- Greece

- /

- Hospitality

- /

- ATSE:OPAP

Three Stocks That May Offer Hidden Value In July 2024

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by fluctuating interest rates and sector-specific challenges, investors are keenly watching for opportunities that may not be reflected in current stock prices. In such an environment, identifying undervalued stocks could prove beneficial, particularly when broader indices show a mixed performance with growth sectors outshining value-oriented shares.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Reach Subsea (OB:REACH) | NOK8.66 | NOK17.19 | 49.6% |

| Military Commercial Bank (HOSE:MBB) | ₫23300.00 | ₫46372.20 | 49.8% |

| Trisura Group (TSX:TSU) | CA$40.53 | CA$80.18 | 49.4% |

| Metsä Board Oyj (HLSE:METSB) | €7.035 | €13.97 | 49.6% |

| Arcadis (ENXTAM:ARCAD) | €60.50 | €119.98 | 49.6% |

| Flexion Mobile (OM:FLEXM) | SEK8.02 | SEK15.96 | 49.7% |

| Hexcel (NYSE:HXL) | US$64.11 | US$127.33 | 49.7% |

| Hecla Mining (NYSE:HL) | US$5.27 | US$10.53 | 49.9% |

| SiteMinder (ASX:SDR) | A$5.03 | A$9.96 | 49.5% |

| Zillow Group (NasdaqGS:ZG) | US$46.35 | US$92.65 | 50% |

Let's explore several standout options from the results in the screener.

Organization of Football Prognostics (ATSE:OPAP)

Overview: Organization of Football Prognostics S.A. operates and manages numerical lottery and sports betting games in Greece and Cyprus, with a market capitalization of €5.56 billion.

Operations: The company generates its revenue through the management of numerical lottery and sports betting games in Greece and Cyprus.

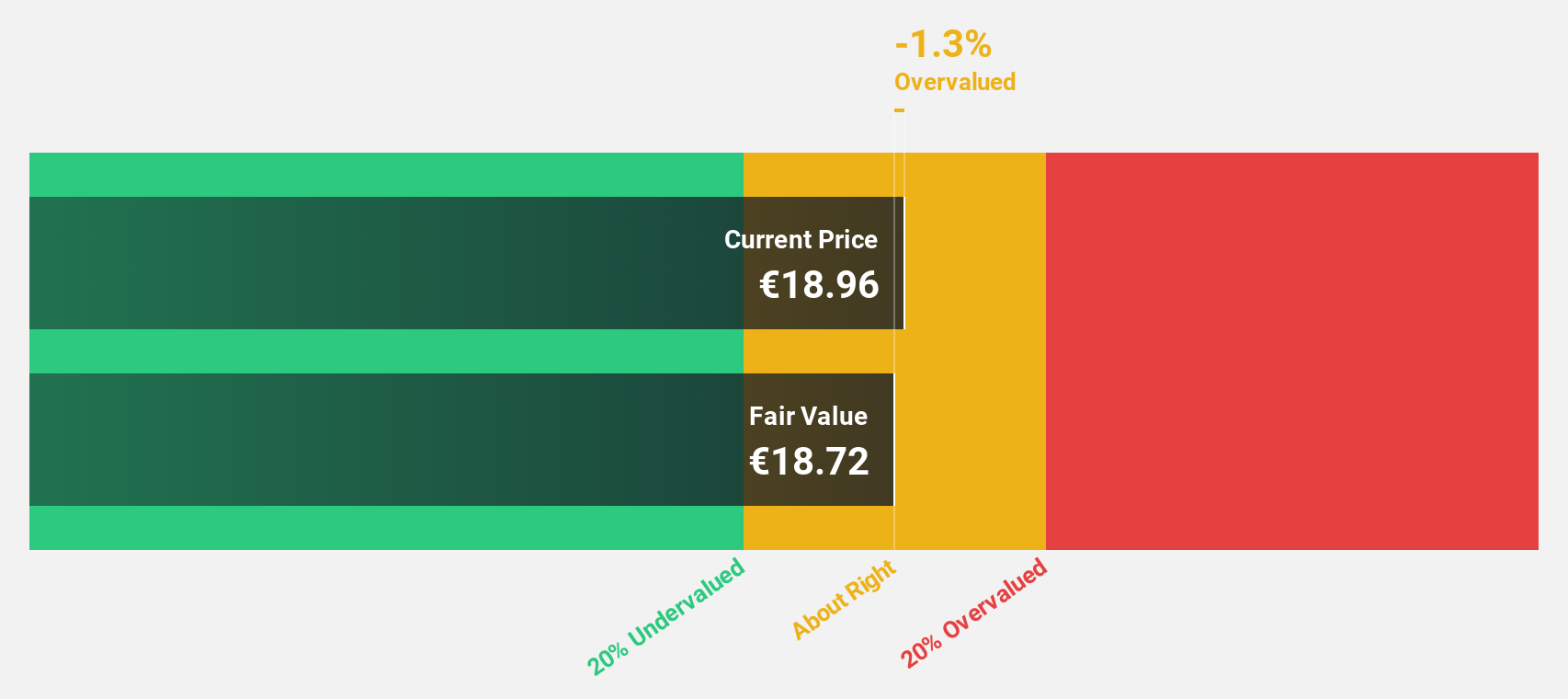

Estimated Discount To Fair Value: 16.5%

Organization of Football Prognostics is currently valued at €15.4, below our fair value estimate of €18.44, suggesting a modest undervaluation. While its Return on Equity is expected to be very high in three years, its revenue growth forecast at 14% per year is robust but not exceptional compared to some higher-growth sectors. The company's earnings are projected to increase by 6.97% annually, outpacing the Greek market's average. However, its substantial dividend yield of 12.09% raises concerns about sustainability given it's not well-covered by earnings or cash flows. Recent activities include a share buyback program and stable quarterly earnings with slight declines in net income and EPS from the previous year.

- Our comprehensive growth report raises the possibility that Organization of Football Prognostics is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Organization of Football Prognostics.

Dr. Sulaiman Al Habib Medical Services Group (SASE:4013)

Overview: Dr. Sulaiman Al Habib Medical Services Group operates a network of hospitals, medical complexes, day surgery centers, and pharmaceutical facilities across Saudi Arabia and globally, with a market capitalization of SAR 99.54 billion.

Operations: The company generates revenue primarily from its hospitals and healthcare facilities segment, which brought in SAR 7.47 billion, followed by its pharmacies at SAR 2.04 billion.

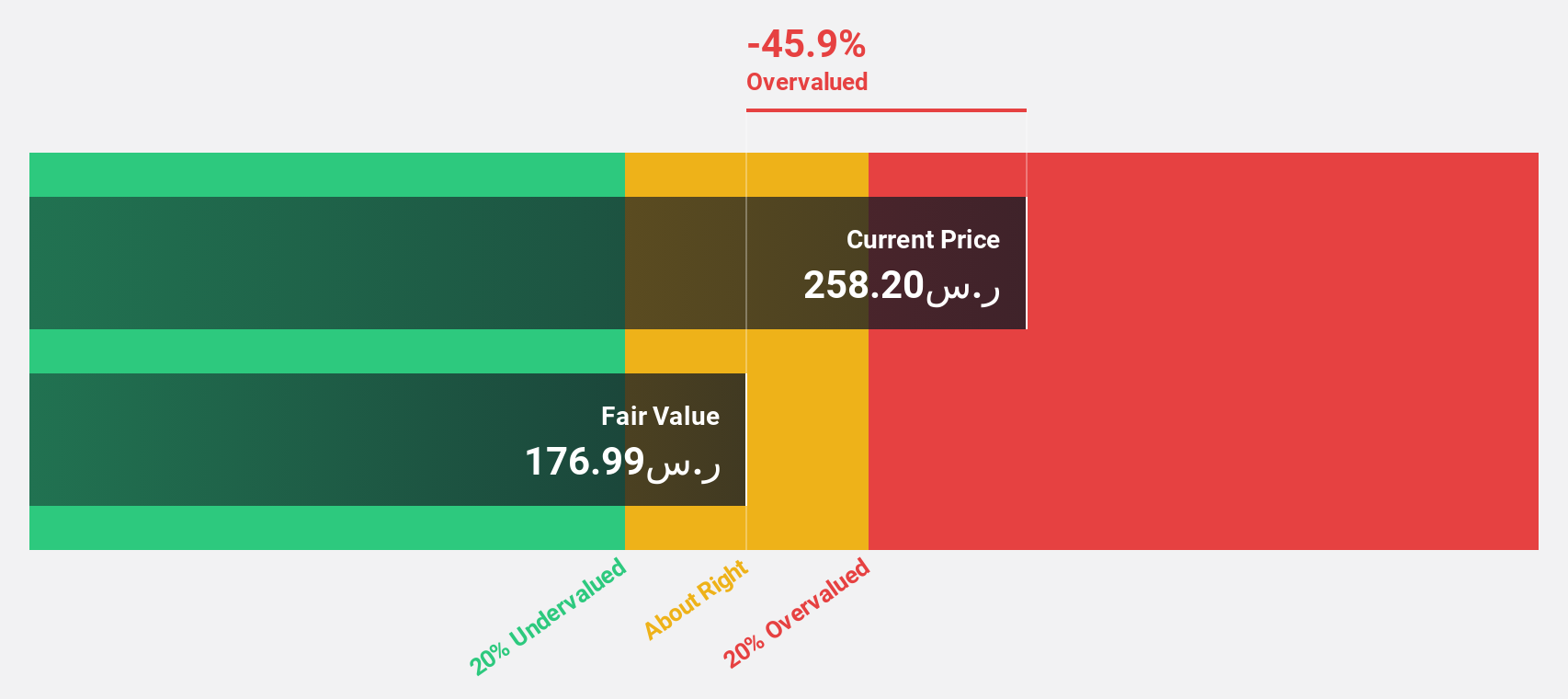

Estimated Discount To Fair Value: 41.8%

Dr. Sulaiman Al Habib Medical Services Group, trading at SAR 283.6, is positioned below the estimated fair value of SAR 487.67, indicating a significant undervaluation based on cash flows. The company's earnings, with a historical growth rate of 20.5% annually over the past five years and forecasted to grow by 14.75% annually, are robust compared to the Saudi market's slower pace. Despite high debt levels and substantial non-cash earnings components, its projected Return on Equity stands impressively at 37.2% in three years time.

- Upon reviewing our latest growth report, Dr. Sulaiman Al Habib Medical Services Group's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Dr. Sulaiman Al Habib Medical Services Group's balance sheet by reading our health report here.

Chung-Hsin Electric and Machinery Manufacturing (TWSE:1513)

Overview: Chung-Hsin Electric and Machinery Manufacturing Corp., with a market capitalization of NT$102.52 billion, specializes in the production and distribution of various electrical machinery and equipment.

Operations: The company generates revenue primarily from three segments: services (NT$4.91 billion), electricity power (NT$17.00 billion), and engineering (NT$2.51 billion).

Estimated Discount To Fair Value: 13.4%

Chung-Hsin Electric and Machinery Manufacturing, with a recent earnings boost to TWD 953.24 million from TWD 744.5 million year-over-year, appears undervalued based on cash flows. Trading at TWD 228 against an estimated fair value of TWD 263.15, it reflects potential unrecognized value despite its high volatility in share price over the past three months. Forecasted revenue growth at 13.6% annually exceeds the TW market average of 11.9%, with projected significant earnings growth and a strong future Return on Equity at 26.8%. However, profit margins have decreased from last year's levels.

- Our earnings growth report unveils the potential for significant increases in Chung-Hsin Electric and Machinery Manufacturing's future results.

- Click to explore a detailed breakdown of our findings in Chung-Hsin Electric and Machinery Manufacturing's balance sheet health report.

Taking Advantage

- Click through to start exploring the rest of the 940 Undervalued Stocks Based On Cash Flows now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ATSE:OPAP

Organization of Football Prognostics

Engages in the operation and management of numerical lottery and sports betting games in Greece and Cyprus.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives