well covered by both earnings and cash flows due to low payout ratios (22.8% and 20.7%, respectively). Despite trading significantly below its estimated fair value, the company's six-year history of paying dividends is marked by volatility, raising concerns about future reliability and stability in its dividend payments.

- Take a closer look at FujishojiLtd's potential here in our dividend report.

- According our valuation report, there's an indication that FujishojiLtd's share price might be on the cheaper side.

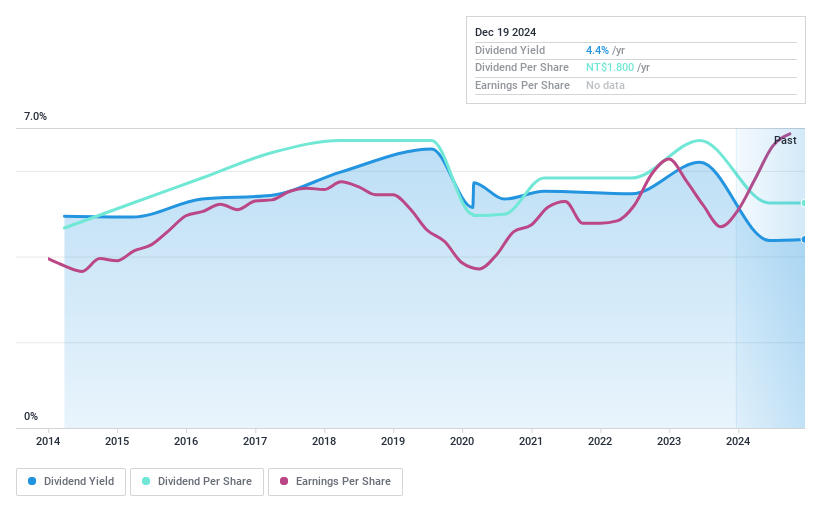

Sanitar (TWSE:1817)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sanitar Co., Ltd. manufactures and distributes sanitary porcelain products both in Taiwan and internationally, with a market cap of NT$3.28 billion.

Operations: Sanitar Co., Ltd. generates revenue primarily from its Building Products segment, amounting to NT$2.73 billion.

Dividend Yield: 4%

Sanitar Co., Ltd. has a dividend yield of 3.98%, which is below the top quartile in Taiwan. Dividends are well covered by earnings and cash flows, with payout ratios of 40.8% and 55.8%, respectively, though they have been volatile over the past decade without consistent growth or stability. Recent earnings show strong performance, with net income for Q3 rising to TWD 72.63 million from TWD 59.07 million year-over-year, supporting sustainable payouts despite historical volatility concerns.

- Dive into the specifics of Sanitar here with our thorough dividend report.

- Our valuation report unveils the possibility Sanitar's shares may be trading at a discount.

Where To Now?

- Unlock our comprehensive list of 1938 Top Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:SNN

S.N. Nuclearelectrica

Engages in the production and transmission of electricity and thermal energy in Romania.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives