- Taiwan

- /

- Electrical

- /

- TWSE:1612

Top Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating corporate earnings, AI competition fears, and central bank rate decisions, investors are keenly observing the implications for their portfolios. Amidst this volatility, dividend stocks continue to draw attention for their potential to provide steady income streams in uncertain times. A good dividend stock typically offers a reliable payout history and aligns with economic conditions that support its sustainability.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.29% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.09% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.08% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.43% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.45% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.66% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.88% | ★★★★★★ |

Click here to see the full list of 1955 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

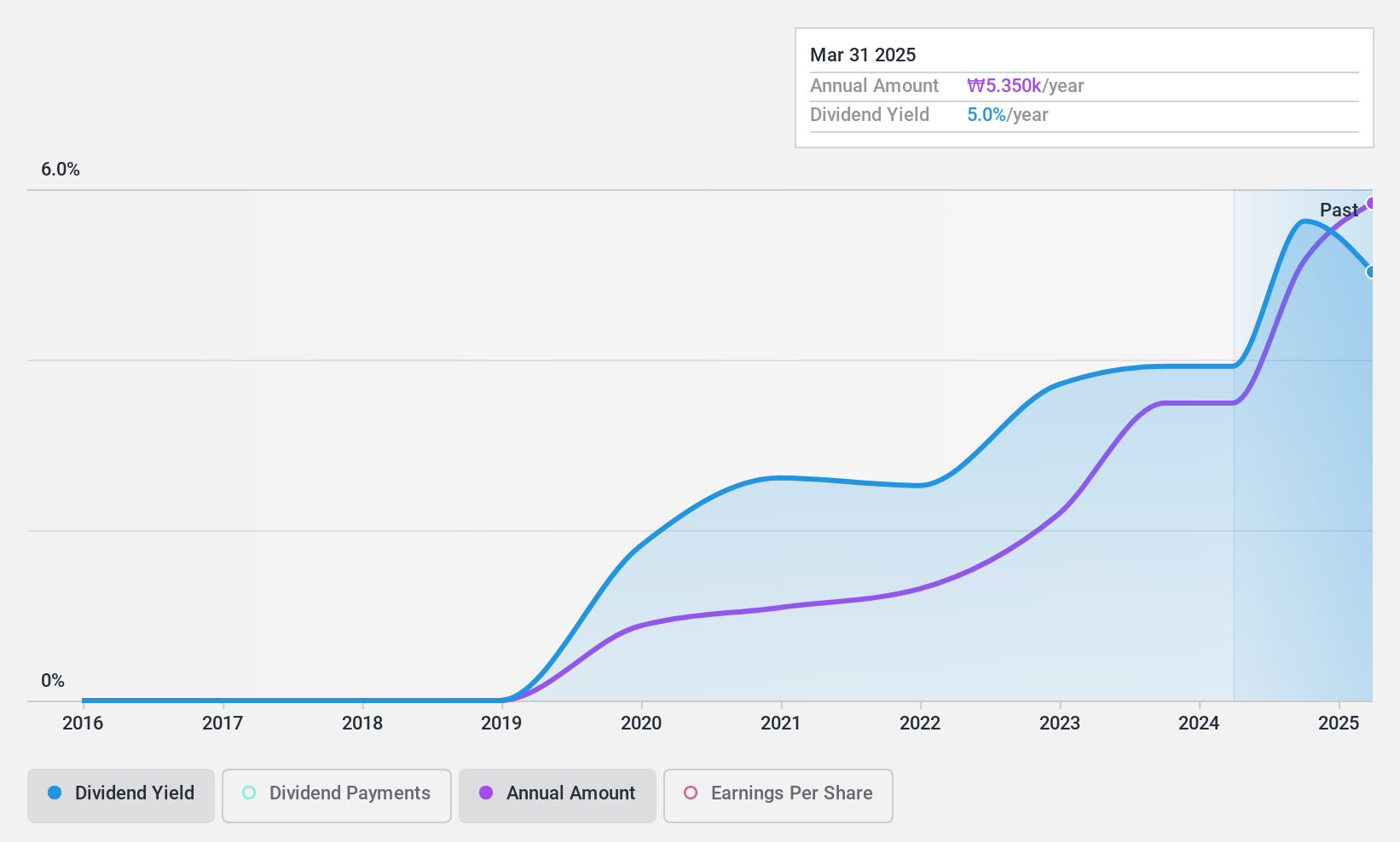

Youngone Holdings (KOSE:A009970)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Youngone Holdings Co., Ltd. is a company that manufactures and sells apparel, footwear, gear, sportswear, and jackets both in South Korea and internationally with a market cap of ₩966.69 billion.

Operations: Youngone Holdings Co., Ltd. generates revenue primarily from its Manufacture OEM segment at ₩4.16 trillion, followed by Domestic Retail at ₩1.01 trillion, and SCOTT at ₩980.97 billion.

Dividend Yield: 5.7%

Youngone Holdings offers a compelling dividend profile, with a yield in the top 25% of the KR market. Although it has paid dividends for only five years, these payments have been stable and growing. The company's low payout ratios—16.4% from earnings and 13.6% from cash flows—indicate strong coverage and sustainability. Trading at 87% below its estimated fair value further enhances its attractiveness for dividend investors seeking both income and potential capital appreciation.

- Dive into the specifics of Youngone Holdings here with our thorough dividend report.

- Our valuation report here indicates Youngone Holdings may be undervalued.

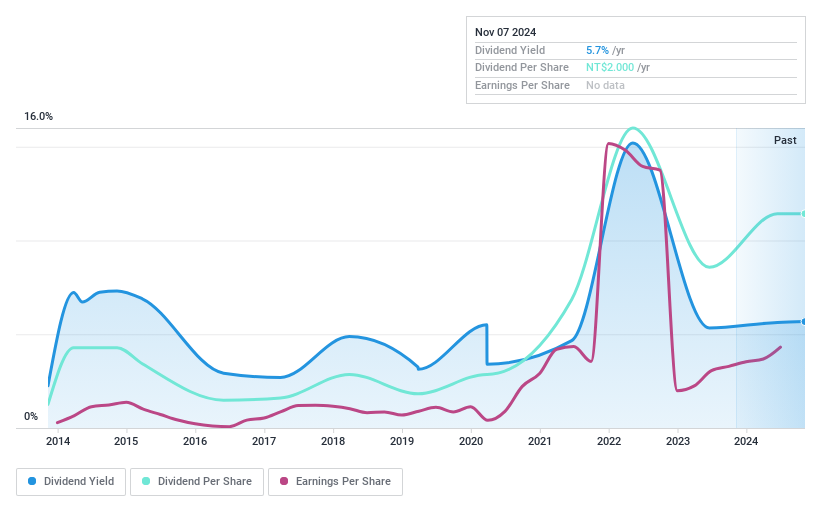

Hong Tai Electric Industrial (TWSE:1612)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hong Tai Electric Industrial Co., Ltd. is involved in the manufacturing, processing, and selling of wires and cables, communication products and accessories, and copper foil substrates with a market cap of NT$10.02 billion.

Operations: Hong Tai Electric Industrial Co., Ltd. generates NT$6.56 billion in revenue from its manufacturing, processing, and sales of electric wire and cable, communication products, and accessories.

Dividend Yield: 6.3%

Hong Tai Electric Industrial offers a dividend yield in the top 25% of the TW market, yet its high cash payout ratio of 198.8% raises concerns about sustainability. While dividends have grown over the past decade, they have been volatile and unreliable. Despite a favorable price-to-earnings ratio of 12.8x compared to the market average, earnings growth has not sufficiently covered dividends through cash flows, posing risks for income-focused investors seeking stability.

- Click here to discover the nuances of Hong Tai Electric Industrial with our detailed analytical dividend report.

- The analysis detailed in our Hong Tai Electric Industrial valuation report hints at an inflated share price compared to its estimated value.

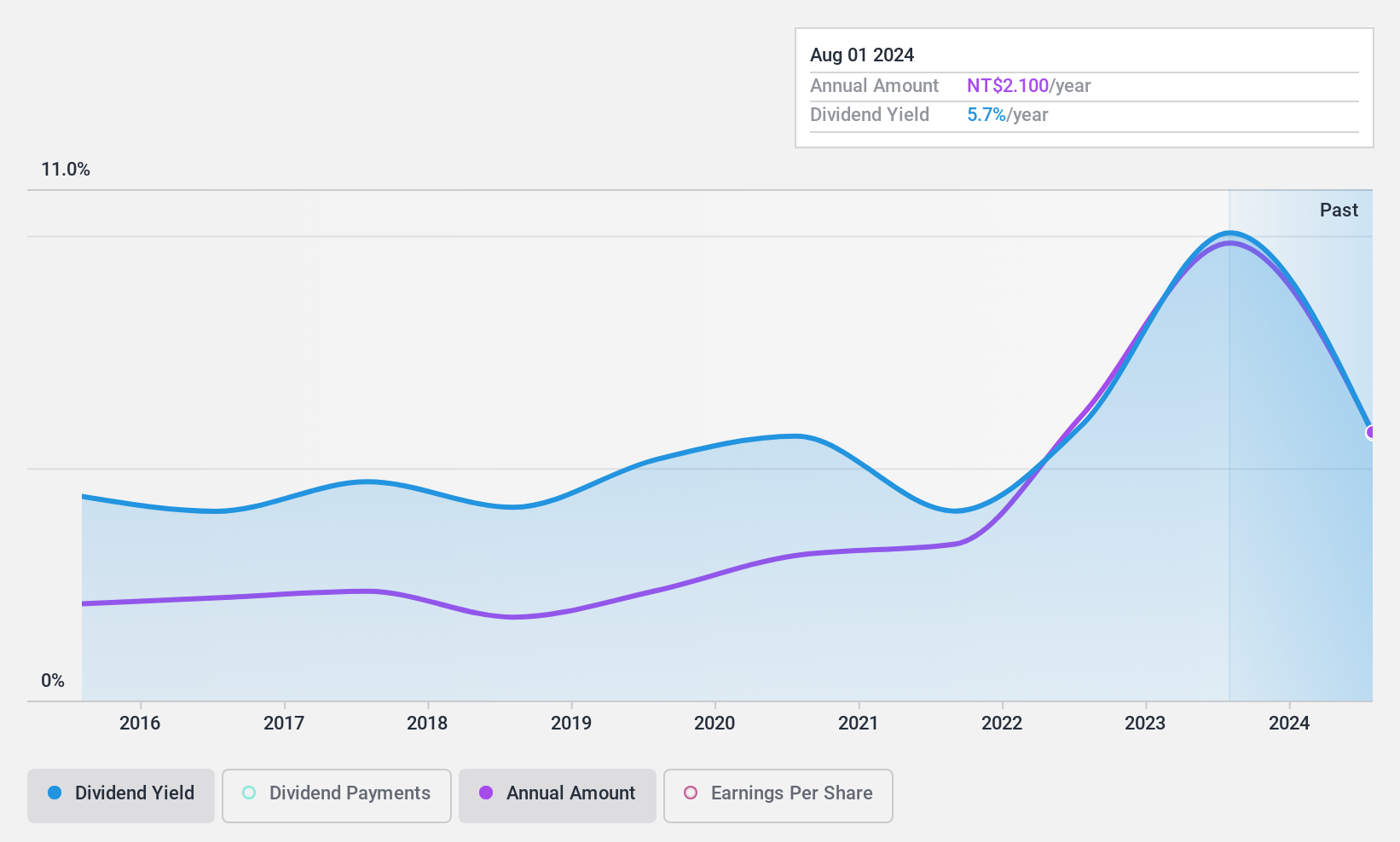

Alltek Technology (TWSE:3209)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Alltek Technology Corporation is a communication components distributor and solution provider operating in Taiwan, China, and internationally with a market cap of NT$7.89 billion.

Operations: Alltek Technology Corporation's revenue segments include Alltek Technology Corp. with NT$25.58 billion, Gaosen Technology, Inc. with NT$690.32 million, and Alltek Group Corp and Alltek Technology (H.K.) Limited contributing NT$22.22 billion.

Dividend Yield: 6.2%

Alltek Technology's dividend yield of 6.19% ranks in the top 25% of the TW market, but its sustainability is questionable due to a lack of free cash flow coverage and volatile payments over the past decade. Although dividends have grown, they remain unreliable and not fully covered by earnings or cash flows. Recent earnings growth is positive, with net income rising to TWD 244.13 million for Q3 2024, yet financial stability concerns persist due to insufficient debt coverage by operating cash flow.

- Get an in-depth perspective on Alltek Technology's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Alltek Technology's current price could be quite moderate.

Turning Ideas Into Actions

- Dive into all 1955 of the Top Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hong Tai Electric Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1612

Hong Tai Electric Industrial

Manufactures, processes, and sells wires and cables, and communication products and accessories.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)