Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Allis Electric Co.,Ltd. (TWSE:1514) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Allis ElectricLtd

How Much Debt Does Allis ElectricLtd Carry?

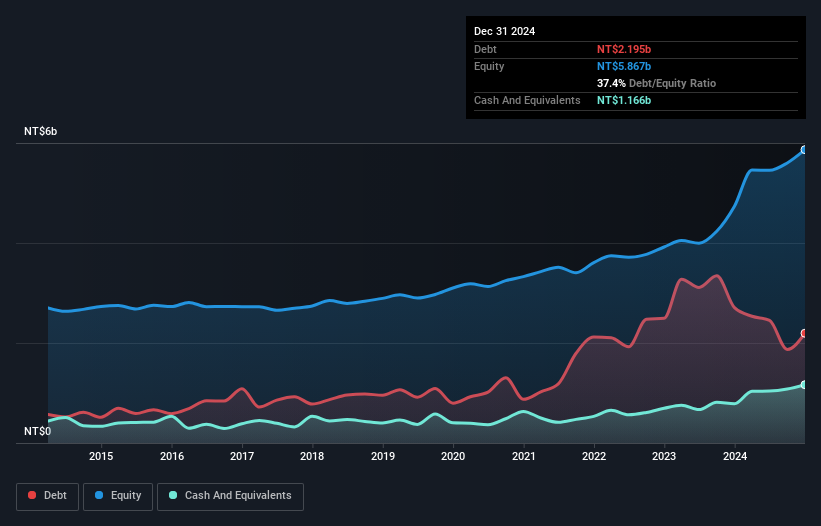

As you can see below, Allis ElectricLtd had NT$2.20b of debt at December 2024, down from NT$2.71b a year prior. However, it also had NT$1.17b in cash, and so its net debt is NT$1.03b.

How Healthy Is Allis ElectricLtd's Balance Sheet?

According to the last reported balance sheet, Allis ElectricLtd had liabilities of NT$5.05b due within 12 months, and liabilities of NT$379.2m due beyond 12 months. On the other hand, it had cash of NT$1.17b and NT$4.82b worth of receivables due within a year. So it can boast NT$559.9m more liquid assets than total liabilities.

Having regard to Allis ElectricLtd's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the NT$29.9b company is short on cash, but still worth keeping an eye on the balance sheet.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Allis ElectricLtd's net debt is only 1.1 times its EBITDA. And its EBIT covers its interest expense a whopping 20.5 times over. So we're pretty relaxed about its super-conservative use of debt. On the other hand, Allis ElectricLtd saw its EBIT drop by 4.1% in the last twelve months. That sort of decline, if sustained, will obviously make debt harder to handle. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Allis ElectricLtd can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Allis ElectricLtd reported free cash flow worth 9.8% of its EBIT, which is really quite low. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

When it comes to the balance sheet, the standout positive for Allis ElectricLtd was the fact that it seems able to cover its interest expense with its EBIT confidently. But the other factors we noted above weren't so encouraging. For example, its conversion of EBIT to free cash flow makes us a little nervous about its debt. Considering this range of data points, we think Allis ElectricLtd is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. Over time, share prices tend to follow earnings per share, so if you're interested in Allis ElectricLtd, you may well want to click here to check an interactive graph of its earnings per share history.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1514

Allis ElectricLtd

Develops, produces, and sells transformers, switching devices, and electronic products worldwide.

Excellent balance sheet with reasonable growth potential and pays a dividend.