As global markets navigate a landscape marked by fluctuating corporate earnings and geopolitical tariff tensions, investors are keenly observing central bank policies and inflation trends. With the Federal Reserve holding rates steady amidst solid U.S. economic activity, dividend stocks continue to attract attention for their potential to provide stable income streams in uncertain times. In this environment, a good dividend stock often combines strong fundamentals with a reliable payout history, offering investors a measure of stability amid market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.05% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.33% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.66% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

Click here to see the full list of 1980 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

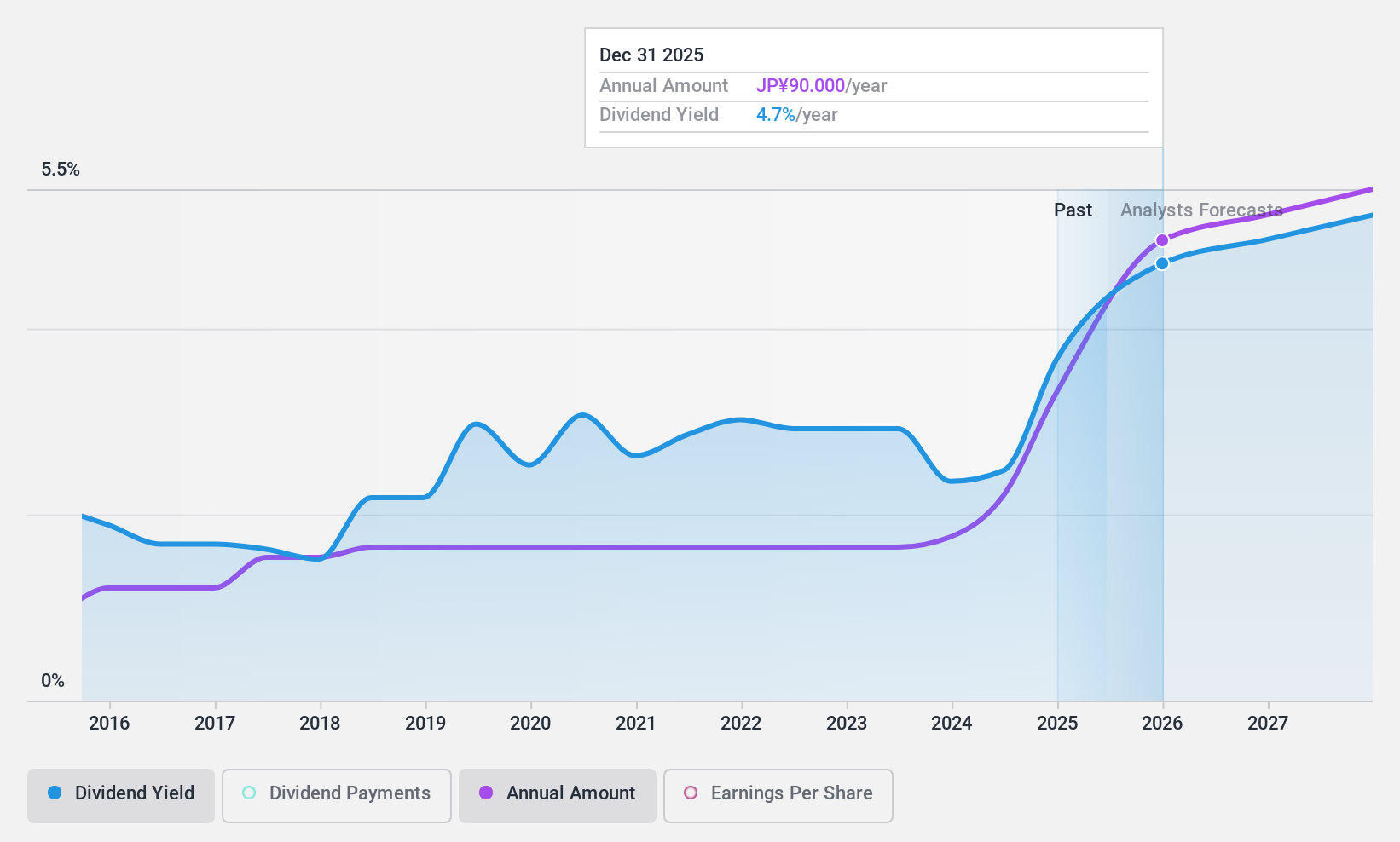

Sakata INX (TSE:4633)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sakata INX Corporation manufactures and sells a range of printing inks and auxiliary agents both in Japan and internationally, with a market cap of ¥85.72 billion.

Operations: Sakata INX Corporation's revenue segments include the manufacturing and sale of printing inks and auxiliary agents, both domestically in Japan and on an international scale.

Dividend Yield: 3.5%

Sakata INX offers a stable dividend profile, supported by a low payout ratio of 24.5% and a cash payout ratio of 28.4%, ensuring dividends are well-covered by earnings and cash flows. Trading at 66.9% below estimated fair value, it presents good relative value compared to peers. Despite its dividend yield of 3.47% being lower than the top tier in Japan, the company's dividends have been stable and growing over the past decade.

- Click to explore a detailed breakdown of our findings in Sakata INX's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Sakata INX shares in the market.

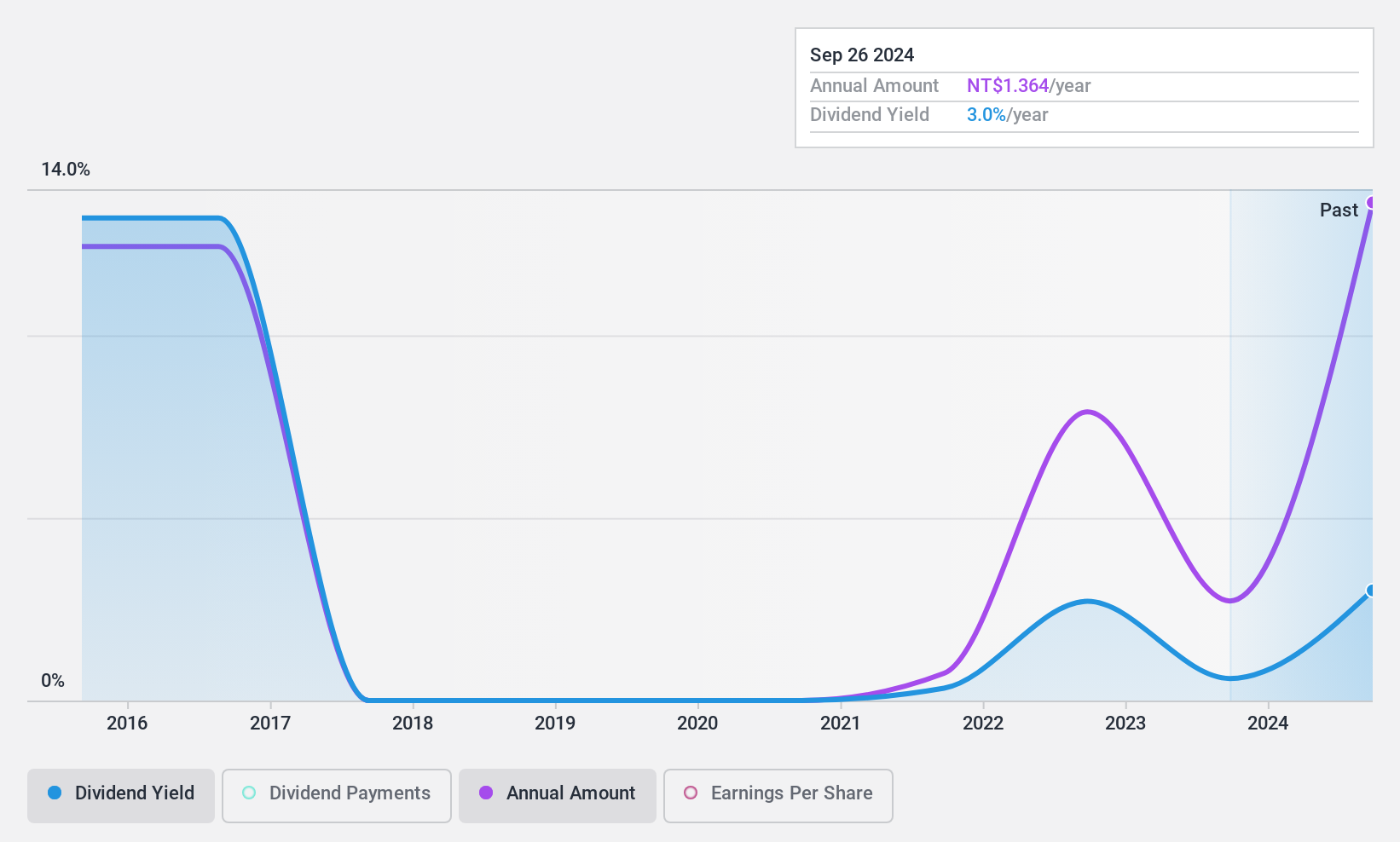

Run Long Construction (TWSE:1808)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Run Long Construction Co., Ltd. operates in Taiwan focusing on the construction, sale, and leasing of residential and commercial buildings, with a market cap of NT$36.27 billion.

Operations: Run Long Construction Co., Ltd.'s revenue primarily comes from its Construction Division, generating NT$4.47 billion, and the Construction Industry Department, contributing NT$14.75 billion.

Dividend Yield: 3.7%

Run Long Construction's dividend payments are well-covered by a low payout ratio of 35.2% and a cash payout ratio of 36.8%, indicating sustainability from earnings and cash flows. However, the dividend yield of 3.73% is below Taiwan's top tier, and its track record is unstable with past volatility over 20%. Recent earnings show significant declines, which may impact future payouts despite trading at a favorable price-to-earnings ratio compared to the market.

- Click here and access our complete dividend analysis report to understand the dynamics of Run Long Construction.

- Our comprehensive valuation report raises the possibility that Run Long Construction is priced higher than what may be justified by its financials.

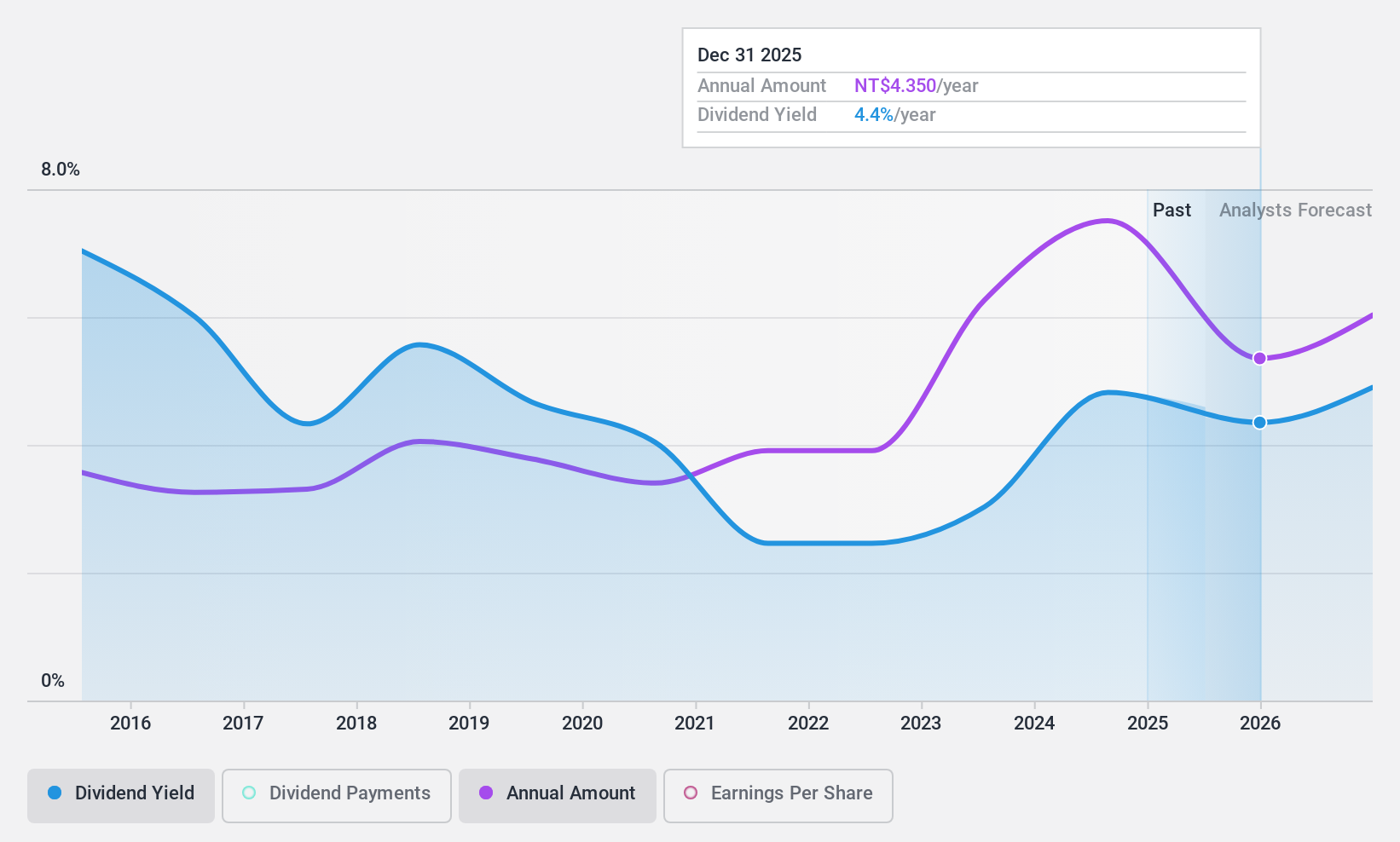

Yulon Finance (TWSE:9941)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Yulon Finance Corporation offers a range of financial services in Taiwan, China, and internationally, with a market cap of NT$63.59 billion.

Operations: Yulon Finance Corporation's revenue is primarily derived from its Leasing Segment, which contributes NT$18.96 billion, and its Financing Segment, which accounts for NT$20.47 billion.

Dividend Yield: 5.3%

Yulon Finance's dividend payments are well-supported by a payout ratio of 68.2% and a cash payout ratio of 40%, ensuring sustainability from both earnings and cash flows. The company offers an attractive dividend yield of 5.26%, placing it in the top 25% in Taiwan. Despite recent declines in net income, Yulon Finance has maintained stable and growing dividends over the past decade, with its price-to-earnings ratio suggesting good relative value compared to peers.

- Dive into the specifics of Yulon Finance here with our thorough dividend report.

- Our valuation report unveils the possibility Yulon Finance's shares may be trading at a discount.

Where To Now?

- Take a closer look at our Top Dividend Stocks list of 1980 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4633

Sakata INX

Manufactures and sells various printing inks and auxiliary agents in Japan and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives