- France

- /

- Semiconductors

- /

- ENXTPA:STMPA

Global's July 2025 Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

In July 2025, global markets have shown a muted response to new U.S. tariffs, with the Nasdaq Composite Index demonstrating resilience amid modest declines in major U.S. stock indexes. As investors navigate these complex economic conditions, identifying undervalued stocks can be crucial; such stocks often present opportunities when their market prices are perceived to be below their intrinsic value, especially during periods of market volatility and uncertainty.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Resurs Holding (OM:RESURS) | SEK27.50 | SEK54.83 | 49.8% |

| Puyang Refractories Group (SZSE:002225) | CN¥6.34 | CN¥12.61 | 49.7% |

| Medy-Tox (KOSDAQ:A086900) | ₩161200.00 | ₩322233.66 | 50% |

| JRCLtd (TSE:6224) | ¥1149.00 | ¥2297.30 | 50% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.48 | €6.92 | 49.7% |

| Hibino (TSE:2469) | ¥2339.00 | ¥4677.94 | 50% |

| Grand Korea Leisure (KOSE:A114090) | ₩17020.00 | ₩33826.04 | 49.7% |

| Giant Biogene Holding (SEHK:2367) | HK$57.00 | HK$113.05 | 49.6% |

| cottaLTD (TSE:3359) | ¥429.00 | ¥853.36 | 49.7% |

| Astroscale Holdings (TSE:186A) | ¥679.00 | ¥1347.22 | 49.6% |

Here's a peek at a few of the choices from the screener.

STMicroelectronics (ENXTPA:STMPA)

Overview: STMicroelectronics N.V. is a company that designs, develops, manufactures, and sells semiconductor products across various regions including Europe, the Middle East, Africa, the Americas, and the Asia Pacific with a market cap of approximately €24.74 billion.

Operations: The revenue for STMicroelectronics is primarily derived from its Analog, MEMS & Sensors Group (AMS), which generated $4.43 billion.

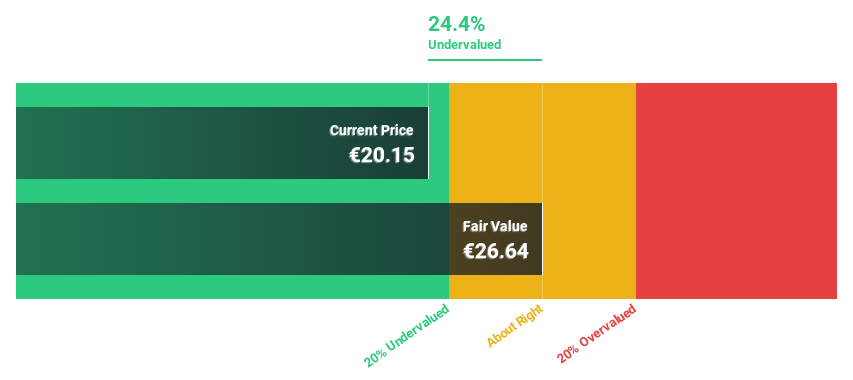

Estimated Discount To Fair Value: 48.2%

STMicroelectronics appears to be trading at €27.66, significantly below its estimated fair value of €53.35, suggesting it is undervalued based on discounted cash flows. Despite a decline in profit margins from 22.3% to 8.9%, the company's earnings are projected to grow by 23.5% annually over the next three years, outpacing both revenue growth and market expectations in France. Recent strategic agreements in advanced optics and human presence detection technology bolster its innovative edge and potential market expansion.

- Insights from our recent growth report point to a promising forecast for STMicroelectronics' business outlook.

- Navigate through the intricacies of STMicroelectronics with our comprehensive financial health report here.

Puyang Refractories Group (SZSE:002225)

Overview: Puyang Refractories Group Co., Ltd. operates in the research, development, production, and sales of shaped, unshaped, and functional refractory products both in China and internationally with a market cap of approximately CN¥6.14 billion.

Operations: The company's revenue is derived from its activities in the research, development, production, and sales of shaped, unshaped, and functional refractory products both domestically and abroad.

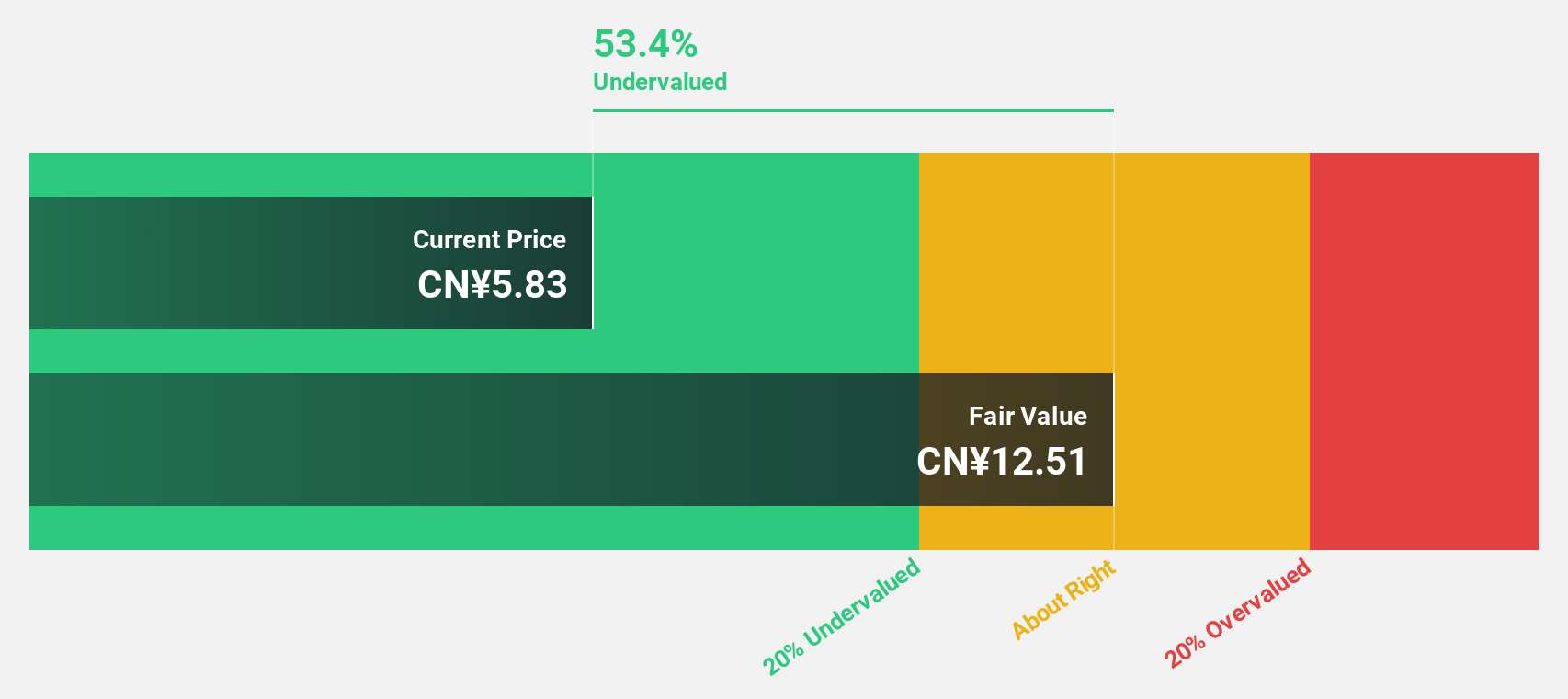

Estimated Discount To Fair Value: 49.7%

Puyang Refractories Group, trading at CN¥6.34, is valued significantly below its estimated fair value of CN¥12.61, highlighting a potential undervaluation based on discounted cash flows. Despite recent dividend decreases and declining profit margins from 4.8% to 2.4%, earnings are projected to grow significantly at 45.5% annually over the next three years, surpassing market expectations in China. However, interest payments remain inadequately covered by earnings, posing a financial risk.

- In light of our recent growth report, it seems possible that Puyang Refractories Group's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Puyang Refractories Group's balance sheet health report.

Chung-Hsin Electric and Machinery Manufacturing (TWSE:1513)

Overview: Chung-Hsin Electric and Machinery Manufacturing Corp., with a market cap of NT$81.52 billion, specializes in the production and distribution of electrical equipment and machinery.

Operations: The company's revenue is primarily derived from its Motor Energy Business at NT$19.28 billion, followed by the Service Business at NT$5.17 billion and Engineering and Other at NT$3.21 billion.

Estimated Discount To Fair Value: 21.5%

Chung-Hsin Electric and Machinery Manufacturing, trading at NT$166.5, is priced 21.5% below its estimated fair value of NT$212.19, suggesting potential undervaluation based on discounted cash flows. Despite a slight decline in net income to NT$878.6 million for Q1 2025 compared to the previous year, earnings are projected to grow significantly at 21.55% annually over the next three years, outpacing Taiwan's market growth rate and indicating strong future prospects amidst reliable dividend payouts.

- Our earnings growth report unveils the potential for significant increases in Chung-Hsin Electric and Machinery Manufacturing's future results.

- Click here to discover the nuances of Chung-Hsin Electric and Machinery Manufacturing with our detailed financial health report.

Summing It All Up

- Unlock more gems! Our Undervalued Global Stocks Based On Cash Flows screener has unearthed 472 more companies for you to explore.Click here to unveil our expertly curated list of 475 Undervalued Global Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:STMPA

STMicroelectronics

Designs, develops, manufactures, and sells semiconductor products in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives